Labor market strength continues to exceed all expectations. The economy added 263,000 jobs in November, beating consensus forecasts for an increase of 200,000. The prior month’s payroll figure was revised up from 261,000 to 284,000, leaving the three-month average gain at almost 275,000— a level that has historically been consistent with a very strong economy. After some 375 basis points of policy rate hikes in less than 12 months, the U.S. labor market is proving to be stubbornly resilient, putting continued pressure on the Federal Reserve (Fed) to raise policy rates further.

Report details

- The participation rate nudged lower from 62.2% in October to 62.1% in November, a sign of further tightening in labor supply and an almost perverse reaction to an economic backdrop that is supposedly weakening. The unemployment rate remained stable at 3.7%, near record lows.

- Payroll gains were broad-based, but the majority of gains were concentrated in the services sector, with education, health services, and leisure and hospitality accounting for the bulk. The information sector will be interesting to follow as it contributed to the strong growth in November, but technology (a sub-sector within information) has recently been generating headlines about significant layoffs.

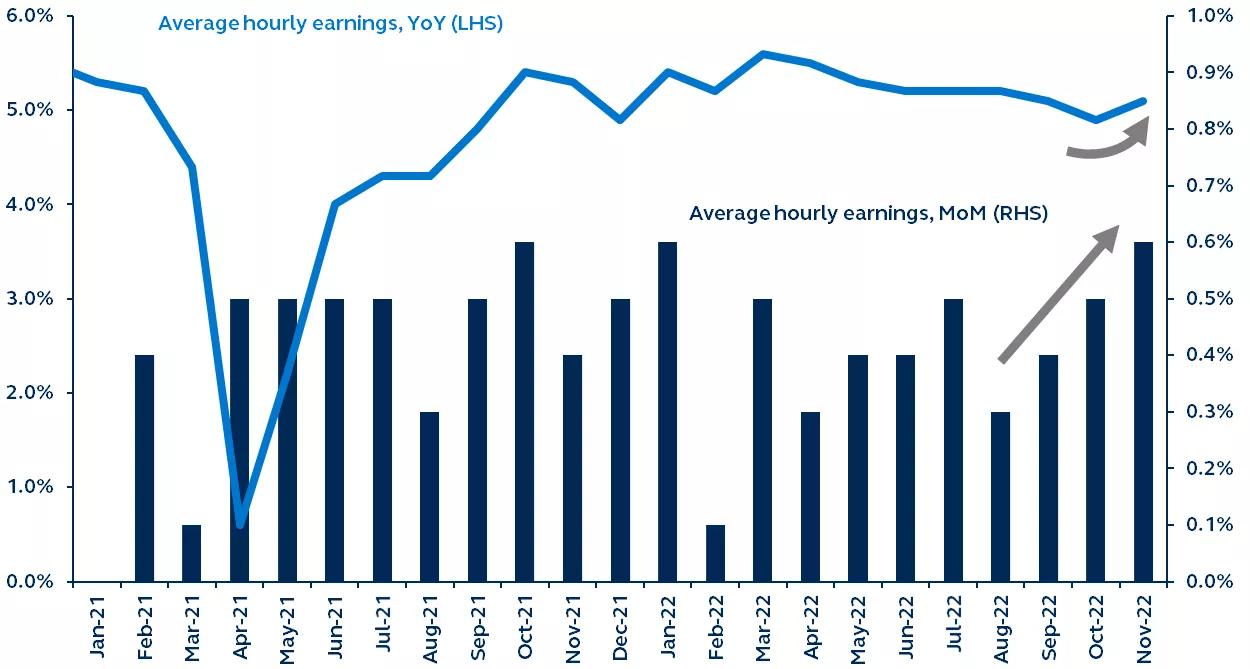

- Average hourly earnings came in very strong, rising 0.6% month-on-month (versus expectations for 0.3%) and matching the highest level all year. At this point in the hiking cycle, hourly earnings growth should be decelerating.

- Tightening labor supply and still strong labor demand are clearly pressuring wage growth and, therefore, inflation. Fed Chair Jerome Powell himself said earlier this week that the labor market is key to understanding core services inflation, the largest and “most important category for understanding the future evolution of core inflation.”

Yearly and monthly average hourly earnings

Year-over-year, month-over-month, 2021–present

Bureau of Labor Statistics, Bloomberg, Principal Asset Management. Data as of December 2, 2022.

In recent weeks, financial markets had, once again, been lowering their expectations for Fed hikes. Unsurprisingly, however, today’s strong jobs report has re-boosted rate expectations, with markets now expecting the Fed to raise policy rates to 5% by early 2023. In fact, several prominent market analysts who, just a few days ago, were suggesting the Fed could stop short of raising rates to 5% have now put out notes questioning if rates will go as high as 6%! (The fickleness of analyst projections never fails to surprise).

Our view, which is unchanged from before the jobs report and has consistently been more hawkish than market expectations, remains that the Fed will need to raise rates above 5%, to force a loosening in labor market conditions—ultimately resulting in a “hard landing” for the economy. Only under those conditions will price stability become a realistic prospect.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

2621010