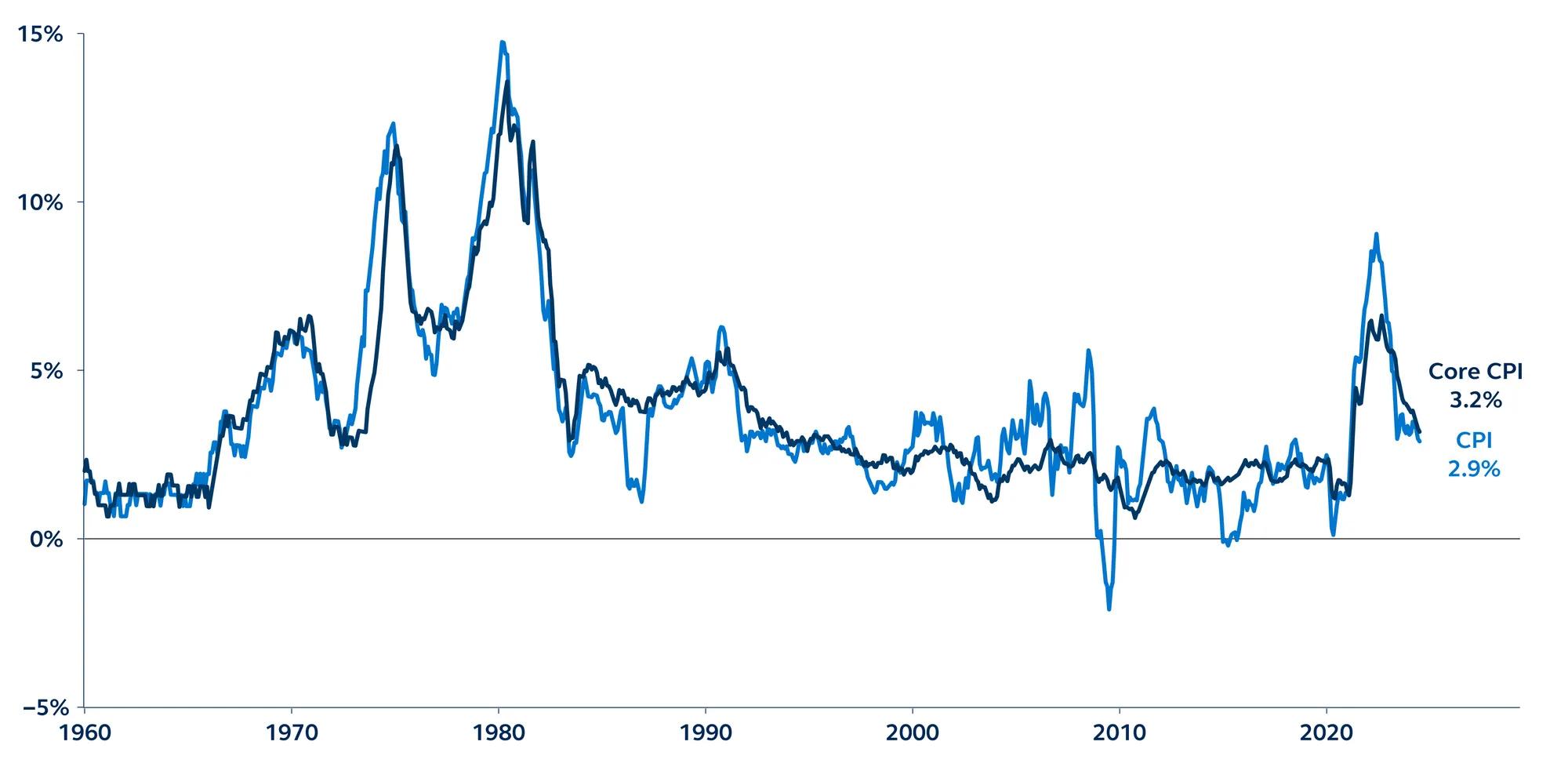

Consumer Price Index

Year-over-year % change, 1960–present

Report details:

- Monthly headline inflation rose 0.2% in July, as expected, seeing the annual rate decline slightly to 2.9%, from 3.0% prior. Core inflation, which strips out food and energy, grew 0.2% over the same period, also as expected, bringing the annual rate to 3.2% from 3.3% prior. Three-month annualized core inflation has fallen to 1.6%, the lowest level since 2021.

- Stickiness within inflation was once again most evident within core services—which rose 0.3% in the month. The increase in the shelter category contributed nearly 90% of the monthly increase in headline inflation, rising 0.4%. This is likely to be a setback for the long-awaited decline in shelter inflation, especially amid the notable deceleration last month. Transportation prices also rose, led by auto insurance, which increased 1.2%.

- Meanwhile, core goods continued to see a deflationary trend, with prices declining 0.3% in the month. This was led by new vehicle prices and apparel, declining 0.2% and 0.5%, respectively.

- The Fed’s preferred supercore inflation measure, which excludes shelter from core services and is significantly influenced by labor costs, rose 0.2% in July. This follows two consecutive months of decline. While this leaves the annual supercore figure above its pre-COVID level, it has resumed its downward trend, easing from 4.7% to 4.5%.

Policy outlook

Today’s inflation report suggests the Fed is unlikely to feel sufficiently emboldened to reduce policy rates by 50 basis points next month. Inflation is decelerating, but progress remains fairly slow, suggesting that the Fed should ease monetary policy only gradually.

Ahead of the next FOMC meeting on September 18, there will be another CPI release and another all-important jobs report for the market to dissect. If the picture looks more ‘mid-cycle adjustment’ than ‘recession,’ markets should be content with just a 25 basis point cut in September. Note that next week, Fed Chair Jerome Powell will be speaking at the Jackson Hole Symposium, and markets (and we) will be on high alert for any hints around the 25 versus 50 bps debate.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3791385