The passage of the so-called “Big Beautiful Bill” will, by itself, boost growth over the medium term. However, offsetting the extent of any boost will be ever-changing tariff policies. Tariffs are a de facto tax on consumers and businesses, and therefore contractionary. In addition to the contractionary impact of any cuts to federal spending—as Congress wrestles with implementing DOGE-recommended cuts—investors will carefully monitor the net effect of these clashing policies.

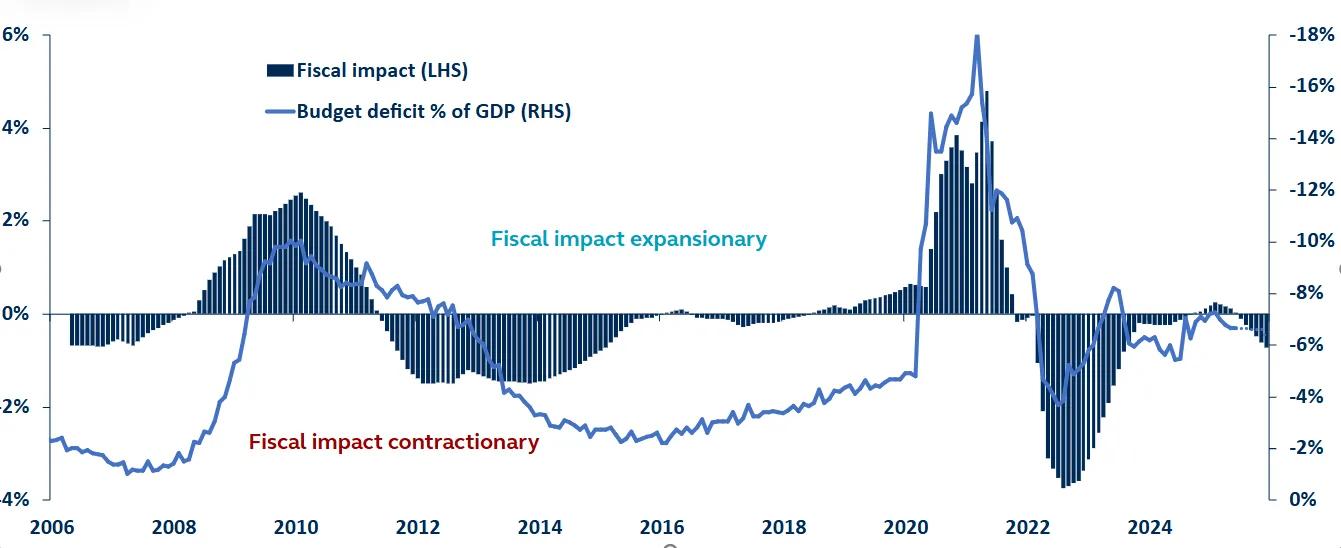

Fiscal impact vs budget deficit

% of GDP, 2006–YE 2025

Note: The Fiscal Impact Measure, sourced from Brookings, shows how much government tax and spending policy adds to or subtracts from overall economic growth. Budget deficit is Bloomberg Consensus from October 2025 – December 2025.

Source: Brookings, Bloomberg, Principal Asset Management. Data as of June 30, 2025.

As fiscal policymakers grapple with the complexities of debt sustainability, they find themselves on a precarious path. The newly enacted tax bill should be expansionary, stimulating economic growth in the medium term. However, this positive effect may be overshadowed by the combined impact of tariffs—essentially acting as a tax hike—and significant cuts to federal grants and other spending.

Tariffs increase the cost of goods, reducing consumer purchasing power and potentially dampening overall economic activity. Meanwhile, should Congress enact any proposed DOGE spending cuts, reductions in federal grants (and other spending) would further constrain growth. While these measures aim to narrow the budget deficit gradually, they risk creating a paradox. As deficit levels decline, growth could slow down, exacerbating the fiscal challenges policymakers seek to mitigate.

In this delicate balancing act, it is crucial for policymakers to assess the implications of their decisions carefully. A sharp slowdown in growth could inadvertently worsen the already elevated budget deficits, leading to a cycle of economic stagnation.

The importance of prioritizing long-term stability over short-term gains cannot be overstated. If fiscal sustainability concerns persist, there may be limited relief from borrowing costs – even if the Federal Reserve starts reducing rates – preventing policymakers from fostering an environment conducive to economic growth and prosperity. The U.S’s growth outlook is dependent on the administration’s ability to successfully navigate the difficult fiscal path.

For a deeper dive into the global markets, including fiscal and monetary policies, and why diversification is especially important amid current policy uncertainty, read our 3Q 2025 Global Markets Perspective - Shaken but not stirred.

Investing involves risk, including possible loss of principal. Past Performance does not guarantee future return. All financial investments involve an element of risk. Asset allocation and diversification do not ensure a profit or protect against a loss.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Asset Management leads global asset management at Principal.®

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

In Europe, this communication is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients.

© 2025, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4654062