The strength of the “magnificent 7” stocks has created an unrivalled amount of top-heaviness in the market, providing a boon to passive investors in 2023. However, diversification has historically proven more critical in times of excess market concentration, and the combination of a soft economic landing and rate cuts will likely allow for attractive performance to broaden to other high-quality companies—setting the stage for potential outperformance by active investors in 2024.

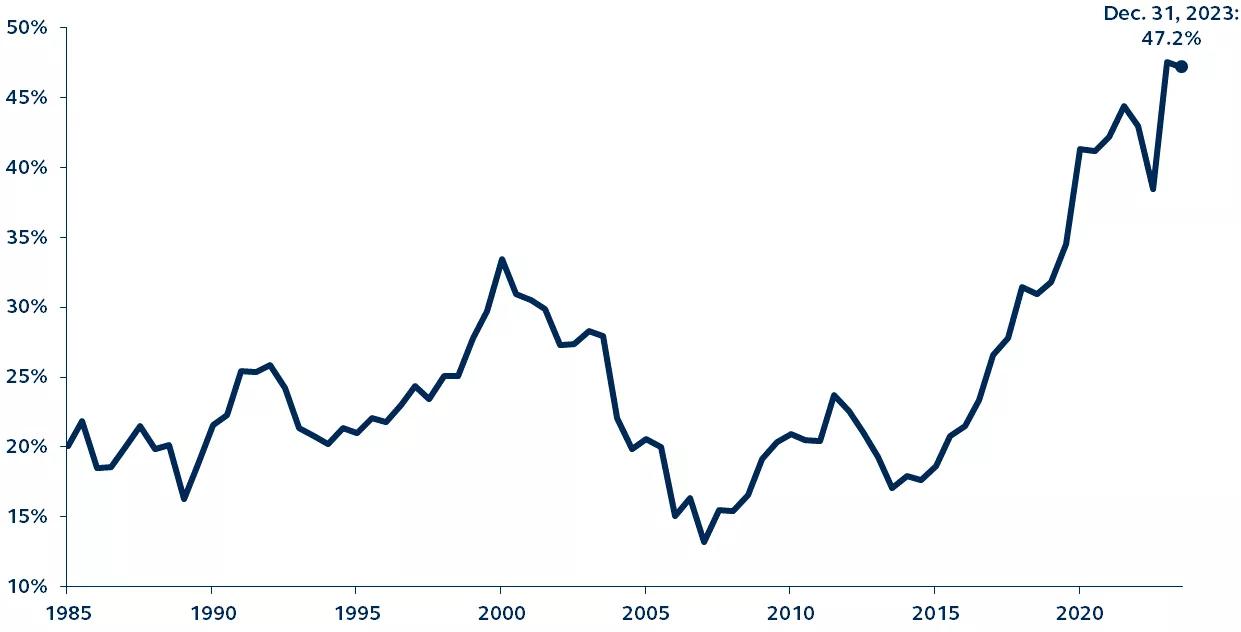

Total percent weight of largest seven companies in the Russell 1000® Growth Index

Data graphed every six months, 1985–present

Only one investment decision mattered in 2023: owning the "Magnificent 7" stocks. This made it a challenging year for active managers as diversification weighed down investment returns. Although the major tech names continue to drive market performance, this year will likely see a broadening out of market breadth and, therefore, the potential for much-awaited outperformance by active investors.

The run by the Magnificent 7 has created historically unrivaled top-heaviness in the market. At the end of 2023, those seven stocks accounted for 47% of the Russell 1000 Growth Index! While this hyper-concentration in U.S. equities has benefitted passive investors handsomely, history shows that diversification becomes even more critical in times of excessive market concentration. The last time the Russell 1000 index became hyper-concentrated, the eventual unwinding of that concentration proved to be a very good time for active management, with 93% of large-cap growth strategies outperforming from June 2000 – March 2008.

The strong balance sheet characteristics and secure competitive market positions of the Magnificent 7 imply that a significant correction is unlikely. Yet, this year, the combination of a soft economic landing and rate cuts will likely allow for attractive performance to broaden to other high-quality companies, particularly those with attractive valuations. Better days are ahead for active investors who remember the virtues of diversification and recognize the current environment as a favorable setup for potential future outperformance by a broader set of companies.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Asset allocation and diversification do not ensure a profit or protect against a loss.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3421341