Policy outlook

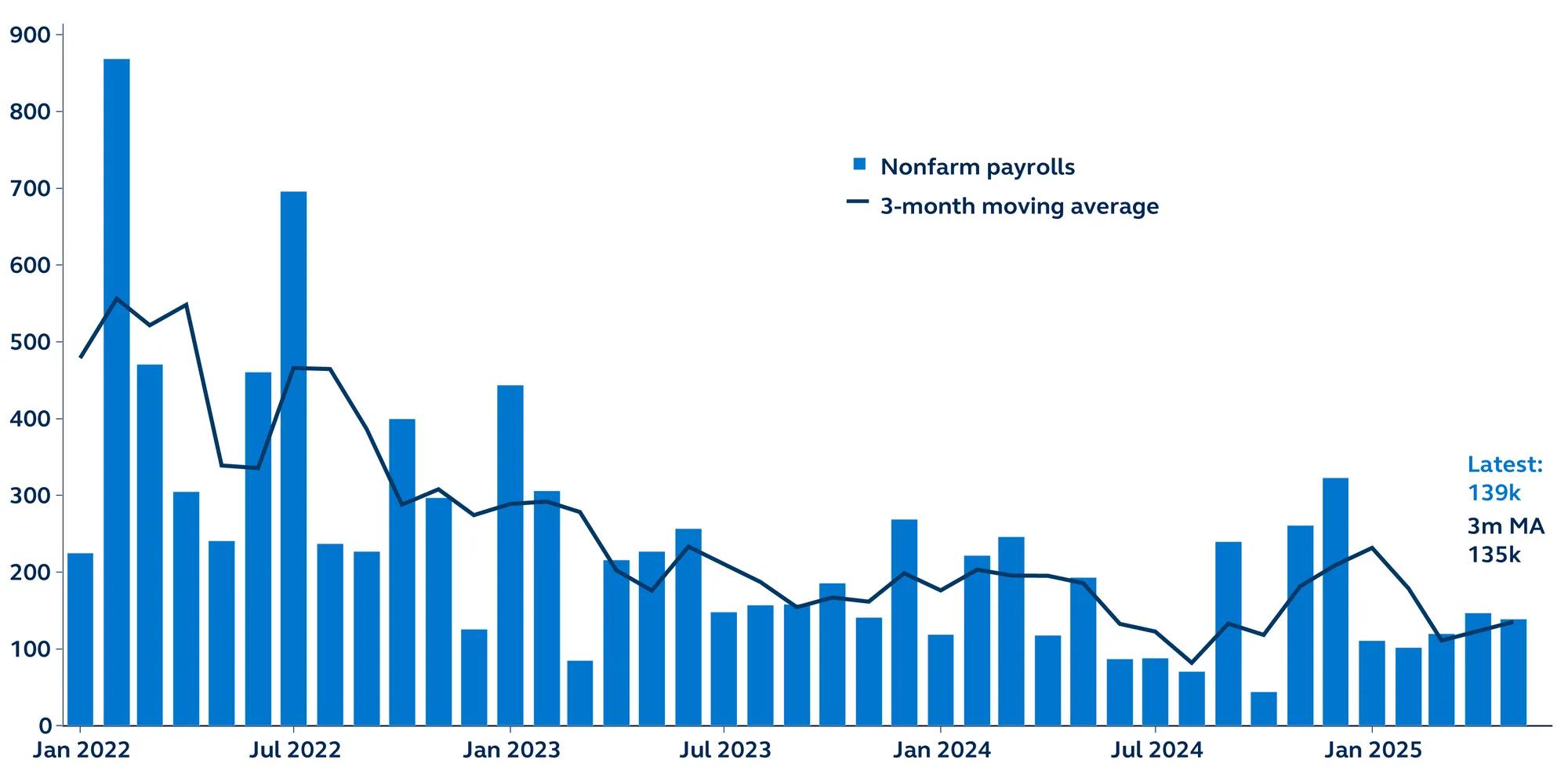

Even during peak trade uncertainty, the U.S. labor market remained fairly solid. Payrolls are still in robust territory, and—although there are clearly cracks forming and employment data is likely to show more evident signs of softening towards the end of summer—this does not appear to be a labor market that is starting to come apart at the seams. With surveys revealing that both small and large businesses plan to hold onto labor despite the more challenging backdrop, coupled with a severe tightening in immigration policy, it’s unlikely the unemployment rate will rise materially this year.

So far, U.S. labor market data is holding up nicely, and the pain trade remains equities grinding higher since the April sell-off despite investors’ reluctance to buy in— the market is clearly skittish about economic risks. For the Fed, there is little urgency to cut rates. They will likely hold on until the trade mist clears to reduce the risk of a policy misstep, particularly while average earnings data remains on the high side of estimates. We still expect the Fed’s first rate cut to come in late 2025.