Major developed market central banks around the globe are almost unanimously indicating rate cuts won’t happen until next year, and in some cases have indicated additional hikes are still to come. The stark contrast with market expectations that global monetary loosening would begin before year-end likely means that optimistic growth expectations also need to be called into question.

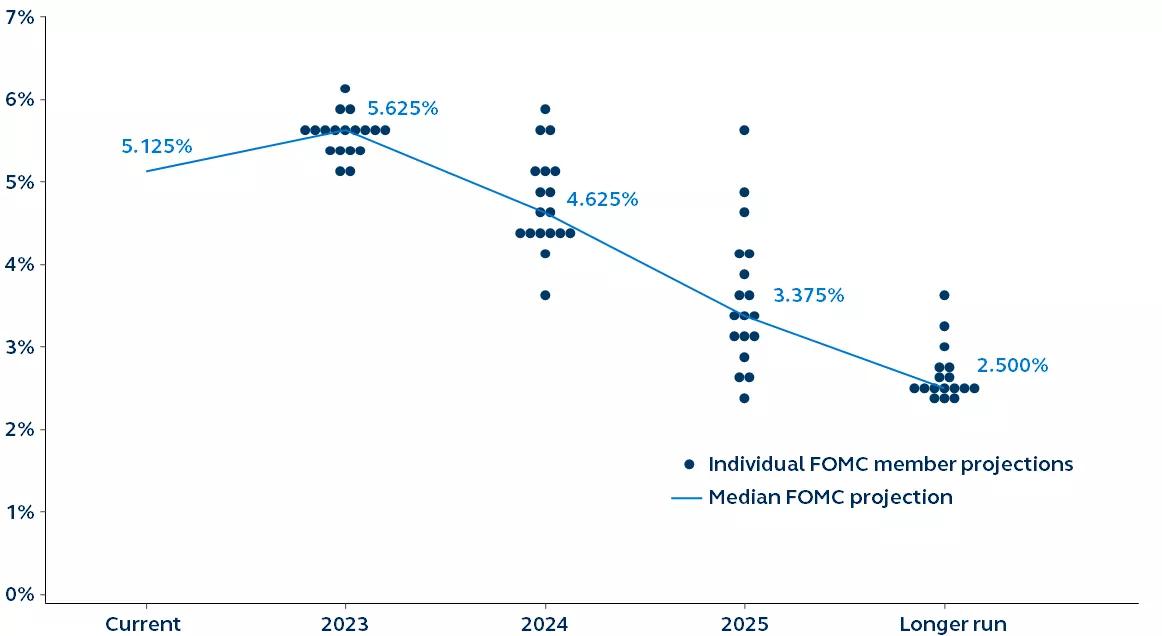

U.S. Federal Reserve dot plot

FOMC participants’ projection of the Federal Funds Rate

Source: Clearnomics, Federal Reserve, Principal Asset Management. Data as of June 16, 2023.

Recently, broad market consensus had converged around the idea that global monetary loosening would start before year-end. However, these expectations may have been presumptuous. Not only have major central banks indicated that rate cuts are not to be expected until next year, but policy rates may still have even further to rise.

- Federal Reserve: The latest dot plot shows that the majority of committee members expect at least two more hikes this year. By contrast, markets currently expect just one more hike and, until just a month ago, believed rates had already peaked.

- European Central Bank: President Lagarde indicated that policy rates are “very likely” to increase again in July. Furthermore, the ECB raised its 2023 core inflation forecast to 5.3%, suggesting there is likely a strong need to continue hiking beyond July.

- Bank of England: Following a string of significant upside inflation surprises, markets have raised their peak rate expectations from 5.00% a month ago to 5.75% currently.

- Reserve Bank of Australia and the Bank of Canada: Both central banks have recently ended their monetary tightening pauses by introducing surprise policy hikes.

Market sentiment has been improving under the assumption that monetary tightening is coming to an end and economic growth has escaped unscathed. Now that risks have swung towards higher terminal rates, sanguine growth expectations need to be questioned. Market sentiment is beginning to look vulnerable.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2958863