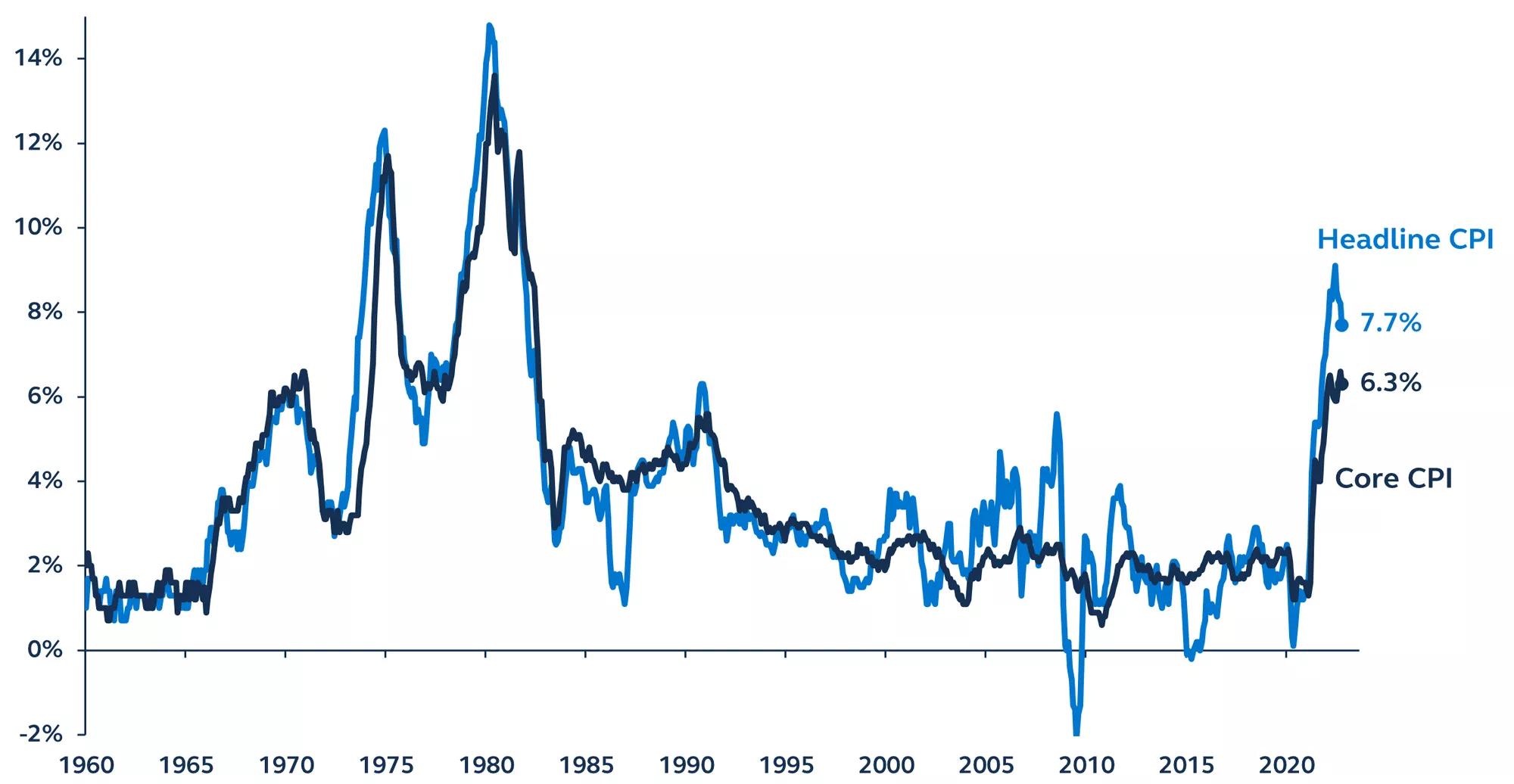

Finally, a Consumer Price Index (CPI) report that the market can celebrate! Both headline and core CPI surprised to the downside in October, falling to 7.7% and 6.3% respectively. The underlying elements of this report were broadly encouraging, with several of the “sticky” components of inflation showing signs of easing. The Federal Reserve (Fed) will welcome today’s data and a downshift in the pace of monetary tightening, from 75 bps hikes to 50 bps, is likely to be instated at the December meeting. Yet, there is still a long way to go, and the Fed needs to see a series of softening CPI reports before they can feel any confidence about the inflation outlook.

Consumer Price Index (CPI) inflation

Year-over-year, 1960–present

Bureau of Labor Statistics, Principal Asset Management. Data as of November 10, 2022.

Response details:

- Headline CPI rose 0.4% on the month (expected 0.6%), bringing the annual rate down from 8.2% in September to 7.7%. Core CPI (which excludes energy and food prices) rose 0.3% on the month (expected 0.5%), an important downshift from the previous month’s 0.6% increase. As a result, annual core CPI fell back from last month’s 40-year high of 6.6% to 6.3% in October.

- The underlying components of the CPI report were broadly encouraging. Within core CPI, core goods prices fell -0.4% (the first monthly drop since March 2022) and services inflation slowed from 0.8% in September to 0.5% in October.

- In core services, the pace of sequential Owners’ Equivalent Rent (OER)—an estimate of the amount homeowners’ properties would currently rent for—decelerated from a 25-year high of 0.8% in September to 0.6% in October. While it is still very elevated, OER has been a significant contributor to the surge in inflation, so the recent easing will be received very positively by policymakers. Rental growth should also continue easing in the coming months given the fall in house prices. Medical services inflation, another driver of price pressures in recent months, fell -0.6%—the largest one-month fall in several decades. This was in-line with expectations and reflected the reset lower in health insurance inflation.

- In core goods inflation, new vehicle prices rose 0.4% on the month, but used car prices fell for a fourth consecutive month. Clothing prices dropped -0.7%, while household furnishings & supplies eased -0.2% month-on-month, as the easing of supply chain bottlenecks and increases in inventories fed through to discounted prices.

- After a few months of subtracting from the monthly headline CPI print, energy boosted headline CPI in October—making the fall in headline CPI all the more impressive. In fact, stripping out food, energy and shelter, CPI fell -0.1% in October—the weakest reading since May 2022.

Implications for Fed policy

The first downside surprise in inflation in several months will inevitably be received by an equity market ovation. However, this trend needs to be sustained for a couple of months before the Fed can feel confident about the inflation direction. As such, the best we can expect from the Fed is a downshift in the pace of tightening. A 50 bps hike, rather than 75 bps, in December is clearly on the cards, but until there has been a series of softening CPI reports, a Fed pause is still some way out. Let the market enjoy today, it still has another 100 bps or so of tightening to commiserate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

2587235