As financial stresses rapidly shifted over to Europe this week, with concerns about Credit Suisse (CS) accelerating sharply and spilling over into the broader market, there were rising expectations that the European Central Bank (ECB) would pause its rate hiking cycle in favor of further tightening of its policy stance. Instead, and in a show of reasonable strength, the ECB again raised its three key policy rates by 50 basis points (bps) for the third time in a row. Accordingly, the interest rate on the main refinancing operations, the marginal lending facility, and the deposit facility will be increased to 3.50%, 3.75% and 3.00% respectively, with effect from March 22, 2023.

Given the recent market volatility following banking concerns in the U.S. and Switzerland, ECB President Lagarde underscored the view that euro area banks are much stronger than during previous crises and stated that “the euro area banking sector is resilient, with strong capital and liquidity positions.” In addition to this reassurance, the ECB “stands ready to adjust all of its instruments within its mandate... to preserve the smooth functioning of monetary policy transmission.”

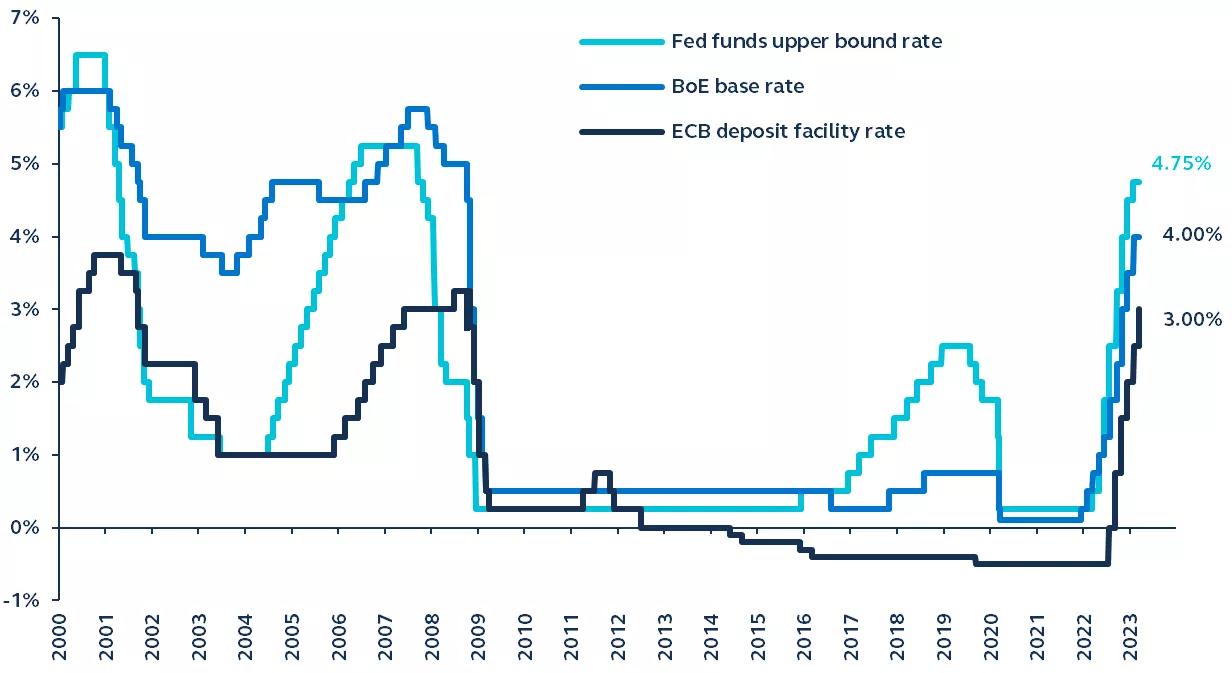

Key central bank policy interest rates

U.S. Federal Reserve, Bank of England, European Central Bank, 2000–present

Source: Federal Reserve, European Central Bank, Bank of England, Principal Asset Management. Data as of March 16, 2023.