For months, many leading indicators of economic activity have been signaling a future recession. The full effects of policy rate hikes are only now just starting to emerge, and should increasingly impact the real economy in coming quarters. While current economic resilience and a tech-led market rally continue to foster optimism, further weakness and a likely recession is still expected as 2024 approaches.

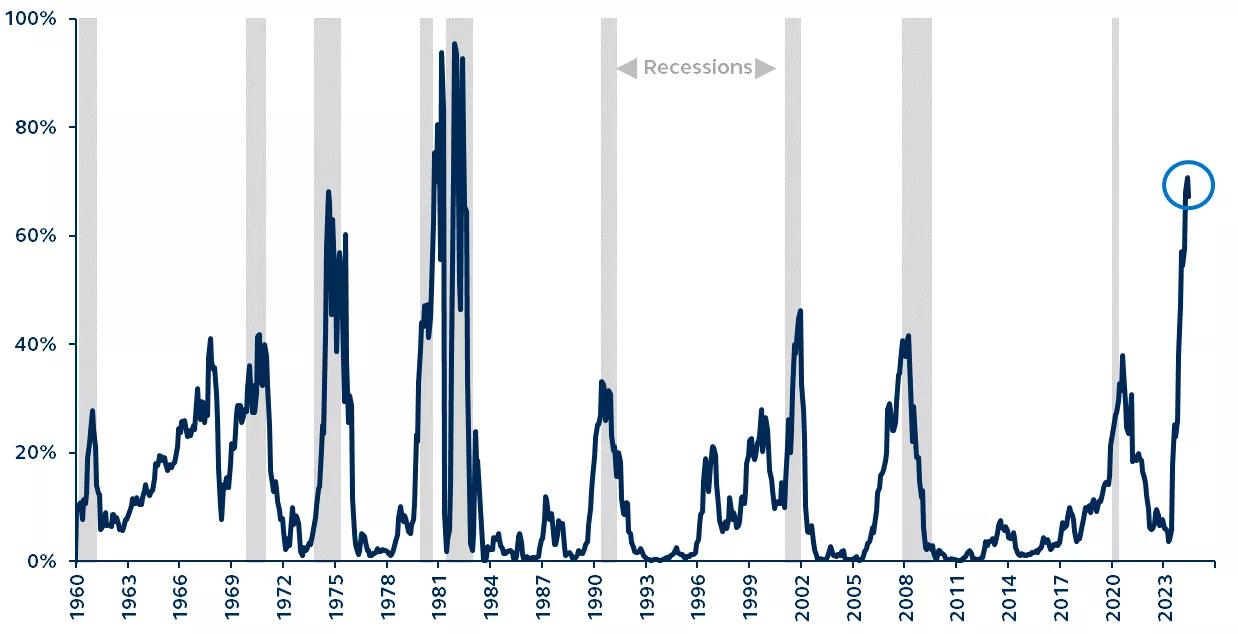

U.S. recession probability in next 12 months

Federal Reserve Bank of New York, 1960–present

Source: Federal Reserve Bank of New York, Bloomberg, Principal Asset Management. Data as of June 30, 2023.

The continued resilience of consumers and labor markets suggest that a U.S. recession is not imminent. However, many risks still lie ahead. Several leading economic indicators have been contracting since 2022, and few are yet to demonstrate any convincing recovery:

- The Conference Board’s leading economic indicator has been contracting for 11 months, while a decline for six or more consecutive months has historically anticipated recession.

- Expectations of a broader slowdown are corroborated by the ISM Manufacturing survey, which has been in contraction since November 2022.

- The 3-month versus 10-year U.S. Treasury yield curve is deeply inverted, and began its inversion last November. History suggests this typically gives a 13-month lead time before recession.

- The New York Federal Reserve’s own recession forecast (derived from the 3m10y curve) has been soaring above 65% since April—recession probability has never been this high without recession ultimately occurring.

Leading indicators almost uniformly signal weaker economic growth, with the full effects of significant and aggressive Fed tightening to-date yet to be fully recognized. The Fed’s hiking cycle isn’t done just yet either. Core inflation remains well above target, and the U.S. labor market continues to exhibit strength, requiring further Fed tightening and all but eliminating the likelihood of rate cuts this year. The foundations have been laid for a short and shallow recession beginning in 4Q 2023.

For more on recession risks, read our 3Q 2023 Global Asset Allocation Viewpoints, where our Global Insights team dives into the themes, opportunities, and investment implications across markets and portfolios in the quarter ahead.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3001808