The Federal Reserve (Fed) was caught behind the curve, and will need aggressive rate hikes to slow demand, and thus, inflation. Maintain neutral risk, but seek high quality, defensive assets.

Executive summary

The Fed is playing catch up

With inflation seemingly reaching new 40-year highs each month, the Fed finds itself woefully behind the rate hiking curve. Though price pressures were initially attributed to “transitory” supply/demand imbalances, repeated negative supply shocks and strong demand have allowed price pressures to broaden and accelerate.

Policy tightening is needed to regain price stability

Some price pressure will ease naturally without Fed intervention. As time and inflation deteriorate household savings and sentiment, especially for the lowest income demographic, consumer demand may soften, and labor supply may expand—limiting both price and wage inflation. However, geopolitical conflict may still weigh on energy, food, and goods supply, causing CPI (consumer price index) inflation to still be elevated above 6% by end 2022, before a recession could reset prices to target by end-2023.

Long term inflation expectations are still anchored around the Fed’s inflation target, which means the inflation fight is not yet lost. However, the Fed will need to be aggressive with its tightening process, continuing to hike at an aggressive pace and carrying interest rate increases into 2023.

Investment implications:

Slower growth: As the Fed fights inflation by dampening demand, seek out high quality firms that can still deliver solid earnings during tighter financial conditions.

Inverted yield curve: Aggressive near-term tightening raises short rates, and as slower growth caps long rates, bank stocks may come under pressure.

Less pricing power: As consumers become more deliberate with purchases, firms with lower pricing power, like small-caps, may struggle passing on higher costs. Mid-cap firms may have better pricing power, and their exposure to the domestic U.S. economy, which is likely to outperform other global markets, presents a sweet spot.

Elevated inflation: Inflation’s eventual descent to the Fed’s 2% target may take many quarters. In the meantime, both equities and fixed income could be challenged, setting up real assets for potential outperformance.

The current inflation situation

A Fed caught behind the curve

With inflation reaching fresh 40-year highs, and the fed funds rate still accommodative, it is apparent that the Fed has been caught behind the curve. However, the Fed has finally recognized its erroneous read of the inflation situation and is now desperately playing catch-up.

Spooked by sizzling CPI reports and rising consumer inflation expectations, coupled with signs of continued strength in the labor market, the Fed raised policy rates by 75 bps in June and by 75 bps in July.

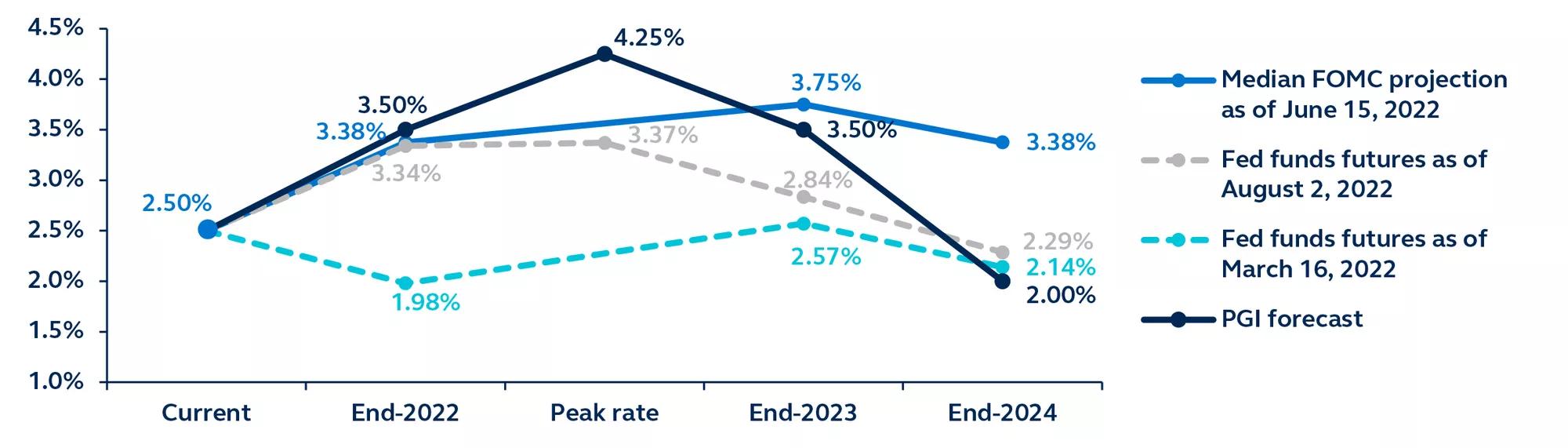

In the space of five months, market expectations for policy rate tightening in 2022 moved from 200 bps as of March 2022 to 330 bps as of early August 2022. Furthermore, the Federal Reserve itself expects further tightening next year.

