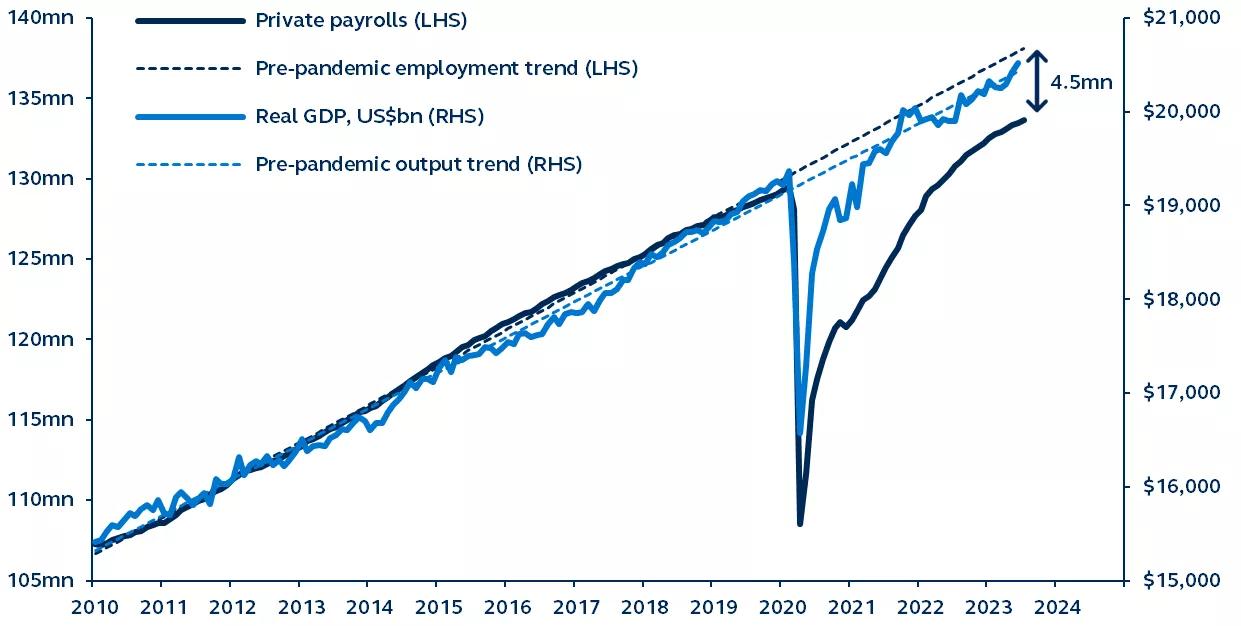

Employment sits below its pre-pandemic trend and notably, has not recovered as fast as U.S. real GDP. Leisure & hospitality has been the biggest culprit, having had a late start on post-COVID reopening. As these predominantly low-wage jobs return, investors should expect structural downward pressure on wage inflation—which would be welcome news for the Fed and bolsters the case for a prolonged pause in Fed rate hikes.

U.S. real GDP and private employment versus pre-pandemic trends

2010–present

Source: Bureau of Labor Statistics, Macroeconomic Advisers, Bloomberg, Principal Asset Management. Data as of July 31, 2023.

Despite the deep pandemic recession, real GDP recovered remarkably fast, and real economic output has now surpassed its pre-pandemic trend. On the other hand, employment and the 22M jobs lost during the pandemic only returned to pre-pandemic levels last June and are still below trend.

From 2010-2020, the relationship between the level of real GDP and private employment was extraordinarily close. Today, however, employment gains have lagged, and the employment shortfall from the pre-pandemic trend suggests that 4.5M more private-sector workers are still needed. Sustainable economic growth will likely require further job gains.

Post-pandemic employment shortfalls have been largely concentrated:

- Manufacturing and Construction, two of the most cyclical sectors, remain about 800k jobs below trend.

- Healthcare services is short over 500k jobs, which likely reflects burn-out among pandemic front-line workers.

- Nearly 1.8M jobs have yet to return to Leisure & Hospitality, indicative of its delayed COVID reopening.

Recently, economywide job gains in the face of aggressive Federal Reserve policy rate hikes have confounded investors. Yet, persistent employment shortfalls suggest continued substantial payroll gains should be, in fact, expected. With the strong likelihood that an outsized portion of job gains from here will come from lower-wage, labor-intensive sectors, wage inflation should continue to moderate while sustaining output growth—another case for a prolonged pause in Fed rate hikes.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3055089