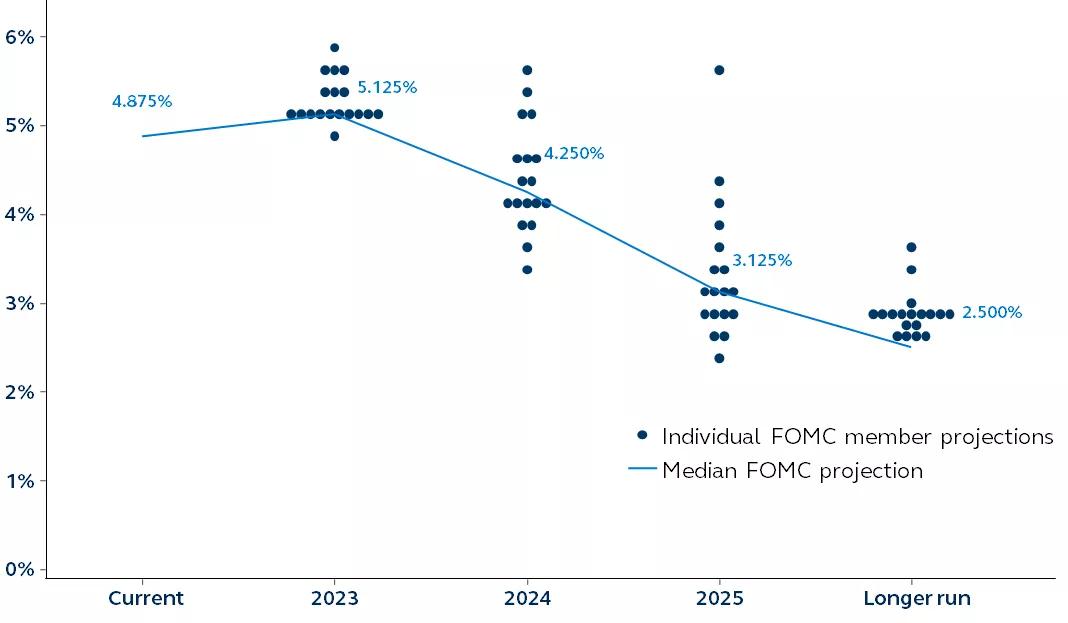

After two weeks of almost non-stop market turmoil and volatility, and just over a year, to the day, from when it first started hiking rates in this cycle, the Federal Reserve (Fed) raised policy rates by 25 basis points (bps), taking the benchmark rate up to 4.75%-5.00% at today’s FOMC meeting. The dot plot showed a peak Fed funds rate of 5.1%, indicating the Fed believes they are nearing the end of their tightening cycle.

The banking sector problems of the past few weeks clearly impacted the Fed’s rate expectations. Fed Chair Jerome Powell emphasized that their statement language had changed from “ongoing increases in the target range will be appropriate” to “some additional policy firming may be appropriate.” Inflation continues to be far too elevated and the labor market still too tight but, increasingly, it seems that tightening credit conditions may do the Fed’s job for them—essentially allowing less Fed action from here.