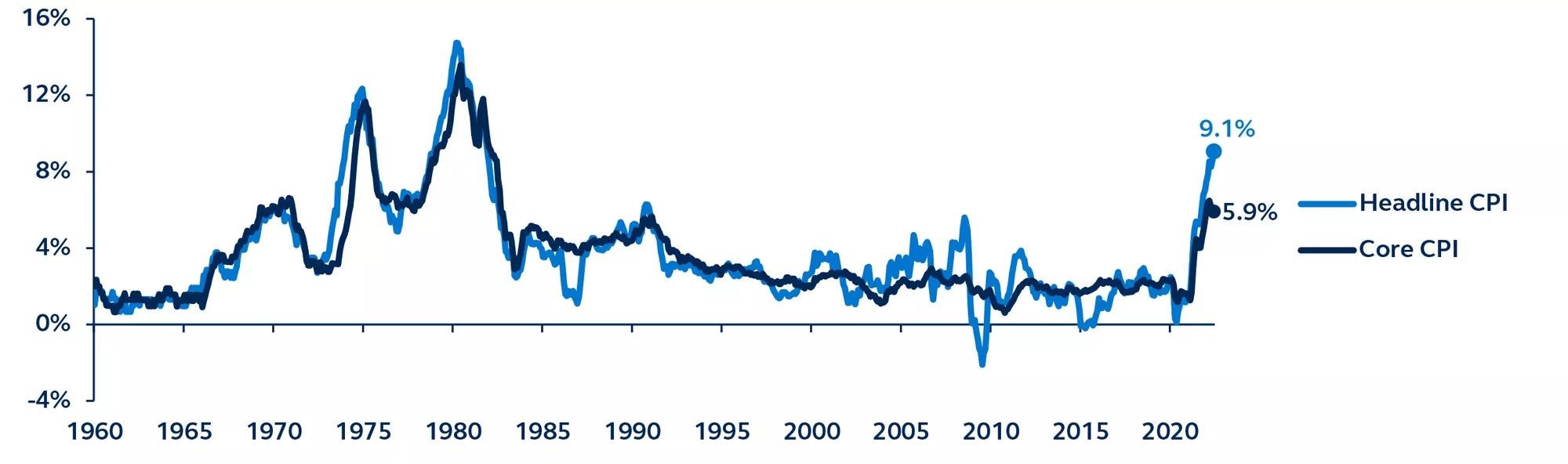

Consumer price index

Year-over-year, 1960–present. Data as of July 13, 2022.

Bureau of Labor Statistics, Principal Global Asset Allocation. Core CPI excludes the often volatile food and energy prices. Data as of July 13, 2022.

Implied fed funds target rate and market expectations

FOMC member projections & fed funds futures

Bloomberg, Federal Reserve, Principal Global Investors. Data as of August 2, 2022.

While long-term inflation expectations are still anchored, the Fed needs to regain credibility with brisk policy normalization.

How transitory became persistent

Scarred by two decades of uncomfortably low inflation and even deflation concerns, the Fed initially didn’t believe inflation would rise meaningfully and sustainably above its 2% target. This erroneous read of the inflation situation is resulting in a more aggressive pace of monetary tightening today.

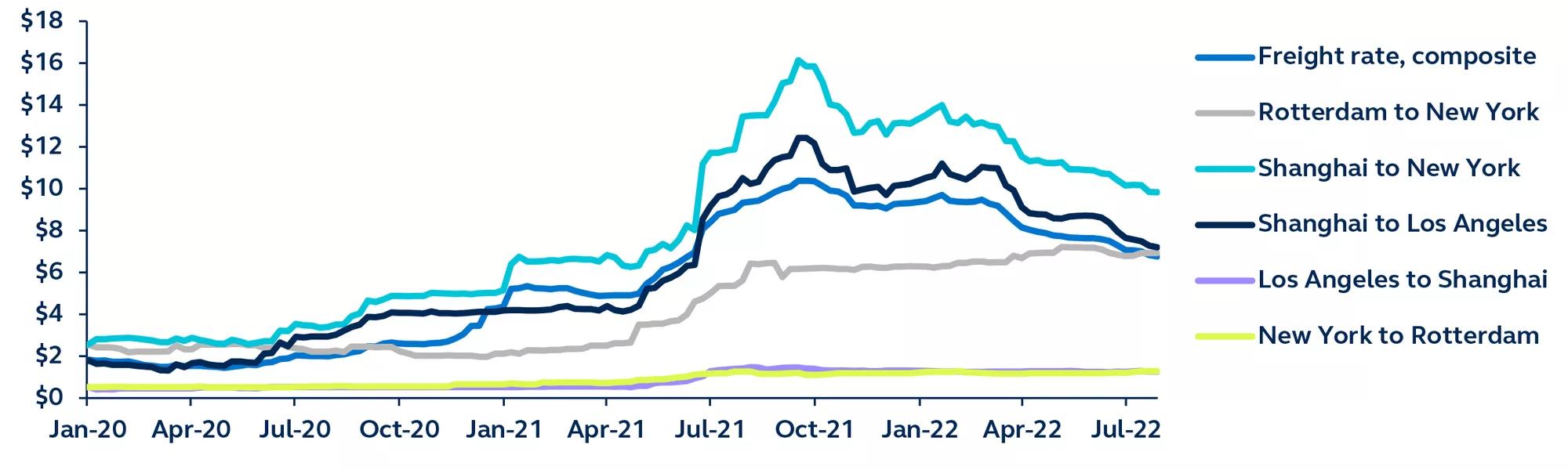

In the Fed’s defense, when inflation started to surge in the first half of 2021, it was concentrated in categories that had seen supply/demand imbalances arise out of the pandemic. However, multiple COVID shocks hindered full healing in goods and labor supply. Indeed, it wasn’t until late fall 2021 that freight rates showed tentative signs of topping. As a result, supply remained tight, and goods prices elevated.

