4Q 2025 Webcast replay60:01 minView video transcript

Against all odds

Our quarterly investment outlook highlights the themes and investment implications for the period ahead.

Global economic strength has withstood U.S. trade policy shocks

Growth forecasts have recovered since Liberation Day and have even improved for 2026. Yet, elevated inflation and U.S. dollar weakness are the lingering scars of the trade policy shocks, adding to already rising global fiscal concerns.

U.S. recession fears have been dismissed, helped along by strong consumers and AI capex spend

Broad macro data have been resilient, supported by robust household and corporate balance sheets. Weakness in labor demand likely stems not from economic distress, but from structural shifts that reduce the need for job growth.

The Federal Reserve does not need to cut policy rates below neutral yet

Resilient U.S. growth and persistent inflation pressures are likely to prevent the Fed from easing policy aggressively, while the OBBBA and recent deregulatory measures point to mildly stimulative fiscal policy in 2026.

Equity markets still have further upside, supported by policy and AI-driven capex

The Fed’s non-recessionary rate-cutting cycle underpins a constructive outlook for 2026 U.S. earnings and equity performance. U.S. small-caps and segments of global markets offer compelling valuations and solid fundamentals.

Fixed income credit: Tight spreads but benefiting from robust macro tailwinds

Credit spreads are at multi-year tights, but a supportive macro backdrop suggests limited default risk and continued strength in higher-yielding fixed income solutions.

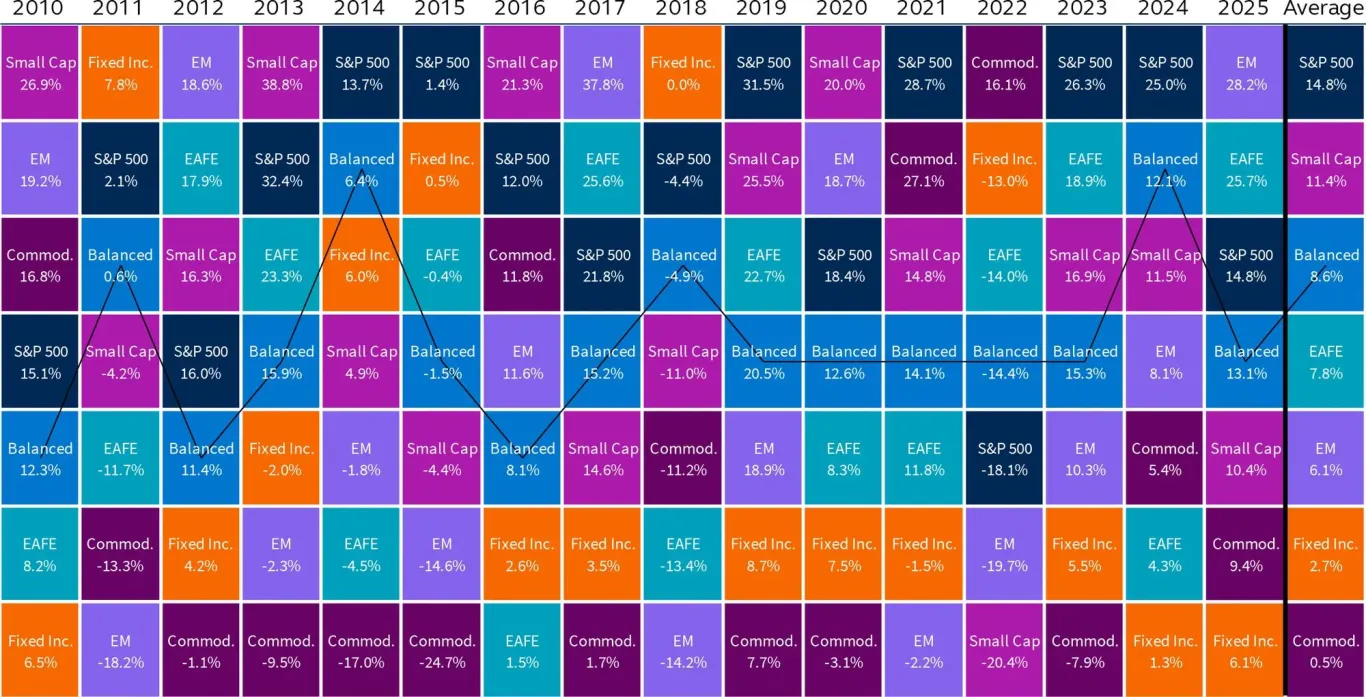

Focus on balance and diversification

The outlook for risk assets remains constructive, but stretched valuations underscore the need for balance and diversification. Opportunities may be found among second-order beneficiaries of major investment themes, attractively valued global markets, and selective private market exposures.

