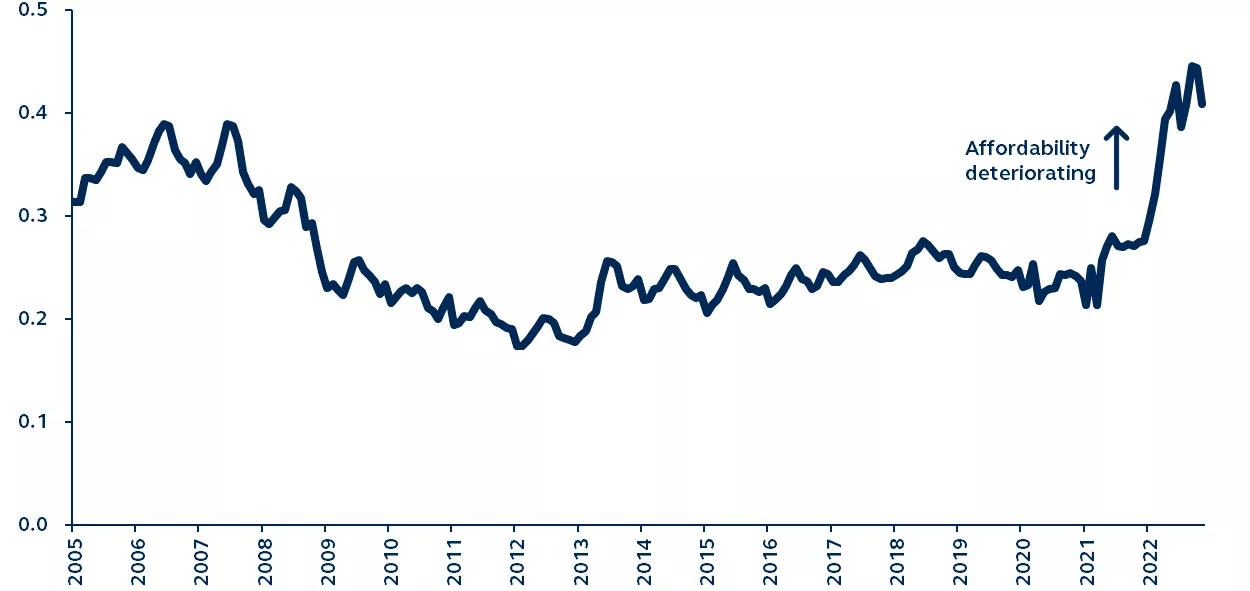

U.S. housing affordability worsened considerably in 2022, driven by expensive home prices and soaring mortgage rates. With the Federal Reserve remaining focused on inflation, a quick recovery from here is unlikely—yet another headwind for the U.S. economy in 2023.

U.S. housing affordability

Ratio of new mortgage payments to disposable income, 2005-2022

Bloomberg, Principal Asset Management, Data as of December 31, 2022. Note: New mortgage payments is calculated using Existing One Family Median Price, assuming 30 years with prevailing 30-year mortgage rate and 20% down payment. House affordability is the ratio between new mortgage payment and disposable income.

U.S. housing affordability, as measured by the ratio of mortgage payments to disposable household income for a median new home, has deteriorated to levels unseen since 2006. As the majority of U.S. mortgages are fixed, most existing homeowners are not seeing their mortgage payments increase. Yet, deteriorating affordability will certainly discourage new demand.

Housing affordability is driven by mortgage rates, household income, and house prices. The deterioration since the pandemic has been so significant that, in order to revert to pre-COVID levels of affordability, it would require either:

- Mortgage rates to fall 420 basis points, or...

- Household income to rise 64%, or...

- House prices to fall 39%.

Admittedly, these factors are not independent of each other and, in reality, they can move together. As a result, it may not require such exaggerated moves in any single driver to improve affordability. Even so, a recovery is likely to be a very prolonged journey. While quantitative easing in the years following the Great Financial Crisis facilitated a relatively quick recovery in housing affordability, the Fed’s prioritization of its inflation goal today means that a return to easy monetary conditions is highly unlikely this year.

Housing market conditions are usually a leading indicator for the U.S. economy. With high mortgage rates likely to continue squeezing affordability, housing demand and activity will be under pressure, intensifying the economic risks in 2023.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2691319