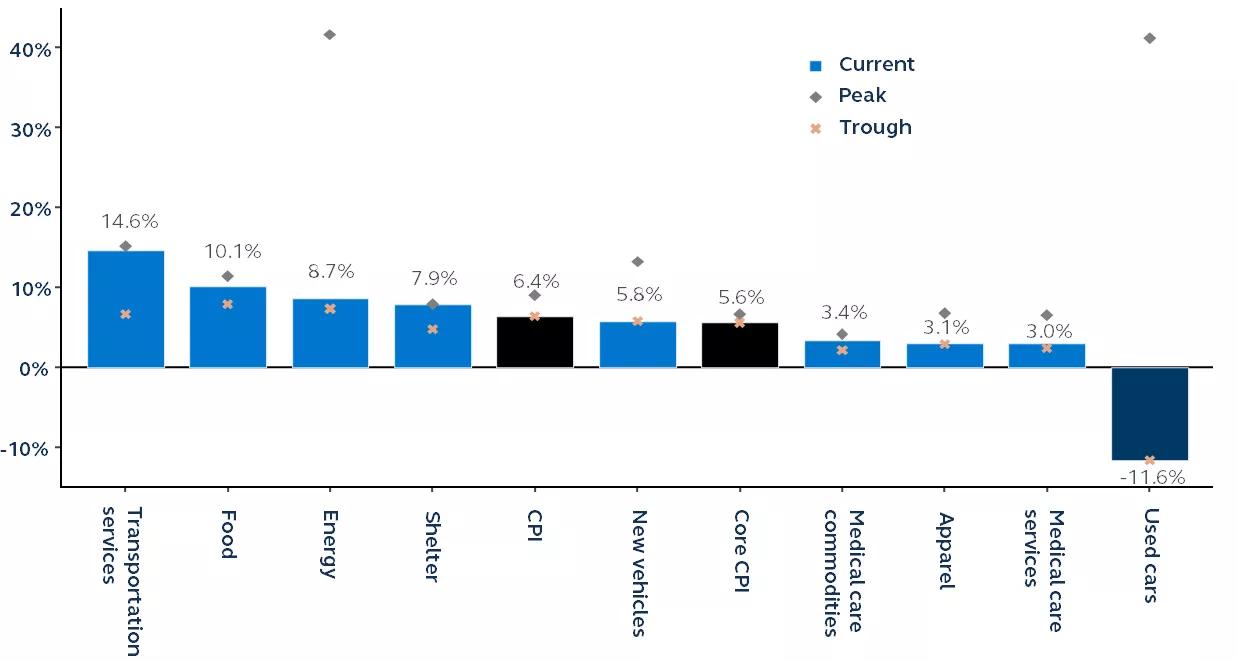

January’s Consumer Price Index (CPI) figures came in right around consensus expectations with headline CPI rising 6.4% year-over-year and core CPI (which excludes food and energy prices) climbing 5.6%. While both are slight improvements (read: decreases) over December’s year- over-year readings, these represent month-over-month increases of 0.5% and 0.4%, respectively—reversing the two months of slowdowns experienced in November and December. Inflation remains far above the Federal Reserve’s (Fed) policy goals, suggesting that more tightening will be needed in the coming months.

Consumer price index components

Current year-over-year changes and 12-month peaks and troughs

Clearnomics, Bureau of Labor Statistics, Principal Asset Management. Data as of February 14, 2023.

Response details:

- Food prices increased by 0.5%, while energy prices moved 2.0% higher during the month. Energy CPI climbed by the most since the first half of 2022, as crude oil and natural gas prices rebounded during January. The gasoline component of CPI also rose for the first time since last October.

- Core goods inflation rose 0.1% in January compared to a -0.1% decline the prior month, but continued its slowing annual trend, reaching just 1.4% in January, the lowest year- over-year reading since March 2021. The prices of used cars and trucks continued to plummet with a 1.9% month-over-month fall (-11.6% year-over-year). This is well below rates experienced last year, representative of improving supply chains and slowing consumer demand. On its own, goods inflation is already consistent with the Fed’s policy goals.

- Within core CPI, services costs rose 0.5% (7.2% year-over-year), with shelter growing 0.7% (7.9% year-over year), and transportation services jumping 0.9% (14.6% year-over- year). Many economists expect shelter prices to begin to decline as the lagged effect of a slowing housing market filter through to new leases.

- Annual core ex-shelter inflation printed 3.9% and continued to exhibit a slowing year- over-year trend since a 6.6% print in September last year, and a February 2022 peak of 7.6%. This slowing in the stickiest and most labor-market-dependent component of CPI will be welcomed by the Fed.

Each year with the release of the January CPI, the Bureau of Labor Statistics (BLS) updates its seasonal adjustment factors. As a result of this yearly recalculation, some previous months’ numbers have shifted. For instance, December’s original -0.1% decline has been revised up to an increase of 0.1%. Overall, 2022 CPI figures are now higher than originally reported. The year- over-year numbers are unchanged.

Today’s CPI print is unlikely to alter the Fed’s current trajectory, which both we, and markets, expect to include a 25 basis point rate hike at the March FOMC meeting and a terminal rate of between 5.00% and 5.25% by July. Despite some progress on the margin, with inflation still more than 3x the Fed’s longer run goal, investor expectations shouldn’t change—continued tightening will be needed in the coming months.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2739788