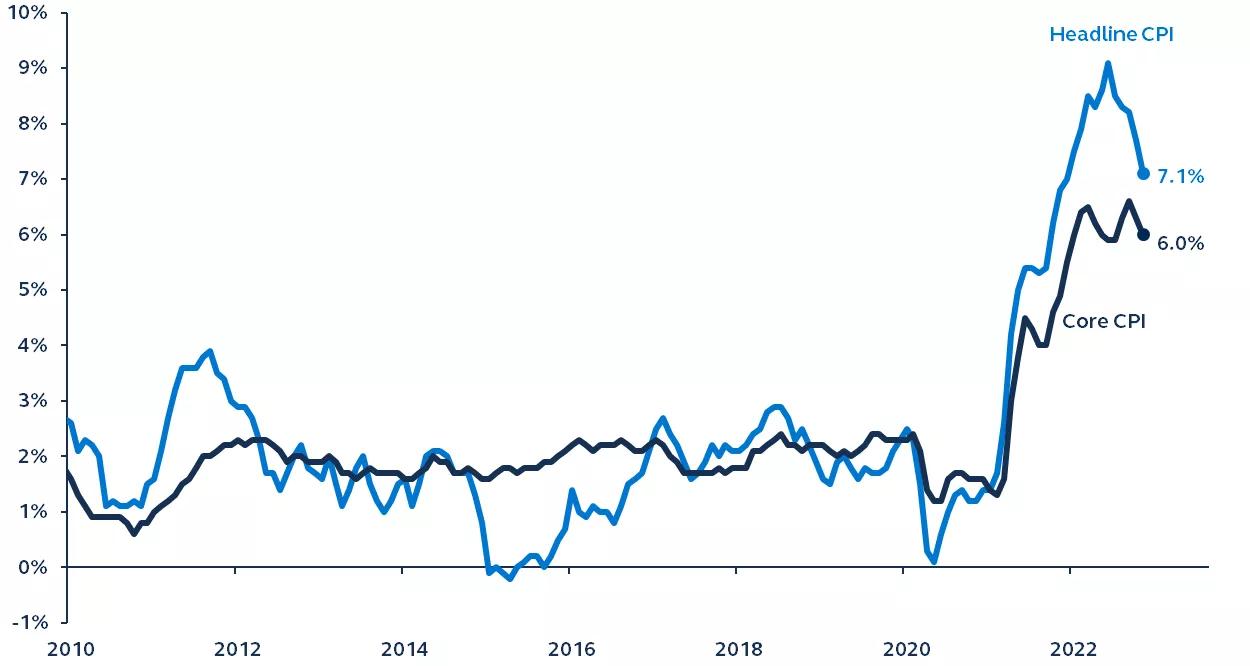

Inflation surprised to the downside for the second consecutive month in November, validating the Federal Reserve’s (Fed) likely step down in the pace of rate hikes at tomorrow’s Federal Open Market Committee (FOMC) meeting. Annual headline Consumer Price Index (CPI) inflation slowed from 7.7% in October to 7.1% in November, while core CPI slowed from 6.3% to 6.0%, confirming that inflation is now on a slowing trend. While this is unambiguously good news for the economy, achieving price stability is still a way off, and the Fed’s work is not yet done.

Consumer Price Index (CPI) inflation

Year-over-year, 2010–present

Bureau of Labor Statistics, Principal Asset Management. Data as of December 13, 2022.

Response details:

- Headline CPI rose just 0.1% on the month (expected 0.3%), bringing the annual rate down to 7.1%. Core CPI (which excludes food and energy prices) rose 0.2% on the month (expected 0.3%), pushing the annual rate down to 6%.

- The underlying components of this month’s report were encouraging, showing a broad deceleration in price pressures. Core goods prices fell for a second consecutive month in November (-0.5% on the month), while core services inflation moderated further (+0.4% on the month, the smallest gain since July).

- In core goods, new car prices were flat on the month, while used car prices dropped for the fifth consecutive month, reflecting a continued easing of supply chain bottlenecks. Clothing prices increased in November, but that followed a very sharp drop last month.

- Core services prices increased but demonstrated a slowing trend. Shelter costs, which are the biggest component of core services and account for around one third of the overall CPI basket, increased by 0.6%, which was the smallest rise in four months. The pace of sequential Owners’ Equivalent Rent (OER)—an estimate of the amount homeowners’ properties would currently rent for—rose from 0.6% in October to 0.7% in November, while rental inflation rose from 0.7% to 0.8%.

- On the face of it, the OER and rental inflation are concerning. But as private sector data point to a stabilization in rents across the country (and there is typically a lag before those developments show through in the official inflation data), the Fed will likely look through these numbers. In addition, medical services inflation fell in November, reflecting the persistent effects of last month's reset lower in health insurance inflation.

- Energy prices declined in November, as gasoline, natural gas and electricity all dropped. Conversely, food prices rose sharply again in the month.

Although equity markets are clearly celebrating today’s data, a word of caution is required. CPI inflation is moving in the right direction but is still far from the Fed’s price stability goal. Fed Chair Jerome Powell has emphasized several times the risks of prematurely claiming victory over inflation. Expect to need to see several months of a clear disinflationary trend before the Fed pauses policy rates, as well as clear evidence that the labor market has cooled. After a year where inflation has been at the forefront of all investor discussions, 2023 should see some inflation relief. For the Federal Reserve, this is still not the time to rest, further tightening, albeit at less of an emergency pace, is still necessary to achieve price stability.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

2637325