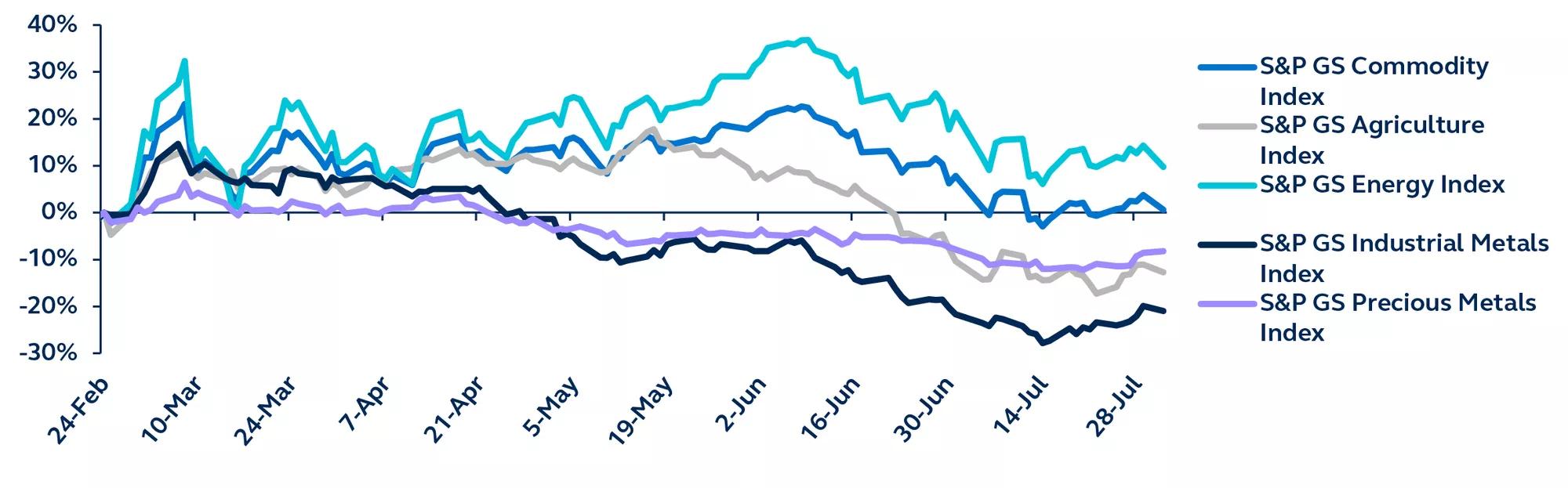

The global economy faced another inflation shock in early 2022 as a result of the Russia/Ukraine conflict, which disrupted exports of oil, natural gas, coal, grains, oilseeds, and fertilizer—sending energy and food prices soaring.

With goods inflation more persistent than anticipated, plus the addition of food and energy inflation, price pressures have broadened out and become sticky.

Global freight rates

Rates per 40-foot box, thousands, January 2020–present

Bloomberg, Principal Global Asset Allocation. Data as of July 28, 2022.

Commodity price movement

Rebased to 1 at invasion of Ukraine on February 24, 2022

Bloomberg, Principal Global Asset Allocation. Data as of August 1, 2022.

Repeated negative supply shocks and strong demand exacerbated supply/demand imbalances, causing inflation pressures to become persistent.

Inflation's path forward

Some price pressures will ease naturally

While fiscal stimulus during the pandemic increased consumer demand, and both generous unemployment benefits and rising asset prices reduced labor supply, these wealth impacts have faded. Higher prices are now eating into household budgets, forcing sidelined workers back into the work force, and should help to cap wage inflation.

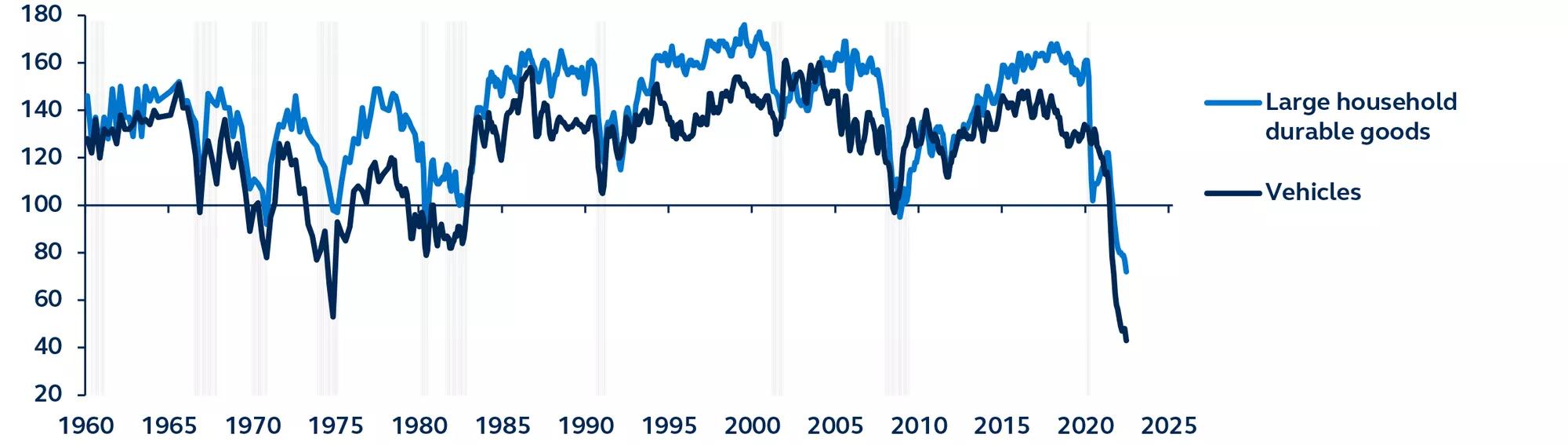

Already, high prices are weighing on consumer sentiment. The University of Michigan consumer survey suggests intentions to purchase vehicles and household durable goods are at the lowest in history. Anecdotes from corporate earnings calls confirm that the U.S. consumer has become more discerning with their purchases, a tentative sign that softer demand may soon outweigh limited supply, easing price pressures.

