Today, the European Central Bank (ECB) raised its three key policy rates for the seventh consecutive time, opting to step-down the increment to 25 basis points (bps). The interest rate on the main refinancing operations, the marginal lending facility, and the deposit facility will be increased to 3.75%, 4.00% and 3.00% respectively.

With 375 bps of rate hikes since last July’s lift-off, and inflation measures still remaining far too high, the ECB’s goal remains one of dampening demand, tightening financial conditions, and guarding against the risk of a persistent upward shift in inflation expectations. It also stated that “future decisions” will ensure that the policy rates “will be brought to levels sufficiently restrictive to achieve a timely return of inflation to the 2% medium-term target”—a clear demonstration that the ECB believes that policy is not yet at a sufficiently restrictive level.

The ECB also confirmed that balance sheet normalization (known as Quantitative Tightening, or QT) will continue “at a measured and predictable pace.” The asset purchase programme (APP) portfolio will continue to decline by an average of €15bn per month until the end of June, but the ECB expects to discontinue the reinvestments under the APP as of July 2023. This is a hawkish policy confirmation, especially given recent global banking stresses. There also was no preemptive action announced to address the approaching June repayment of TLTRO bank term funding, which could inadvertently add to existing global bank stress.

No forthcoming pause

At today’s press conference, ECB President Lagarde removed any doubt about a future pause in rate hikes by stating multiple times that “we are not pausing” and “we have more ground to cover.” Lagarde refused to be drawn about “the destination,” or where on “the journey” of rate hikes she believes we are, stating simply “this is a journey and we have not arrived yet.” The latest economic data available also suggests that indicators of underlying inflation remain too high, which further explains the ECB’s hawkish tone, acceleration of QT, and their definitive declaration of no forthcoming pause in its rate hikes.

