The Federal Open Market Committee (FOMC) kept the benchmark policy rate at 5.25%-5.50% at its June meeting for the seventh consecutive meeting. More significantly, the latest dot plot revealed that the FOMC’s median projection has removed two cuts from their 2024 rate projections. From the FOMC perspective, that leaves just one 25 basis point reduction this year—market expectations had been for the dot plot to show two cuts in 2024.

Yet, May’s softer-than-expected CPI print is prompting many market participants to question the validity of the dot plot already. Did the dots take May’s CPI print into account? Powell noted that FOMC voters were given the option of adjusting their projections after seeing the CPI print but that most officials “do not.” It’s not entirely clear how to interpret his response (do voters always avoid changing their projections in response to last-minute data, or was May’s data not significant enough to prompt a revision?). But, with Powell downplaying the dot plot and emphasizing the need for greater confidence that inflation is trending towards the Fed’s 2% target, it likely implies that if there are further inflation prints like May’s, two rate cuts could be back on the agenda.

The economic backdrop

Powell described today’s economy as solid but slower than last year. He characterized the labor market as better balanced than before and considers inflation to have made “modest progress” toward the 2% goal. He said, “We’ll need to see more good data to bolster our confidence that inflation is moving sustainably toward 2%.”

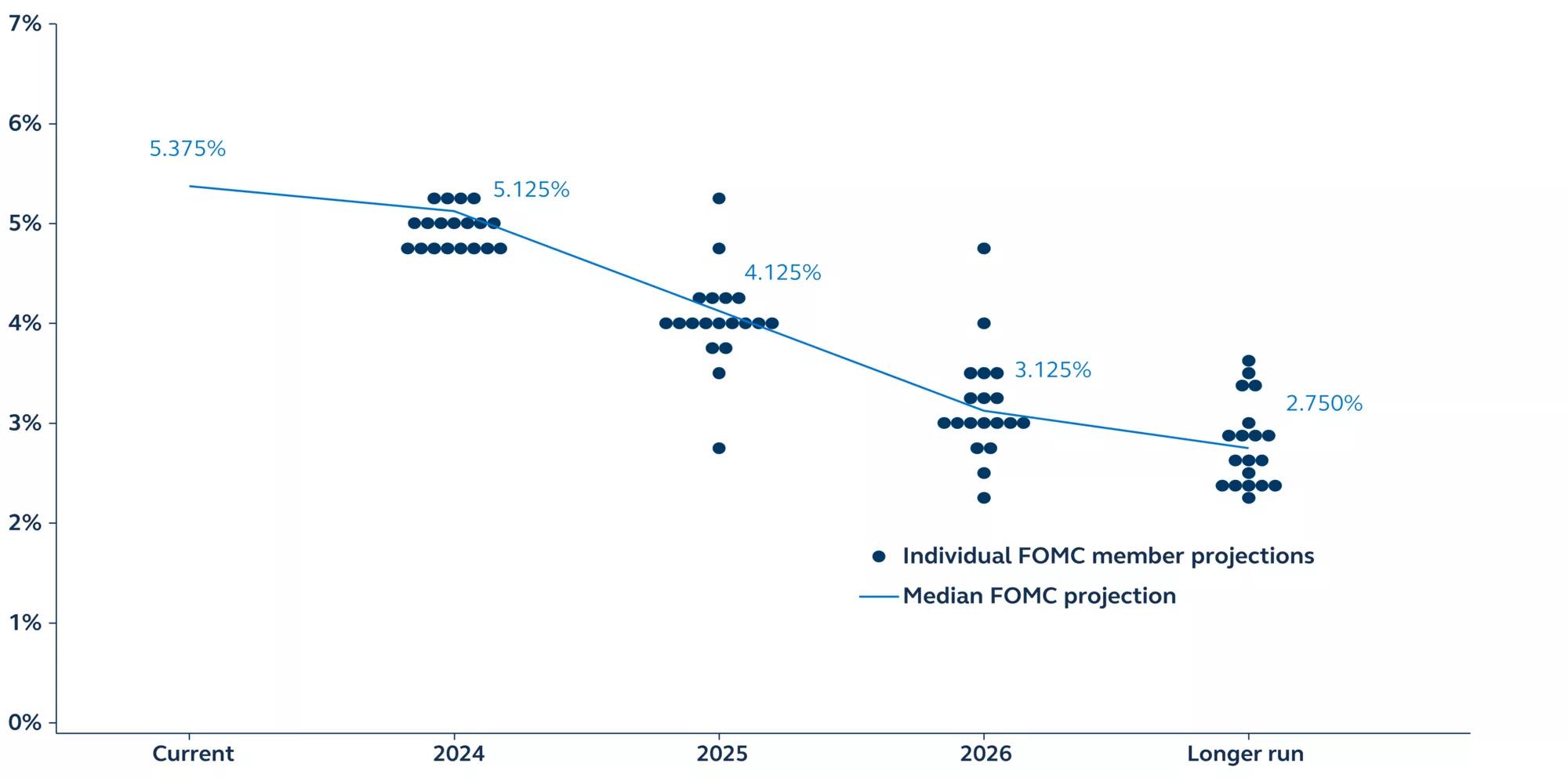

FOMC dot projections

June 2024

Source: Federal Reserve, Clearnomics, Principal Asset Management. Data as of June 12, 2024.

Updates to the Summary of Economic Projections

The new Summary of Economic Projections (SEP) saw minimal revisions.

- The GDP growth forecasts for 2024, 2025 and 2026 were left unchanged (2.1%, 2.0% and 2.0% respectively). This implies that they expect growth to remain slightly above potential (estimated at 1.8%) for the entire forecast period.

- The 2024 unemployment rate forecast was left unchanged at 4.0%, while the 2025 and 2026 forecasts were nudged up to 4.2% and 4.1%, respectively.

