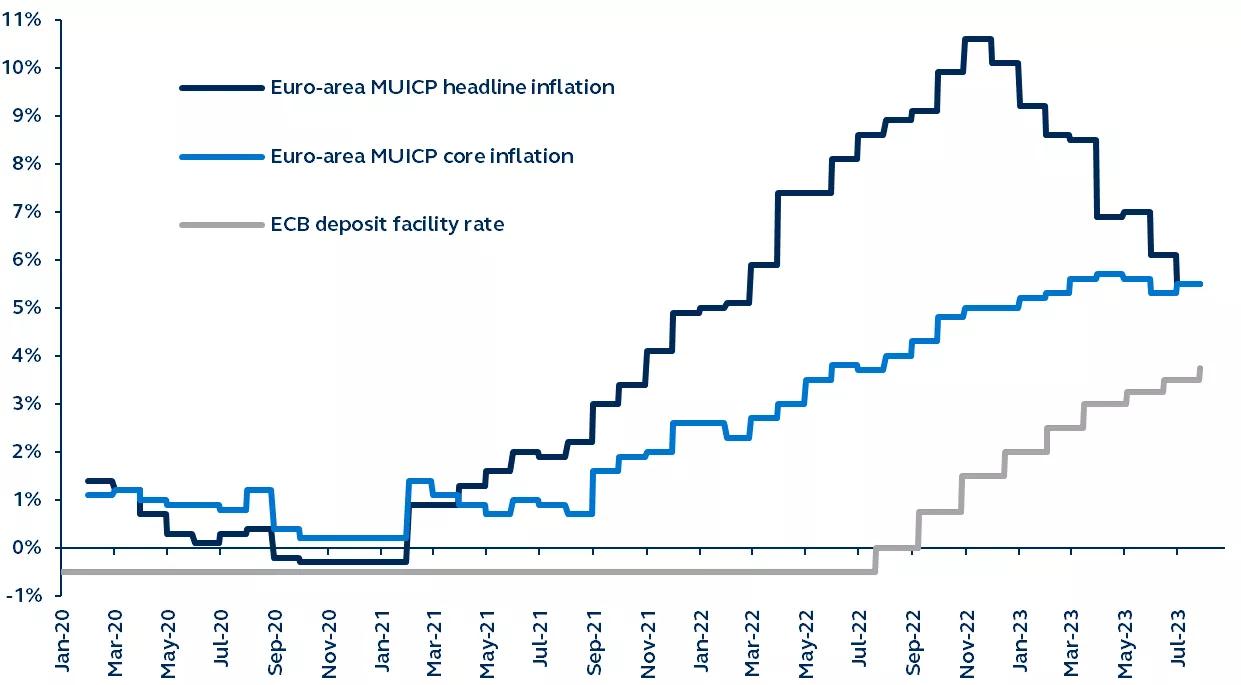

Today, the European Central Bank (ECB) raised its three key policy rates for the ninth consecutive time, opting again to raise rates by 25 basis points (bps). The interest rate on the main refinancing operations, the marginal lending facility, and the deposit facility will be increased to 4.25%, 4.50%, and 3.75%, respectively.

With 425 bps of rate hikes since last July’s lift-off, the ECB’s goal remains to dampen demand, tighten financial conditions, and guard against the risk of a persistent upward shift in inflation expectations. While progress on inflation continues, it is still expected to remain too high for too long, suggesting restrictive conditions will be required for some time.

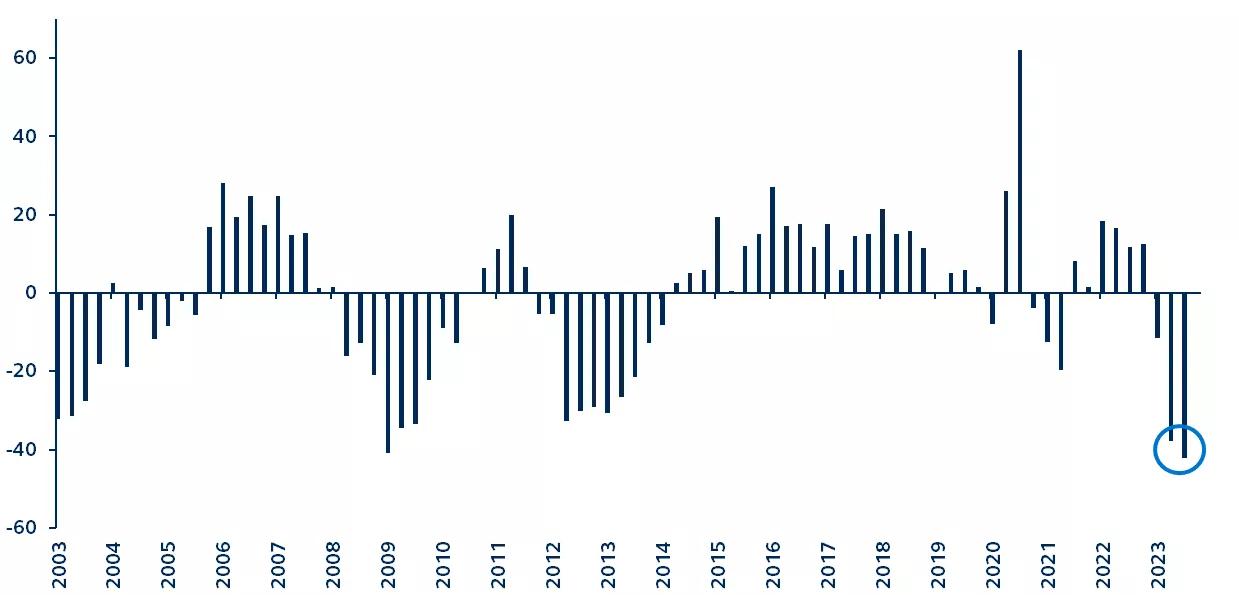

Today’s rate hike decision came as no surprise—markets had priced in a 97% probability of a 25 bps hike. The policy statement did alter its language ever so slightly by changing from June’s “rates will be brought to levels sufficiently restrictive” to today’s “rates will be set at sufficiently restrictive levels.” This shift in emphasis from rate changes to rate levels may suggest the ECB believes rates are now sufficiently restrictive and therefore opens the door, albeit only slightly, to a future pause. The shift also appears to acknowledge recent economic weakness, as well as the ECB’s latest quarterly bank lending survey, which showed that business demand for enterprise loans has fallen to its lowest level on record, surpassing measures during the Global Financial Crisis. Markets interpreted the slight change in language dovishly, as reflected by the slightly weaker Euro and a minor rally in short-end euro-area bonds.

The ECB also confirmed that balance sheet normalization (known as Quantitative Tightening, or QT) is continuing “at a measured and predictable pace.” The asset purchase programme (APP) portfolio has been declining since the end of June, and the ECB confirmed its discontinuation of reinvestments under the APP. There was no change to the expectation for the reinvestment of PEPP principal payments until at least the end of 2024.