High inflation vs. dampening credit

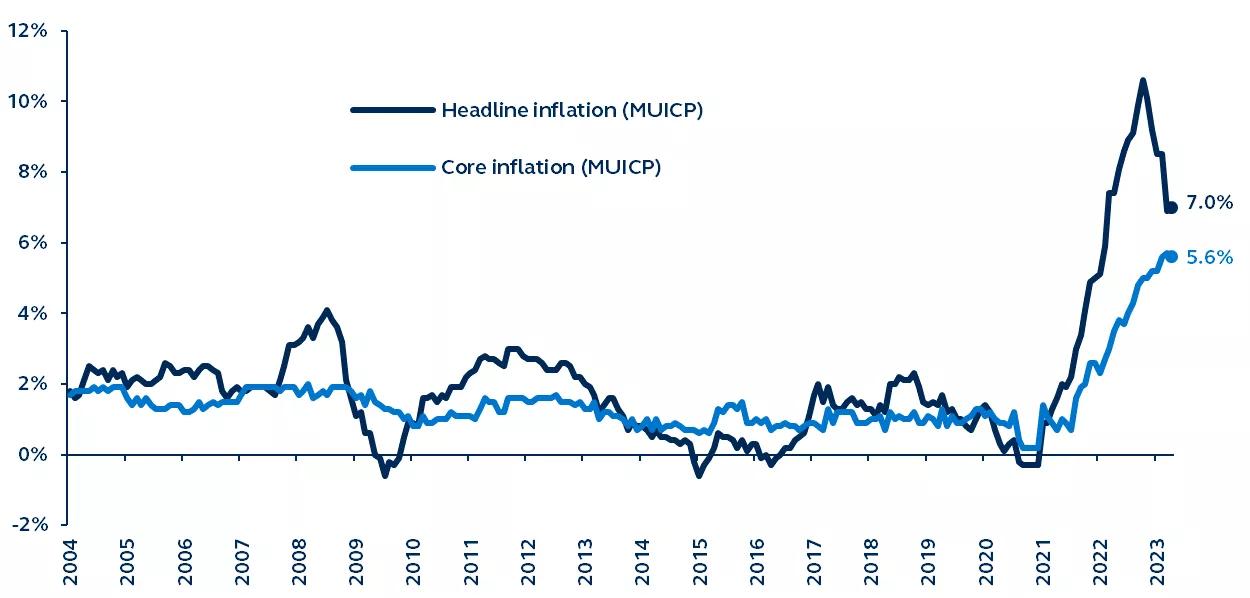

While headline inflation had been steadily declining since its October 2022 peak, April’s reported inflation figure showed a modest uptick to 7.0%. And despite the extremely modest decline in the ECB’s preferred inflation measure (Core MUICP) in April, it too remains well above target levels at 5.6%. Inflation is still being affected by gradual pass-throughs of prior energy price increases and supply bottlenecks, albeit now to a lesser degree. Services are also contributing, driven by a tailwind from pent- up demand after the reopening of the economy, and by rising wages.

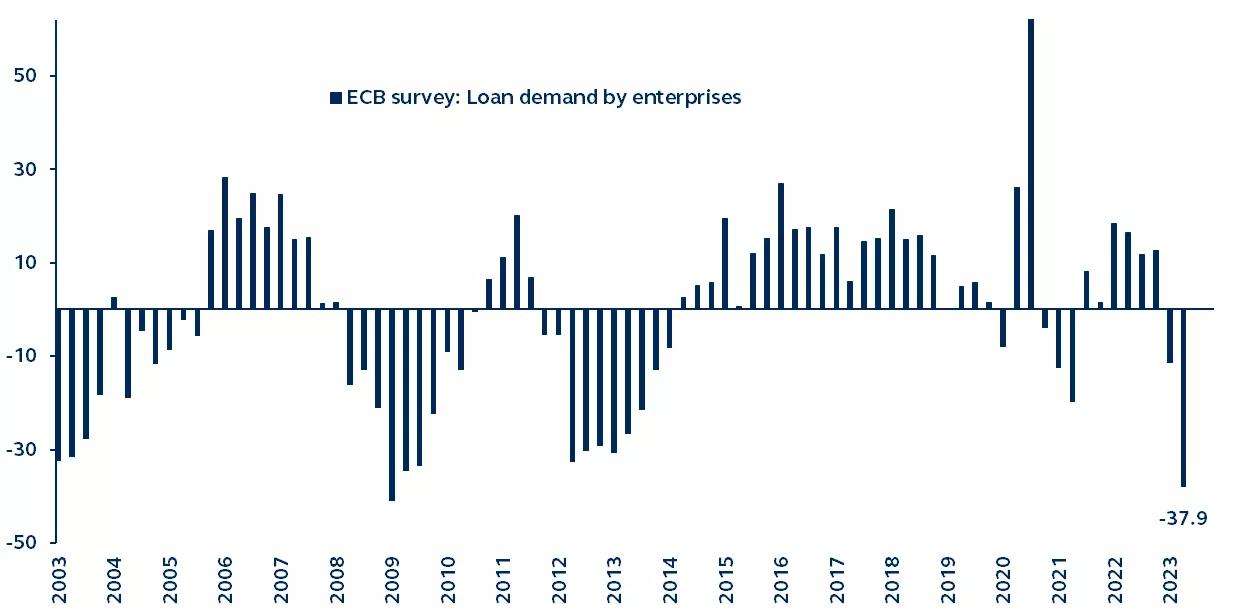

Today’s incremental decrease in the pace of tightening, mirroring the Federal Reserve and other central banks’ slowing of rate hikes, comes amid a hazardous inflation backdrop coupled with increasing concerns around tightening financial conditions in bank lending and credit. Earlier this week the ECB released its own quarterly bank lending survey showing that business demand for enterprise loans had fallen to its lowest level since the Global Financial Crisis—suggesting that the increases in the policy rates since last July are taking effect on credit conditions in the real economy.

Eurozone inflation

Year-over-year % change, 2004–present

Source: Eurostat, Bloomberg, Principal Asset Management. Data as of May 4, 2023.