- The core PCE inflation forecast for 2024 was revised up from 2.6% to 2.8%. Yet, May’s CPI print has prompted several forecasters to suggest that that PCE inflation may fall to 2.6%— the FOMC’s original forecast— by year-end. Powell was questioned about this, and he simply responded by describing the inflation projection as “conservative.” He also rightly pointed out that base effects become increasingly challenging in the second half of the year, so it is possible that even with soft monthly inflation prints, annual core PCE could drift higher over the coming months.

The major changes to the FOMC’s outlook came in the dot plot:

- The median projection now sees rates falling to 5.1% rather than 4.6% by the end of this year. This equates to just one 25 basis point reduction in 2024— two less than the March dot plot had projected.

- However, more participants expect two cuts than those that expect just one cut. Indeed, of the 19 participants, eight expect two cuts, seven expect just one cut, and four expect no cuts at all this year.

- The median dot falls further to 4.1% by the end of 2025, equivalent to another 100 basis points of cuts. By contrast, the March 2024 dot plot projected 75 basis points of cuts in 2025. Essentially then, one of the cuts has been removed from 2024 and shifted into 2025.

- The 2025 dispersion in dots is very significant, ranging from a high of 5.4% (essentially, no cuts in 2024 or 2025) to a low of 2.9% (equivalent to 250 basis points of easing between now and end-2025).

- The median dot for 2026 remains unchanged at 3.1%, equivalent to a further 100 basis points of easing.

- As was anticipated, the median longer-run dot was raised from 2.6% to 2.8%. However, Powell went to pains to note that the neutral interest rate is a theoretical concept— in essence, dismissing its relevance to current policy.

Looking ahead

Even after this dot plot revision, the timing of the first cut remains a difficult question. There is significant uncertainty around the “last mile” of progress for stubborn and sticky inflation. May’s soft inflation print likely does keep a September cut in play, but deceleration in price pressures would need to be sustained for the next few months and also be joined by further evidence of labor market rebalancing.

We continue to expect cuts in September and December this year, but it is very much dependent on the incoming data showing convincing and consistent evidence of an easing in economic activity, reduced labor market strength, and softening inflation.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3642110