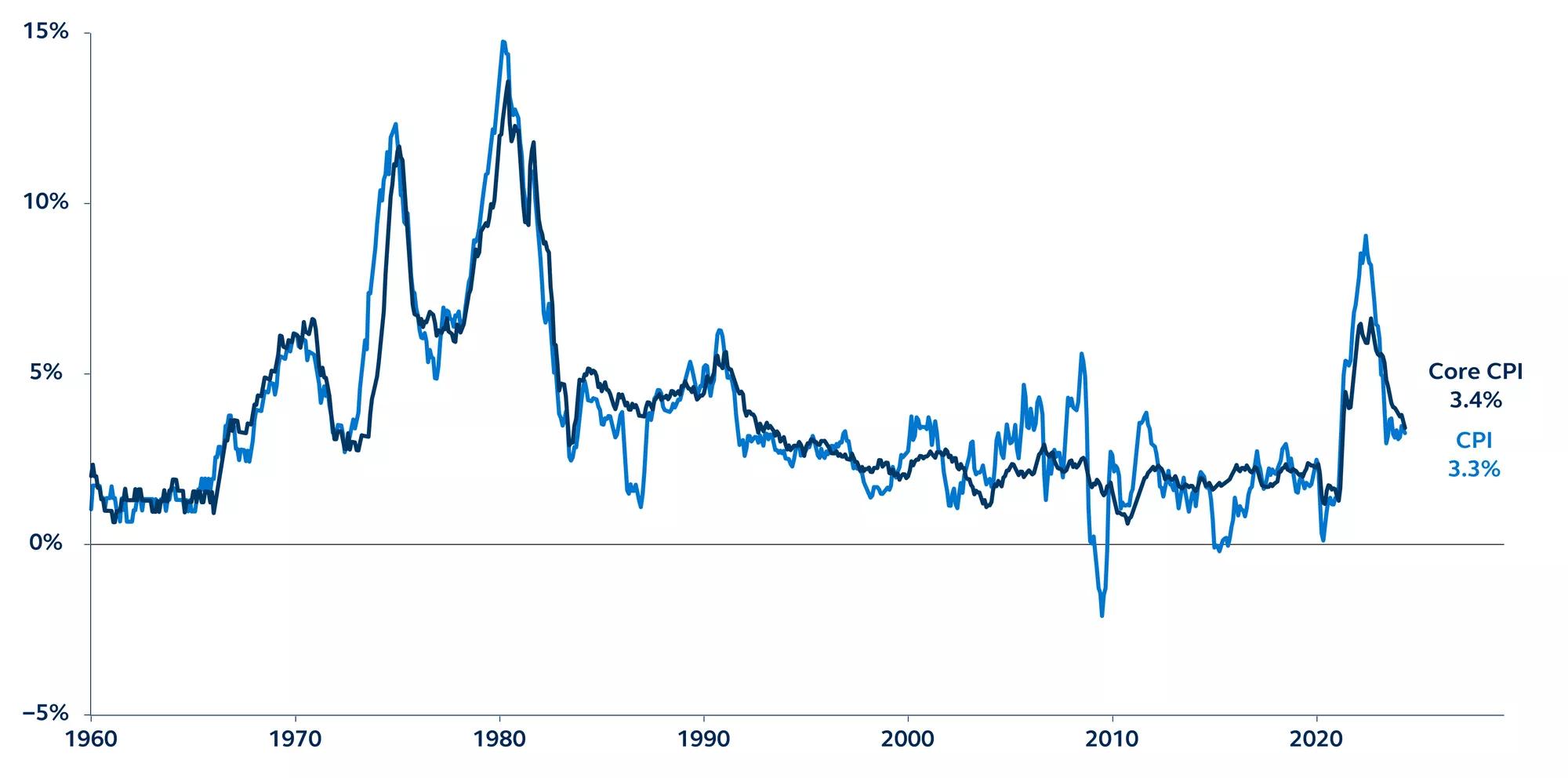

May's CPI report came in softer than expected, delivering a positive sign that recent months of sticky inflation may have been just a bump in the road. Both headline and core inflation came in below consensus estimates in May, with core CPI rising just 0.2% month-on-month and headline CPI unchanged on the month. May’s downside surprise is particularly welcome in light of last week’s blowout jobs report, and should go some way to easing fears that labor market strength may lead to renewed inflation strength. A September rate cut remains in the picture.

Consumer Price Index

Year-over-year % change, 1960–present

Report details

- Headline CPI inflation eased from 0.3% in April to 0.0% in May, a significant milestone following many months of hot prints. This is the first time since July 2022 where there has been no change in monthly CPI. Core inflation slowed from 0.3% last month to 0.2% month-over-month, not only slower than the encouragingly low prints of late 2022, but the slowest pace since October 2023.

- Core goods continue to experience deflation, with prices declining marginally on the month. Core services prices rose just 0.2% on the month, the smallest increase since September 2021.

- Within core services, shelter remained a stubborn contributor to inflation, rising 0.4% for the fourth month in a row. Surveys continue to indicate an easing in these price pressures ahead, but it is taking a frustratingly long time to materialize.

- Removing shelter from the inflation numbers paints a much more positive picture. Core services ex-shelter— the Fed’s preferred CPI measure as it reflects the parts of the economy that monetary policy should clearly impact—was negative for the first time since 2021. However, it is worth noting that much of the slowdown in price pressures was in the airfares and auto insurance segment of CPI services— neither of which flow into the core PCE measure which the Fed targets.

Policy outlook

Last week’s hotter than expected jobs report had raised significant market doubt around the prospects of a September rate cut. May’s inflation print appears to have erased most of those doubts and the market is once again assigning some probability to a September move. Even so, this is just one inflation number. The Fed will need to see a series of soft inflation prints, as well as evidence that the labor market is not restrengthening and risking an acceleration in wage growth, before it can be sufficiently confident to ease. Fed Chair Jerome Powell may have a spring in his step, but the strength of last week's jobs report means that his tone should be one of caution and balance.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3640967