Commodity price inflation may also ease in coming months as recession fears grow. With this, headline inflation should soon peak and start its downward trend.

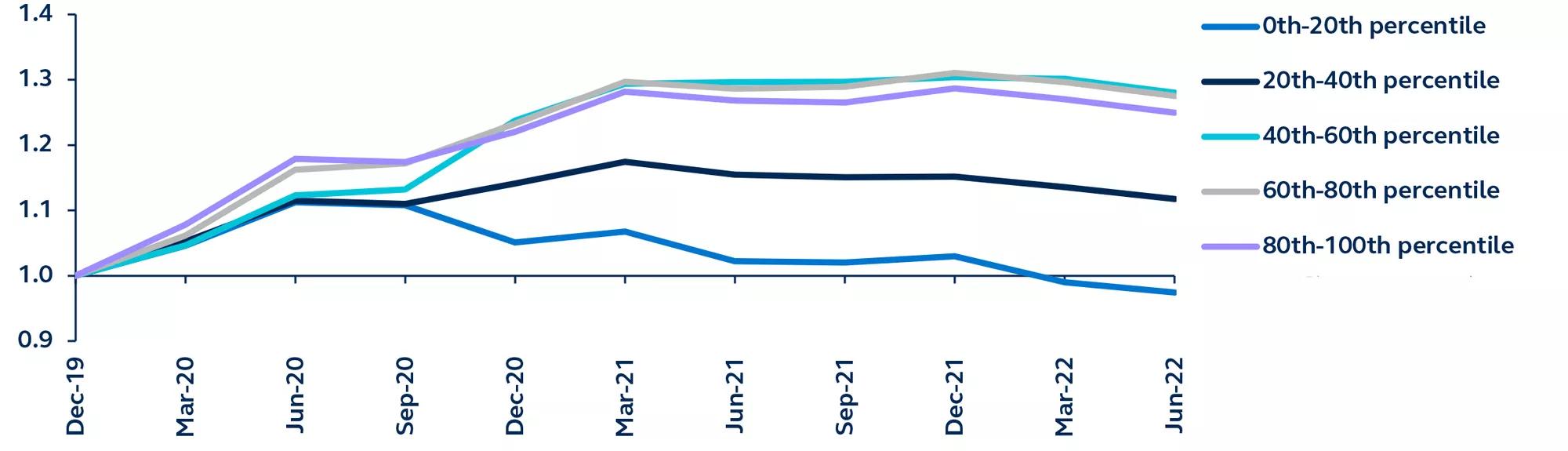

Real cash holdings by household net worth

Level, rebased to 1 at December 31, 2019.

Bloomberg, Federal Reserve Distributional Financial Accounts, Principal Global Asset Allocation. Cash includes checkable deposits, currency, short-term investments, and money market fund shares. Nominal cash is deflated by headline CPI index. Data as of June 30, 2022.

Buying conditions

Level, 100 = neutral sentiment, University of Michigan consumer sentiment survey, recessions are shaded, 1960–present

Bloomberg, Federal Reserve Distributional Financial Accounts, Principal Global Asset Allocation. Cash includes checkable deposits, currency, short-term investments, and money market fund shares. Nominal cash is deflated by headline CPI index. Data as of June 30, 2022.

As high prices weigh on savings and sentiment, consumer demand may soften, and labor supply may expand—limiting both price and wage inflation.

Nonetheless, quick and steady rate hikes are needed

Even with inflation close to its peak, the Fed needs steady rate hikes to tighten exceptionally accommodative financial conditions, and thus rein in inflation by dampening demand.

More importantly, it remains crucial that the Fed clamps down on inflation expectations before they rise too far and become unanchored.

