Report details

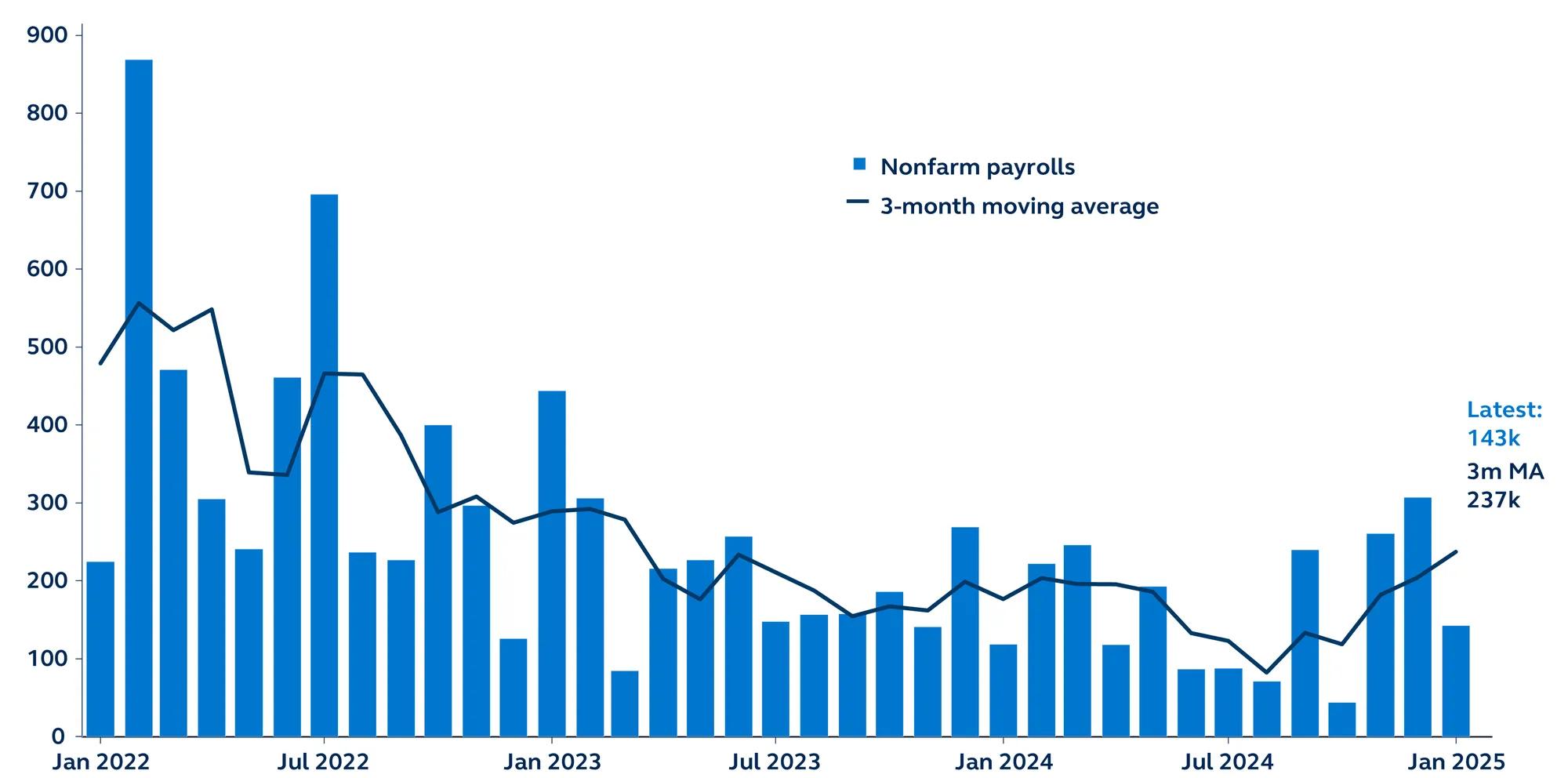

- Total non-farm payrolls increased by 143,000 in January, below consensus expectations, which had called for 175,000. December’s already strong report was revised even higher to 307,000. The BLS noted that the wildfires in Southern California and severe winter weather impacting much of the country has no discernable effect on the report.

- Overall job growth was dominated by a few industries, including healthcare and government, where employment grew 44,000 and 32,000, respectively. Employment in retail trade also showed a continued rebound, adding 34,000 jobs, despite having added little net jobs in 2024. While government employment has been a steady source of job gains over the past year, contributing over 20% of total average payroll gains in 2024, a reduction of government employees as signaled by the Trump administration could weigh on overall payroll growth in the months ahead.

- Meanwhile, professional and business detracted from job gains, shedding 11,000 jobs, while employment in mining & logging also declined by 7,000. Despite seeing very strong employment gains over the previous two months, leisure & hospitality jobs dropped by 3,000 workers in January, with a total decrease of 16,000 jobs within restaurants.

- The unemployment rate unexpectedly declined to 4.0%, helped largely by a continued decline in layoff activity. Hiring activity remains sluggish, however, with the duration of unemployment staying elevated at 10.4 weeks. The labor market remains in an uneasy equilibrium—low layoffs coupled with low hirings—suggesting that there remains risk that only a mild pick up in layoffs is needed to see the unemployment rate rise. The labor force participation rate ticked up to 62.6%, from 62.5% prior.

- Average hourly earnings rose by 0.5% in the month, larger than expected, keeping the annual rate steady at 4.1%. The recent pace of earnings growth has remained particularly strong, with the three-month annualized rise in wages steadily accelerating in recent months and rising to 4.7% from 4.3% in December.

- The January jobs report included an annual revision to overall payroll data, which showed job growth in 2024 to be 598,000 lower than initially reported, implying payroll gains averaged 166,000 a month last year, a slowdown from the initially reported 186,000. Annual adjustments were also made to incorporate updated population estimates that—while relatively large relative to past years and a significant boost to total labor supply—only marginally increased the unemployment rate and labor force participation rate.