Policy outlook

In this week’s meeting, the FOMC kept its benchmark policy rate unchanged at 4.25%-4.5%. Interestingly, there were two dissents, including from Fed Governor Christopher Waller whose concerns around slowing labor demand have gained traction within the committee. A meaningful remark from the press conference, however, was Chairman Powell’s acknowledgment of declining labor supply keeping the labor market in balance despite weakening demand. As such, the case for policy easing was not deemed necessary.

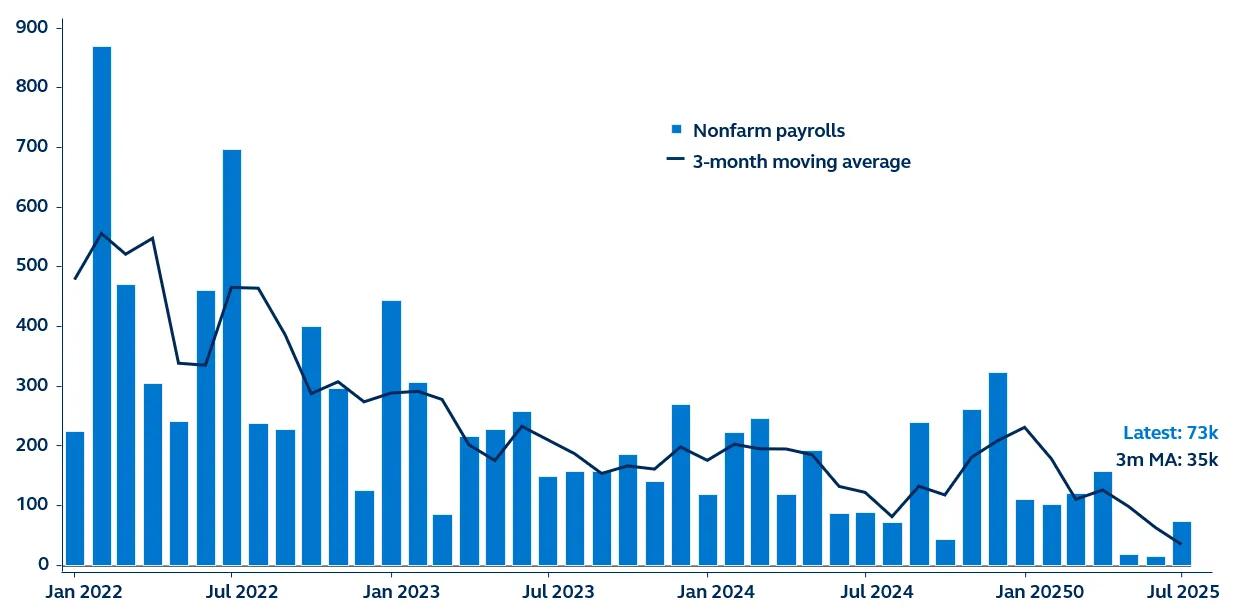

After today’s weak payroll print and sizable downward revisions to the prior two months, the odds of a September rate cut have risen meaningfully. While tighter immigration policies may slow labor force growth—effectively lowering the breakeven pace of job gains—the Fed is likely to focus on any signs of softening labor demand. If upcoming jobs and inflation data disappoint again, the case for a cut in September could become clear. Still, underlying structural dynamics in the labor market may continue to limit any sharp rise in unemployment, complicating the policy response.