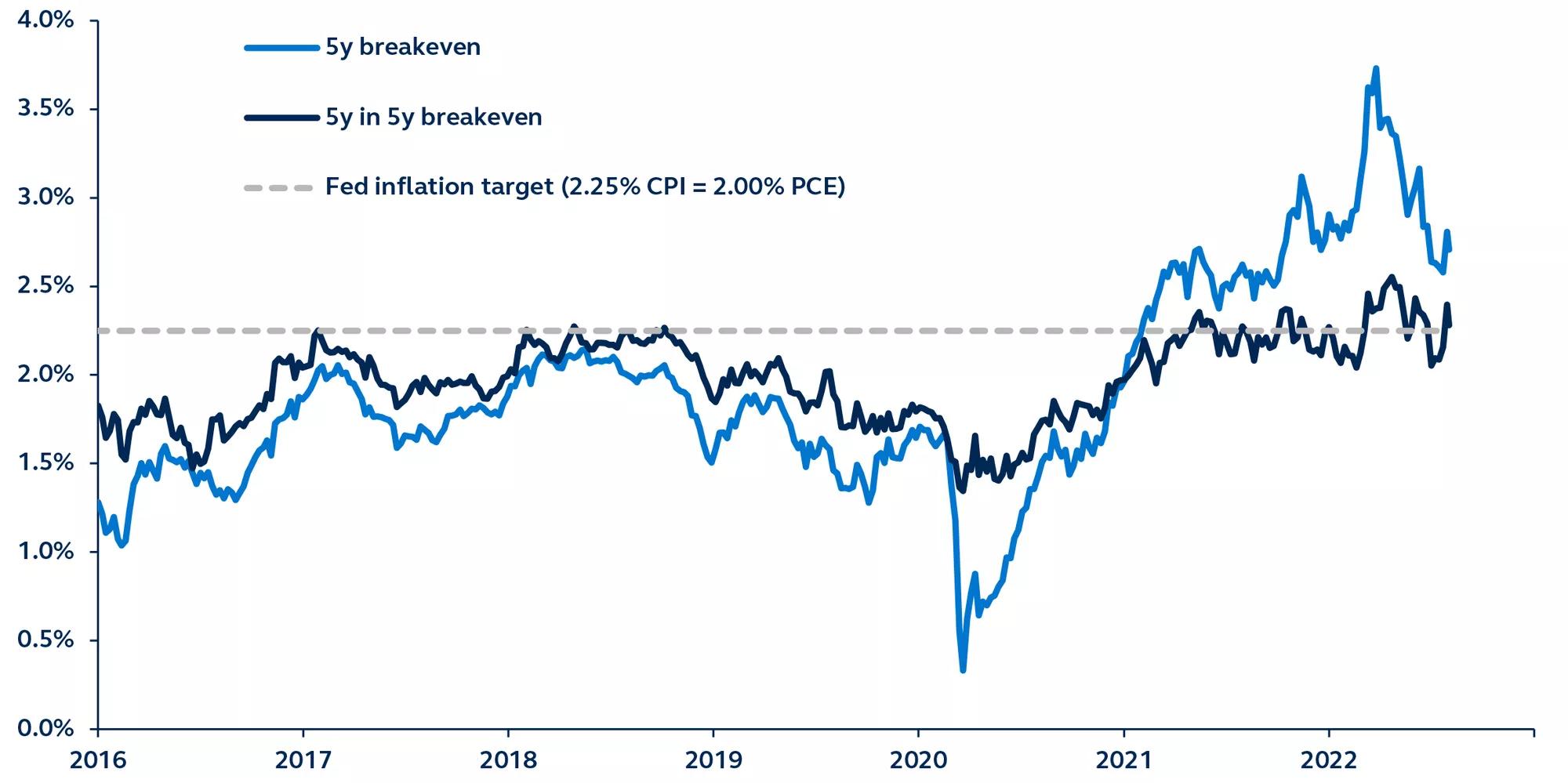

Currently, inflation breakevens imply that longer-term expectations are still anchored, with the spike in expectations contained to the near-term. However, without continued action from the Federal Reserve, inflation expectations could drift higher, threatening long-term price stability.

Although the Fed hasn’t lost the inflation fight, it must continue to tighten policy.

U.S. breakeven inflation

2016–present

Bloomberg, Principal Global Asset Allocation. Data as of August 2, 2022.

While long-term inflation expectations are still anchored, the Fed needs to regain credibility with brisk policy normalization.

