Policy outlook

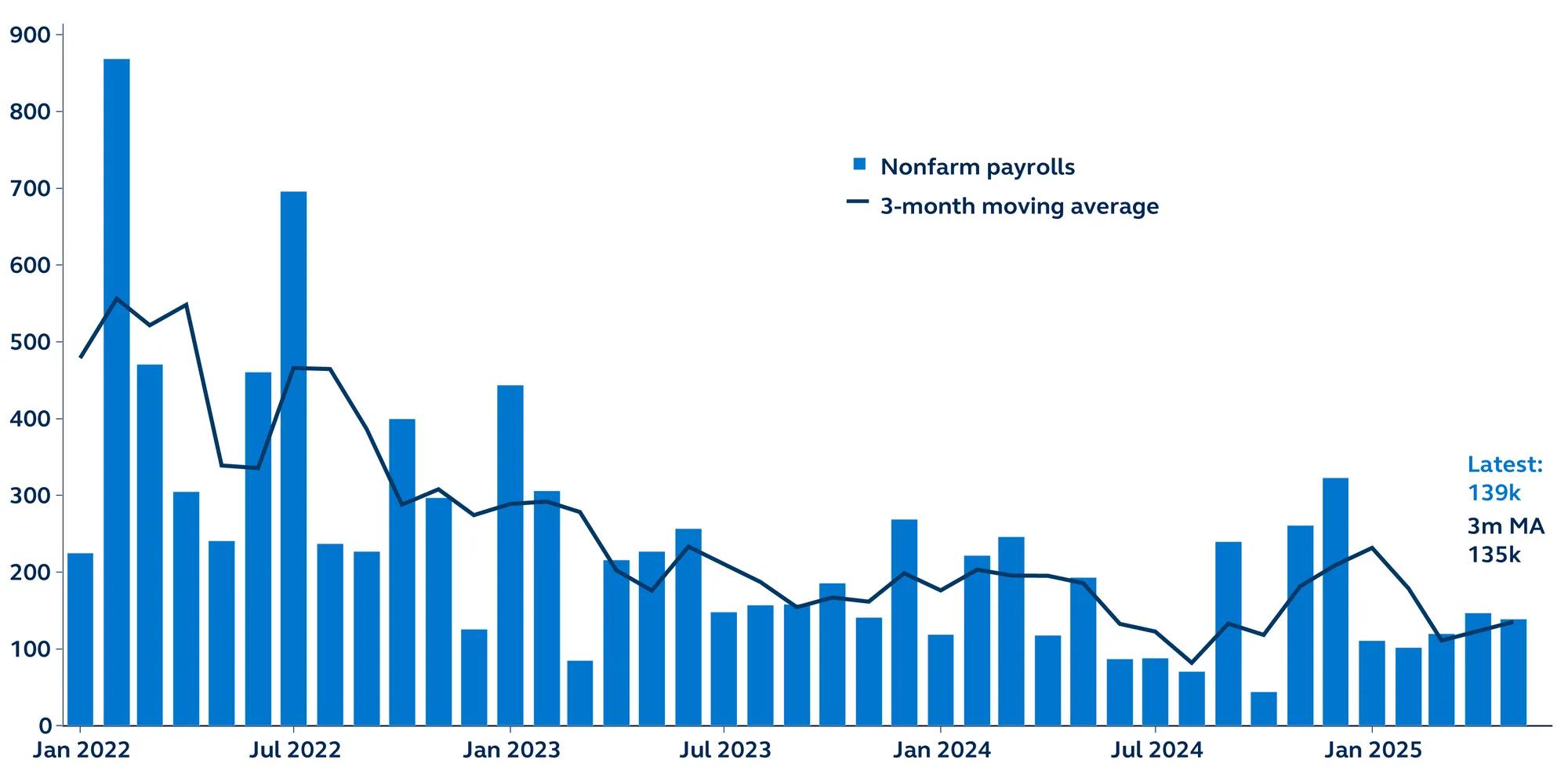

While a few Fed speakers have mentioned their inclination to cut interest rates as early as July, today’s employment data, showing higher than expected payrolls, a drop in the unemployment rate, and a fall in jobless claims completely dispels their case for imminent easing and implies that there is no urgency for Fed support. We continue to expect the first rate cut to come in late 2025.

Looking ahead, it will be worth remembering that important structural forces are also at play, adding complexity to deciphering traditional labor market signals. As labor demand begins to soften, tighter immigration policies are also weighing on labor force growth. As a result, the breakeven pace of payroll growth is likely declining. This dynamic has three key implications: monthly payroll gains may decline due to limited labor supply rather than weakening economic activity; any increase in the unemployment rate should remain contained this year; and a tighter labor supply could keep wage inflation elevated, weighing on corporate profits.