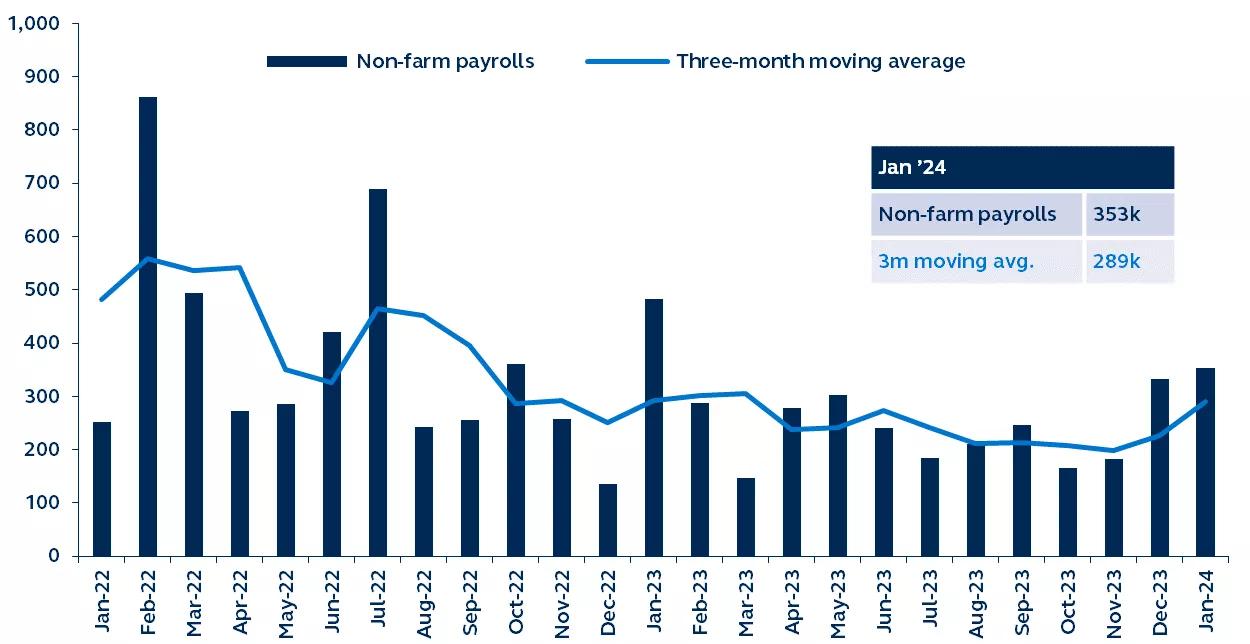

January delivered a monster payrolls number, beating expectations across the board and giving pause to anyone still expecting the Fed to begin aggressive rate cuts imminently. The economy added 353,000 non-farm payrolls in January, while revisions also showed that 2023 monthly numbers were higher than initially reported. The strength wasn’t isolated to the employment front—monthly average hourly earnings rose sharply to 0.6%, the strongest pace since March 2022. On these numbers alone, a March rate cut must be off the table, a May cut is a stretch, and even a June cut is questionable.

Non-farm payrolls

Thousands, January 2022–present

Report details

- Total non-farm payroll employment increased by 353,000 in January, a second consecutive month of 300k+ gains. Remember that, pre-COVID, a 150,000 number would have been considered consistent with a robust U.S. economy—December and January numbers are twice that! Moreover, prior months' revisions added 359,000 to 2023's total gains. The three-month moving average has risen to 289,000, completely reversing its previous downward trend. The unemployment rate held steady at 3.7%, lower than the 3.8% consensus forecast.

- Wage growth also surprised to the upside. Average hourly earnings growth rose from 0.4% to 0.6%, versus consensus expectations for a slowdown to 0.3%. This meant that annual average hourly earnings growth continued to drift higher, rising from an (upwardly revised) 4.3% in December to 4.5% in January. The Fed cannot be content with this development and will require evidence that wage growth is not settling at elevated levels before it can progress with monetary easing.

- There were a handful of slightly dovish signals from the jobs report. Hours worked dropped to the lowest level since March 2020, while the prime-age participation bounced higher, suggesting that some modest labor market rebalancing could be underway.

Rates outlook

Our view has been that, given the continued strength of economic data and the risk that it poses to the inflation outlook, March is too soon for the first rate cut—May or June are more likely.

Following the FOMC decision on Wednesday where Fed Chair Jerome Powell explicitly stated that he doubts the committee will be ready to cut by March, today’s data also throws a May cut into question. What's more, the 6 or 7 rate cuts markets had been pricing in for 2024 seem out of place. Our own, more hawkish, view remains that there will be just 3 to 4 cuts this year, starting in May or June—but for even this to be correct, a near-term weakening in the jobs data is required.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

3368883