…and stubborn prices mean an aggressive Fed

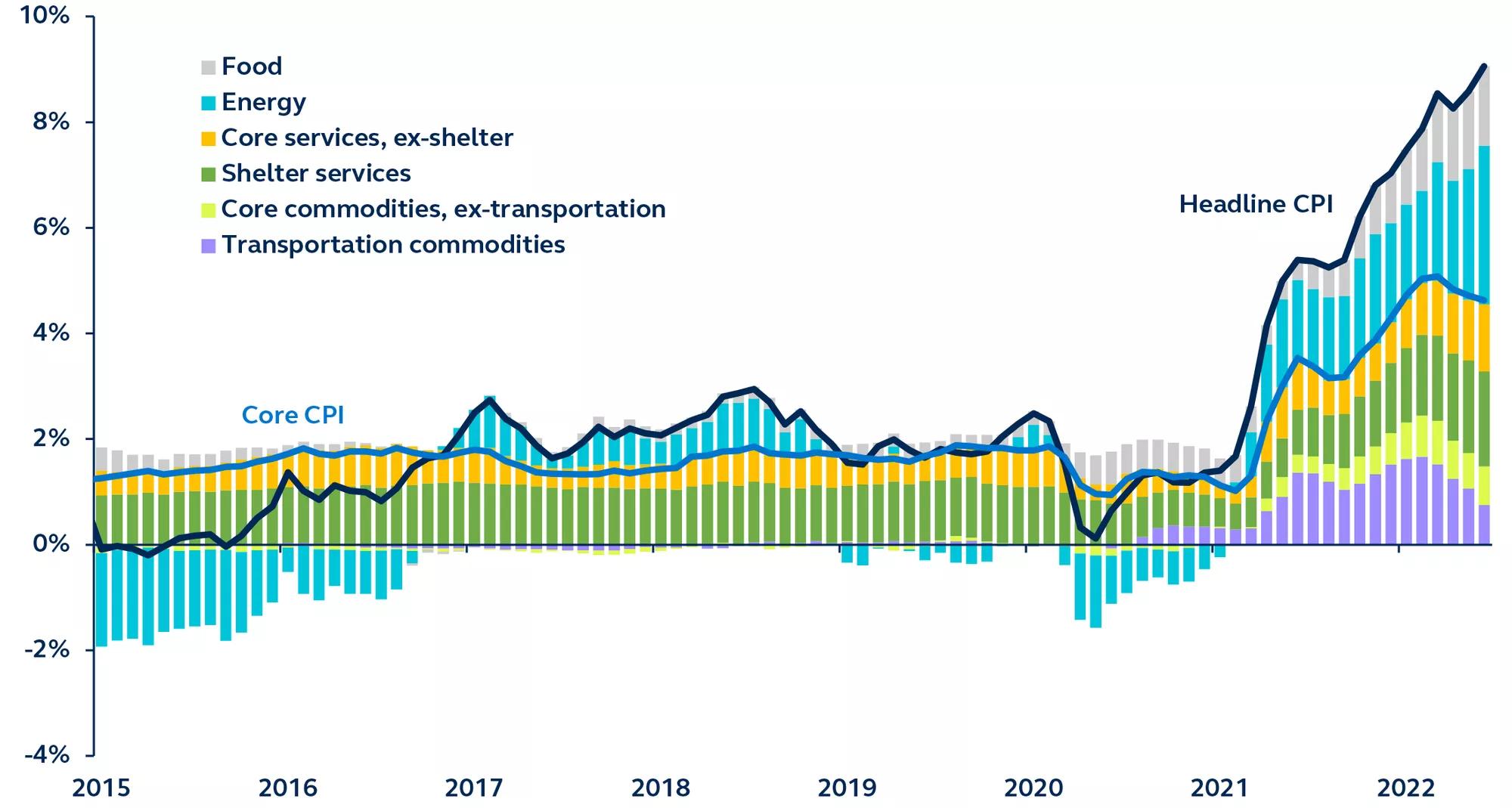

While recent easing in food and energy prices should provide some relief for the next few CPI readings, inflation may remain uncomfortably high.

- House price appreciation has yet to peak and typically takes 18 months to flow into shelter inflation (worth around 1/3 of the CPI basket). This component of CPI will likely be elevated for some time.

- Excluding shelter, core services is currently being bolstered by summer vacation spending. While pressures may reduce in the autumn, a spending shift from goods to services is also characteristic of the post-COVID lifting of restrictions.

- Durable goods (like transportation commodities) have shown surprising resilience to weakening growth. However, as recession approaches and households cut discretionary spending, this category is most vulnerable to deflationary pressures.

Shelter and non-essential goods/services have traditionally been more responsive to monetary policy. As rate hikes have generated slow progress thus far, the Fed must continue hiking aggressively if it wants to get a handle on the inflation problem.

Contribution to headline inflation

Year-over-year, 2015–present

* Core measures excludes the oft-volatile food and energy prices

Bureau of Labor Statistics, Principal Global Investors. Data as of July 13, 2022. * Core measures excludes the oft-volatile food and energy prices.

Inflation is expected to fall, but slowly. Stubborn prices means the Fed will need to hike even more aggressively.

