Report details:

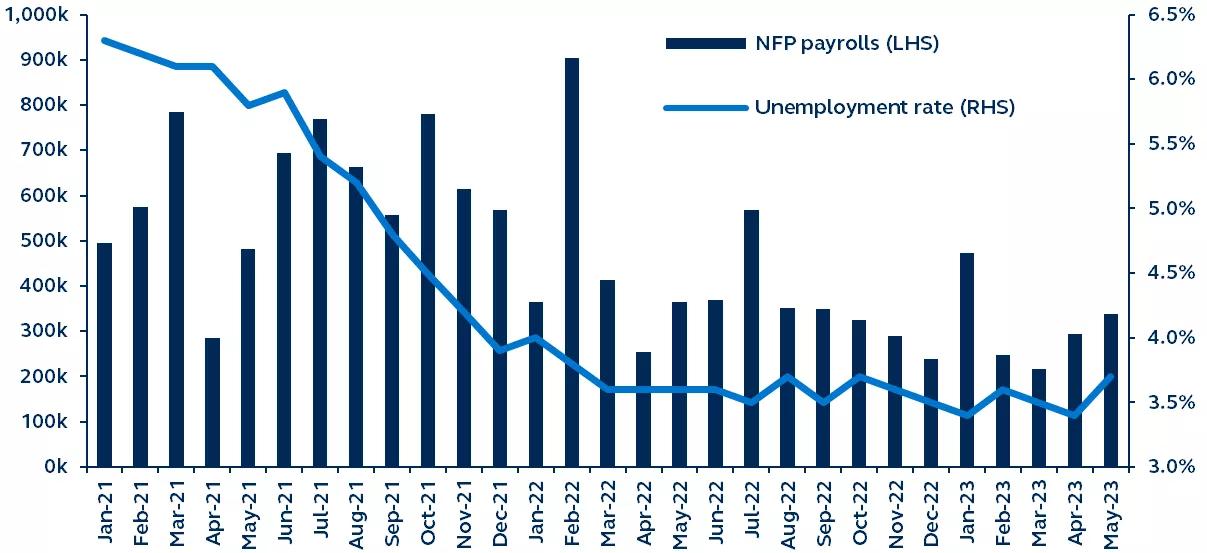

- Total nonfarm payrolls rose 339,000 in May, beating consensus expectations for a 195,000 gain. April's payroll number was revised higher from 253,000 to 294,000. Job gains have averaged 314,0000 this year, significantly outpacing the monthly rate in the ten years pre- pandemic, when U.S. employers added an average of 187,000 jobs a month. Historically, after 500 basis points of Fed tightening, job gains would be weakening sharply—this time, they're defying gravity.

- Payrolls growth was fairly broad-based. Hiring in the services sector remained strong, with leisure and hospitality adding significant jobs and providing further evidence of a still very- resilient consumer.

- Although the payrolls number was extraordinarily strong, the unemployment rate jumped from 3.4% to 3.7%. Reminder, payrolls and unemployment come from two different reports: While the establishment survey is used to calculate monthly payrolls, the unemployment rate is calculated from the household survey (which reported a 310,000 drop in employment).

- Questions will be raised by this significant discrepancy between the two surveys, and the confusing picture means that a June hike is not a given. However, when a similar divergence emerged last year, the household survey (unemployment rate) eventually fell in line with the establishment survey (nonfarm payrolls).

- Average hourly earnings growth slowed from 0.4% in April (revised down from 0.5%) to 0.3% in May, in line with expectations. Aggregate hours worked declined, resuming its previous downward trend. These details, alongside the unemployment rate, have clouded the labor market picture.

Since the Fed's last meeting in early May, the two jobs reports have shown greater-than-expected jobs growth. Other incoming economic data over the past month have also emphasized the strength of the labor market and the continued stickiness of inflation. Although the rise in unemployment muddies the picture somewhat, the overriding sense is that this is not a slowing labor market. And if the labor market isn't slowing, then inflation isn't coming down to 2%.

Markets have repriced their rate outlook significantly in recent weeks. No longer assuming a pause in Fed hikes, the market now strongly expects another hike, in line with our own long-held forecasts for a peak Fed funds rate of 5.25%-5.50%. The timing of the hike likely depends on the CPI data (released on June 13), as well as how much emphasis the Fed places on the establishment survey versus the household survey. What is more evident than the timing of the next hike is the timing of the next cut: 2024. With almost double the average monthly job gains from the 10 years pre- pandemic and a slowing job market a requirement for taming inflation, why would the Fed cut rates this year?