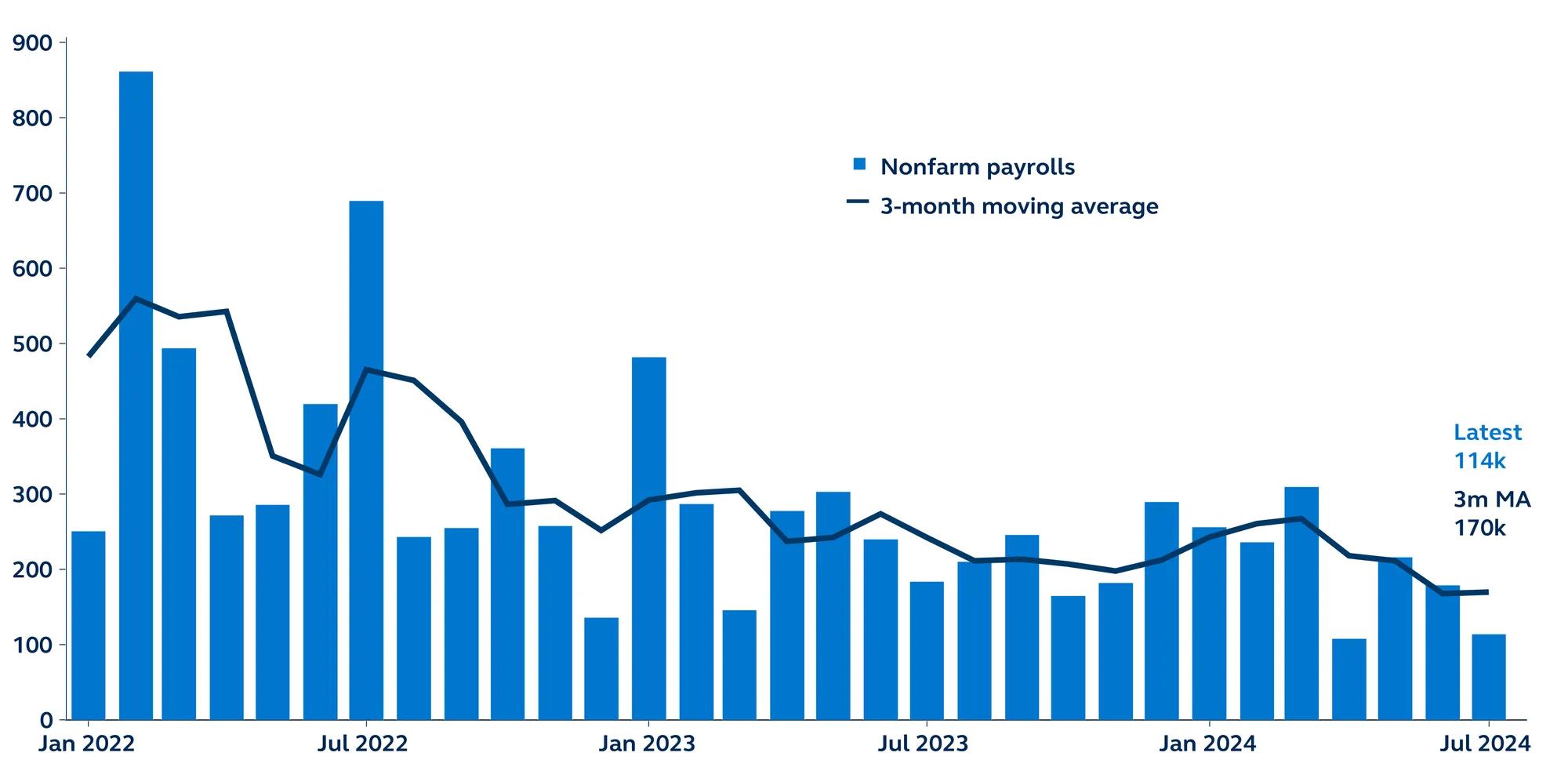

Today’s jobs report for July confirms that the labor market is slowing, all but ensuring a September rate cut. The 114,000 new jobs added last month missed consensus estimates of 175,000. June’s 206,000 figure was also revised down to 179,000. The unemployment rate jumped to 4.3%, inevitably triggering recession concerns, and wage growth came in below expectations. With both sides of its mandate justifying a rate cut, the data raise the question of whether the Fed has been too slow to act.

Non-farm payrolls

Thousands, January 2022–present

Report details

- The BLS categories of Healthcare, Construction, and Transportation and Warehousing accounted for much of the increase in jobs, while Information saw a loss of 20,000 jobs in July, though it has not changed much over the year. Leisure and Hospitality was also relatively flat, remaining close to its level just before the pandemic.

- The weakening in jobs growth was clear across the spectrum, with private payrolls only rising 97,000 versus 140,000 expected and 136,000 in June.

- Average hourly earnings increased only 0.2% on the month, below estimates, bringing the year-over-year rate to 3.6%, the smallest gain since May 2021.

- Unemployment rose to 4.3% in July, above expectations that it would remain at 4.1% after rising slightly the previous month. While unemployment is still relatively low by historical standards, it is the highest since the pandemic years and mid-2017 before that. The “under-employment rate” (U6) also jumped to 7.8% from 7.4%, the highest level this cycle.

- However, it’s important to note that a rise in labor force participation was partly responsible for rising unemployment. This dulls the recession signal from the newly-triggered Sahm Rule, which states that historically, a 0.5% increase in three-month average unemployment over 12 months indicates that recession has begun.

Policy outlook

The July jobs report suggests that a September rate cut is in the bag. Following rising weekly jobless claims and a notable downside surprise to the latest ISM survey, the Fed will be nervously watching to see how economic data evolves over the coming month. Already several market commentators have warned that the Fed has waited too long before easing policy, raising the risk of a hard landing. However, a key question facing the Fed will be whether the level, versus magnitude of change, matters more.

Markets have responded very negatively to today’s report. But just as markets over-reacted to Powell’s dovish remarks last October, and then once again in April as inflation numbers came in hotter than expected, this is likely an exaggerated reaction too. The labor market is clearly cooling but, with payrolls above 100k, talk of recession is premature. And although the unemployment rate has risen, it is partially due to rising labor supply. Much will depend on how the incoming economic data evolves and, with two more inflation prints and a payrolls print still to come before the FOMC meets again in September, the Fed will have much to consider. At this stage, however, the very negative market response looks overdone. We continue to expect rate cuts in September and December— however, a further deterioration in the broad inflation and labor market data may also add a November cut to the mix.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3765802