Investment implications

Neutral risk, but with a defensive tilt

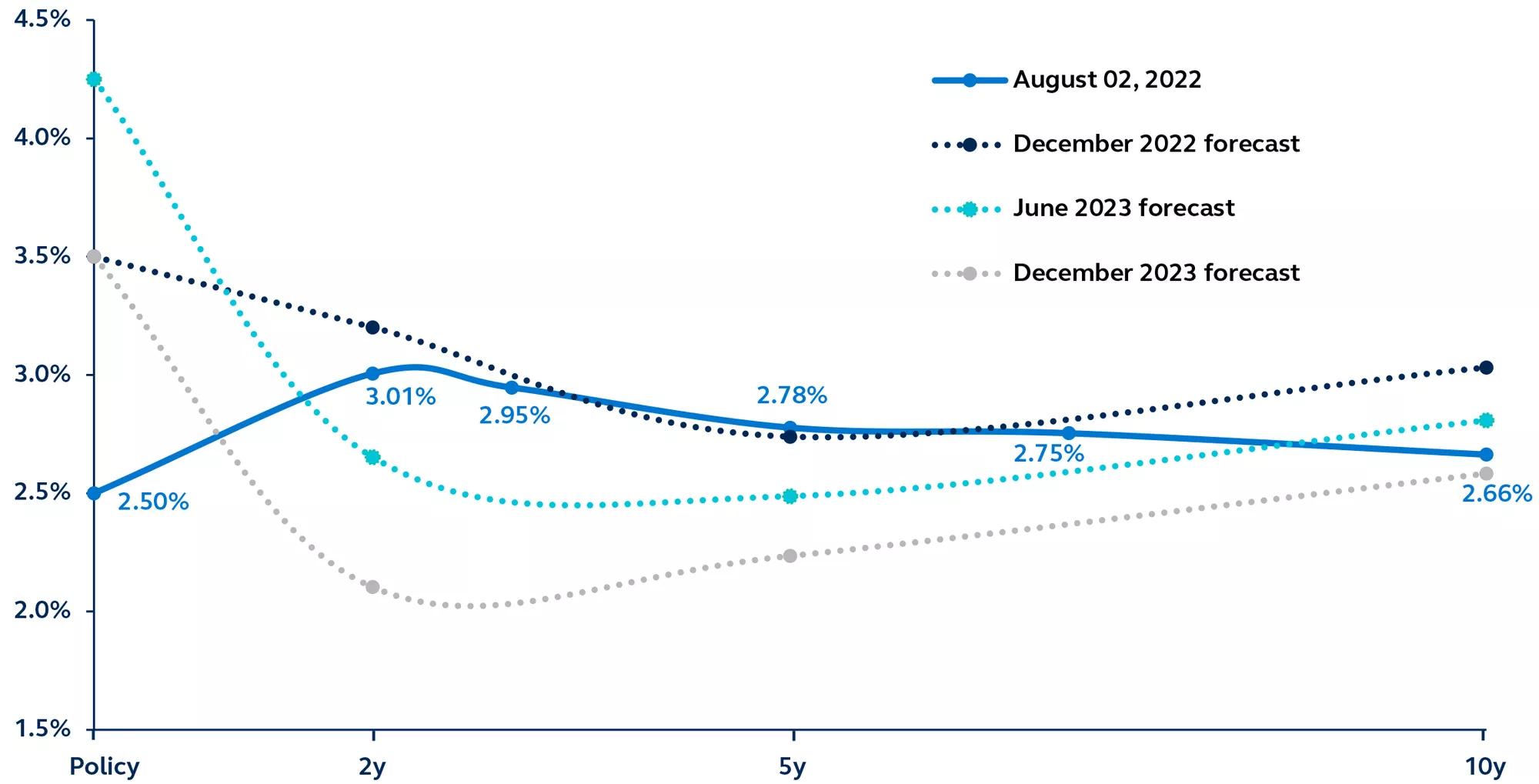

The Fed is committed to controlling prices, even at the risk of speeding up a recession. The front-loaded hiking path puts upward pressure on the short-end of the curve, whereas slower growth significantly limits any upside potential for 10-year U.S. Treasury yields. As such, the 10- year/3-month yield curve—an important recession indicator—is likely to invert by the end of 2022. Rate hikes during early 2023 will drive the front-end higher but, by end-2023, with the Fed embarking on rate cuts to support the economy, the front-end will likely dip back.

Slowing growth and Fed policy inverting the yield curve are challenging the current investment environment. However, opportunities for investors still exist.

Equities: The U.S. economy is slowing rapidly. However, the outlook is far worse for Europe and large parts of emerging markets. U.S. mid-caps are in the size sweet spot—more domestically focused than large-caps, yet better pricing power than small-caps.

Fixed income: 10-year rates, and therefore duration risk, have likely peaked. As such, U.S. Treasurys and securitized debt are likely better positioned for the oncoming recession.

