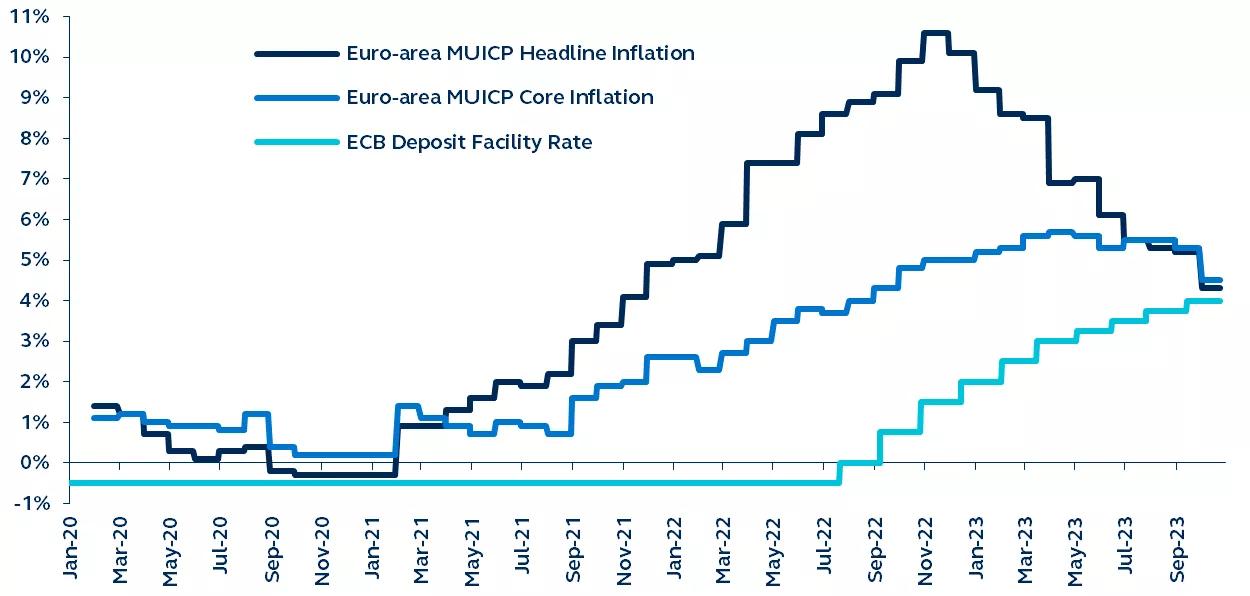

Today, the European Central Bank (ECB) Council unanimously decided to keep its three key policy rates on hold for the first time since lift-off in July 2022. This first pause follows 450 bps of hikes across ten consecutive meetings. The interest rate on the main refinancing operations, the marginal lending facility, and the deposit facility will remain at 4.50%, 4.75%, and 4.00%, respectively.

Markets and consensus forecasts had reached a near certain expectation of no policy rate move, and the ECB duly delivered no surprises. Today’s statement reiterated that “inflation is still expected to stay too high for too long,” which calls for maintaining a restrictive policy stance. The ECB’s goal remains to “ensure that inflation returns to its 2% medium-term target.”

The statement noted that “the Governing Council considers that the key ECB interest rates are at levels that, maintained for a sufficiently long duration, will make a substantial contribution to this goal.” This translates to a higher-for-longer policy backdrop and that restrictive levels have now been reached—suggesting ECB policy rates may have peaked. Accordingly, the ECB is starting to shift emphasis from “how high” the policy rate will rise, to for “how long” rates will remain at current levels.

Despite the softening in rhetoric, ECB President Christine Lagarde was unwilling to explicitly mark today’s pause as the end of its tightening cycle, stating instead that “today’s hold does not mean we will not hike again.” When a question about a peak rate was posed, she replied, “I am not going to make a judgement [around a peak rate],” reemphasizing that “we are data dependent.” President Lagarde also refused to state a particular inflation level, or length of time at which rate levels must remain before cuts could be contemplated. Conversations around rate cuts “are absolutely premature” and “forward guidance is inappropriate at this time.”

Since the September meeting, rising global bond yields have tightened financial conditions, while eurozone inflation has undershot economist forecasts and the ECB’s September projections. Nonetheless, inflation remains in focus, especially given oil price rises and the recent conflict in Israel. President Lagarde stated that “the euro area economy remains weak,” and rising growth risks further complicate the future policy rate path.