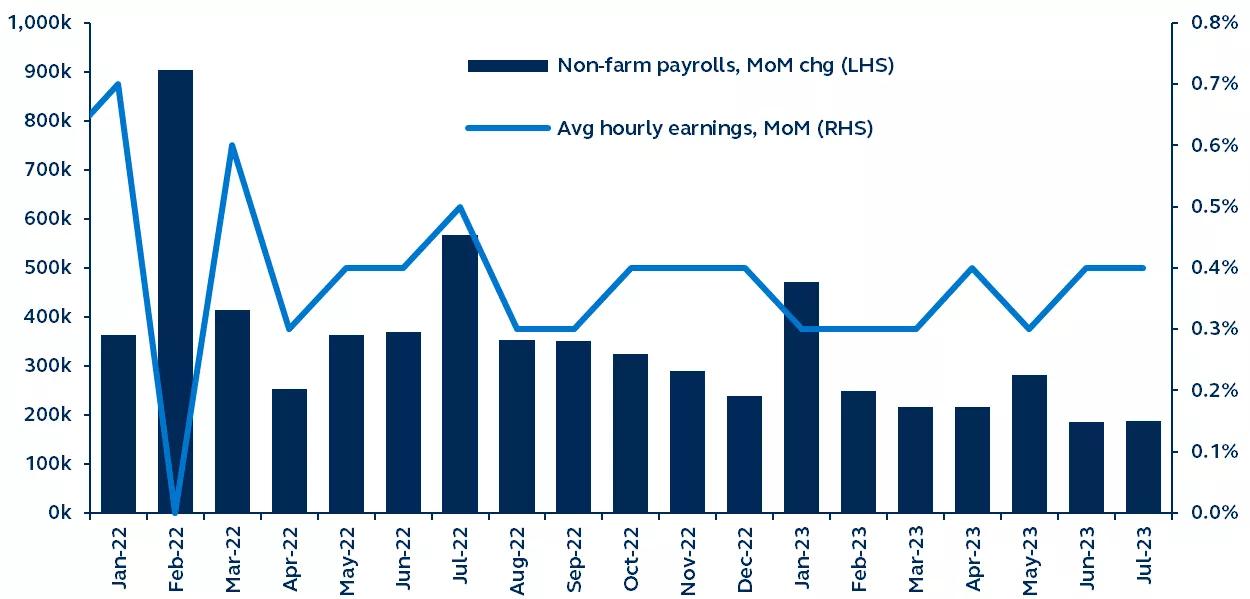

The July jobs report had something for both doves and hawks. Non-farm payrolls rose by 187,000, the first sub-200k number since December 2020, but hourly earnings growth came in a little hotter than expected. This mixed labor market picture will not sway the Federal Reserve (Fed) in one direction or the other.

Report details

- Total non-farm payrolls rose 187,000 in July, slightly below consensus expectations for a 200,000 gain. While this was the second consecutive downside surprise and the first sub-200,000 number since the pandemic, it’s also worth noting that, pre-pandemic, a number above 175,000 would have been considered consistent with a strong economy.

- Some analysts are focusing on the negative revisions, which subtracted 49,000 payrolls over the previous two months. While this slightly adds to the picture of a softening jobs market, it’s hardly a meaningful revision and certainly not a game-changer.

- Hours worked declined again, an additional tentative sign of softening. In previous downturns, a drop in workers’ hours preceded larger-scale layoffs.

- Manufacturing lost 2,000 jobs in July, a significant downside surprise to expectations for an increase of 5,000. Health care accounted for around one-third of jobs added, while private education, construction, and leisure & hospitality also showed strong gains.

- The unemployment rate dropped from 3.6% to 3.5% as employment in the household survey rose by 268,000, while the participation rate remained unchanged at 62.6% for the fifth consecutive month.

- Hawks will have been inspired by the fact that average hourly earnings rose by 0.4% on the month, slightly higher than expected. The annual average hourly earnings growth remained unchanged at 4.4%, higher than the 4.2% consensus forecast. Continued wage pressures imply that the Fed cannot rest easy just yet.