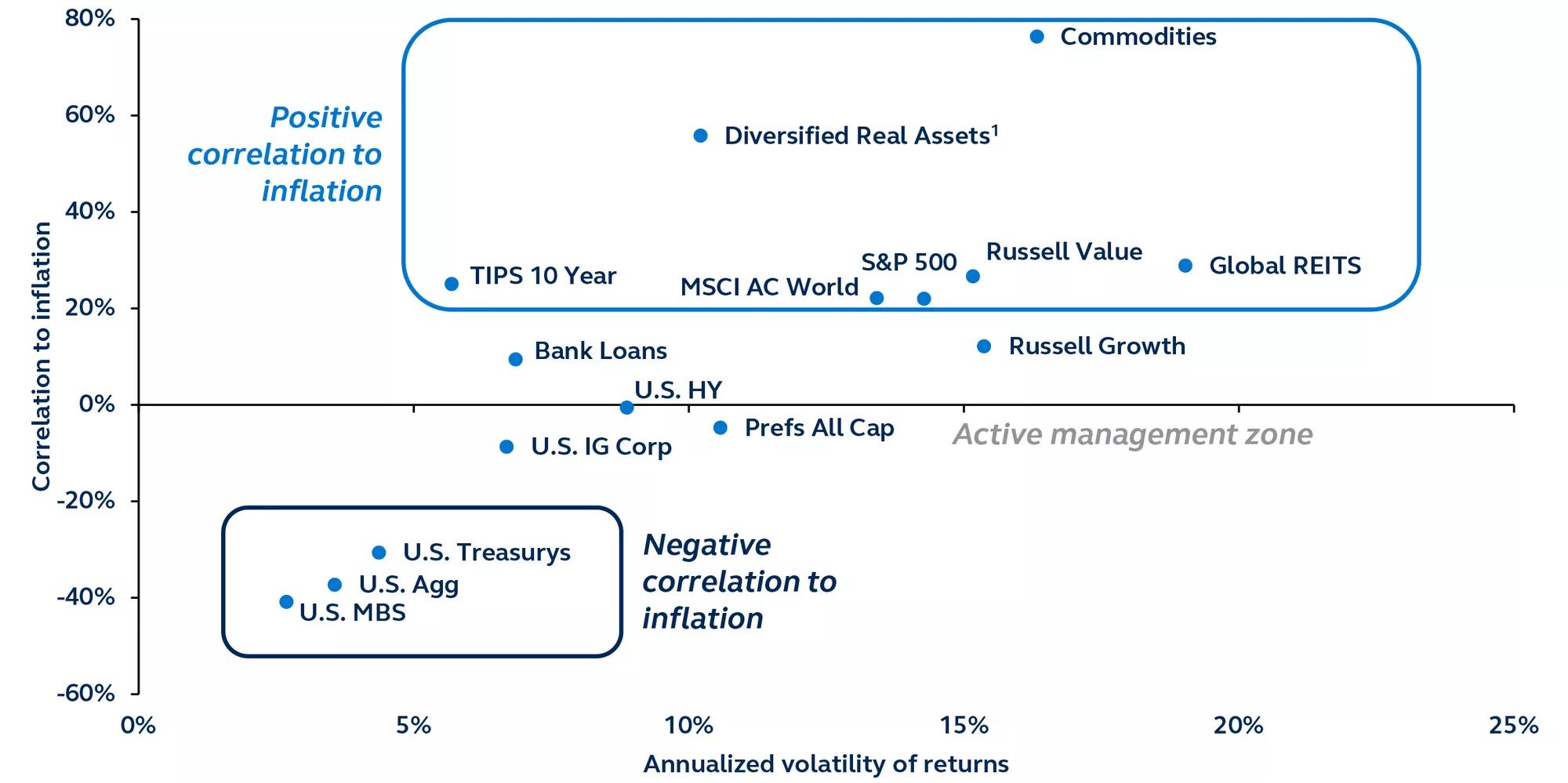

Alternatives: Real assets remain an attractive inflation hedge.

U.S. 10-year Treasury yield curve

Current yield curve vs. forecasts

Bloomberg, Principal Global Asset Allocation. Yield curve forecasts are PGAA forecasts. Data as August 2, 2022.

Against the challenging backdrop, it is important to diversify portfolios with high-quality assets.

Hedging for inflation

Though food and energy prices remain a wildcard, inflation is likely near the peak. However, it may take multiple quarters (and a recession) for prices to normalize near the Fed’s inflation target.

In the meantime, real assets may provide a hedge against elevated inflation. Though returns from commodities and infrastructure may be volatile, they historically outperform in inflationary environments, and help diversify equity exposure. Treasury inflation protected securities (TIPS) also work as an inflation-resilient diversifier.

Ultimately, holding a diversified basket of real assets can provide inflation mitigation with lower volatility than holding commodities or infrastructure alone.

Major asset class inflation sensitivity

Correlation to 12-month rolling CPI, volatility is annualized, January 2003–present

Bloomberg, Principal Global Asset Allocation. Inflation sensitivity is the correlation of the 12-month rolling CPI-U non-seasonally adjusted and the particular asset class. Volatility is annualized monthly returns. Data is for the time period of January 1, 2003 to May 31, 2022, except Diversified Real Assets which started in January 2010.

Though inflation is likely near the peak, investors may want to preserve portfolios against still-elevated inflation.

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. Asset allocation and diversification do not ensure a profit or protect against a loss. Equity investments involve greater risk, including higher volatility, than fixed-income investments. Fixed-income investments are subject to interest rate risk; as interest rates rise their value will decline. International and global investing involves greater risks such as currency fluctuations, political/social instability and differing accounting standards. Potential investors should be aware of the risks inherent to owning and investing in real estate, including value fluctuations, capital market pricing volatility, liquidity risks, leverage, credit risk, occupancy risk and legal risk. Commodities generally are volatile and not appropriate for all investors. Inflation and other economic cycles and conditions are difficult to predict and there Is no guarantee that any inflation mitigation/protection strategy will be successful. Treasury inflation-protected securities (TIPS) are a type of Treasury security issued by the U.S. government. TIPS are indexed to inflation in order to help investors from a decline in the purchasing power of their money. As inflation rises, rather than their yield increasing, TIPS instead adjust in price (principal amount) in order to maintain their real value. Investments in companies involved in agriculture, infrastructure, natural resources and energy can be significantly affected by government policies, regulations, interest costs, surplus capacity, weather conditions, and natural disasters. Investing in derivatives entails specific risks relating to liquidity, leverage, and credit, which may reduce returns and/or increase volatility.

Important Information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intent for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (EU) Limited, Sobo Works, Windmill Lane, Dublin D02 K156, Ireland. Principal Global Investors (EU) Limited is regulated by the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID). The contents of the document have been approved by the relevant entity. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (EU) Limited (“PGI EU”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGI EU, PGIE or PGI EU may delegate management authority to affiliates that are not authorized and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland.

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority ("FCA").

- United Arab Emirates by Principal Global Investors LLC, a branch registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as a representative office and is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organization.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS License No. 225385), which is regulated by the Australian Securities and Investments Commission. This document is intended for sophisticated institutional investors only.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Global Investors (Hong Kong) Limited, which is regulated by the Securities and Futures Commission and is directed exclusively at professional investors as defined by the Securities and Futures Ordinance.

- Other APAC Countries, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

- Nothing in this document is, and shall not be considered as, an offer of financial products or services in Brazil. This presentation has been prepared for informational purposes only and is intended only for the designated recipients hereof. Principal Global Investors is not a Brazilian financial institution and is not licensed to and does not operate as a financial institution in Brazil.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2022 Principal Financial Services, Inc. Principal®, Principal Financial Group®, and Principal and the logomark design are registered trademarks of Principal Financial Services, Inc., a Principal Financial Group company, in the United States and are trademarks and services marks of Principal Financial Services, Inc., in various countries around the world. Principal Global Investors leads global asset management at Principal®.

MM12982 | 2337296