Principal Global Insights team

Seema Shah

Chief Global Strategist

Brian Skocypec, CIMA

Director, Global Insights & Content Strategy

Christian Floro, CFA, CMT

Market Strategist

Jordan Rosner

Sr. Insights Strategist

Magdalena Ocampo

Market Strategist

Benjamin Brandsgard

Insights Strategist

Learn more about the factors impacting markets and portfolios in the quarter ahead by downloading the full PDF.

Bloomberg U.S. High-Yield Corporate Bond Index is a rules-based, market-value-weighted index engineered to measure publicly issued non-investment grade USD fixed-rate, taxable and corporate bonds.

Bloomberg U.S. Corp High Yield 2% Issuer Capped Index is an unmanaged index comprised of fixed rate, non-investment grade debt securities that are dollar denominated. The index limits the maximum exposure to any one issuer to 2%.

Bloomberg U.S. Corporate Investment Grade Index includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements. To qualify, bonds must be SEC-registered. The corporate sectors are industrial, utility and finance, which include both U.S. and non-U.S. corporations.

Bloomberg U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury. Treasury bills are excluded by the maturity constraint. STRIPS are excluded from the index because their inclusion would result in double-counting.

MSCI ACWI Index includes large and mid cap stocks across developed and emerging market countries.

MSCI Brazil Index is designed to measure the performance of the large and mid cap segments of the Brazilian market.

MSCI China Index captures large and mid cap representation across China A shares, H shares, B shares, Red chips, P chips and foreign listings (e.g. ADRs).

MSCI EAFE Index is listed for foreign stock funds (EAFE refers to Europe, Australasia, and Far East). Widely accepted as a benchmark for international stock performance, the EAFE Index is an aggregate of 21 individual country indexes.

MSCI Emerging Markets Index consists of large and mid cap companies across 24 countries and represents 10% of the world market capitalization. The index covers approximately 85% of the free float-adjusted market capitalization in each country in each of the 24 countries.

MSCI Europe Index captures large and mid cap representation across 15 Developed Markets (DM) countries in Europe.

MSCI Europe Banks Index is composed of large and mid cap stocks across 15 Developed Markets countries in Europe. All securities in the index are classified in the Banks industry group (within the Financials sector) according to the Global Industry Classification Standard (GICS®).

MSCI Germany Index is designed to measure the performance of the large and mid cap segments of the German market.

MSCI India Index is designed to measure the performance of the large and mid cap segments of the Indian market.

MSCI Japan Index is designed to measure the performance of the large and mid cap segments of the Japanese market.

MSCI United Kingdom Index is designed to measure the performance of the large and mid cap segments of the UK market.

MSCI USA Growth Index captures large and mid cap securities exhibiting overall growth style characteristics in the U.S. The growth investment style characteristics for index construction are defined using five variables: long-term forward EPS growth rate, short-term forward EPS growth rate, current internal growth rate and long-term historical EPS growth trend and long-term historical sales per share growth trend.

MSCI USA Index is a market capitalization weighted index designed to measure the performance of equity securities in the top 85% by market capitalization of equity securities listed on stock exchanges in the United States.

MSCI USA Large Cap Index is designed to measure the performance of the large cap segments of the U.S. market. MSCI USA Mid Cap Index is designed to measure the performance of the mid cap segments of the U.S. market.

MSCI USA Quality Index aims to capture the performance of quality growth stocks by identifying stocks with high quality scores based on three main fundamental variables: high return on equity (ROE), stable year-over-year earnings growth and low financial leverage. The MSCI Quality Indexes complement existing MSCI Factor Indexes and can provide an effective diversification role in a portfolio of factor strategies.

MSCI USA Small Cap Index is designed to measure the performance of the small cap segment of the U.S. equity market.

MSCI USA Value Index captures large and mid cap U.S. securities exhibiting overall value style characteristics. The value investment style characteristics for index construction are defined using three variables: book value to price, 12-month forward earnings to price and dividend yield.

Standard & Poor’s 500 Index is a market capitalization-weighted index of 500 widely held stocks often used as a proxy for the stock market.

U.S. dollar index (USDX) is a measure of the value of the U.S. dollar relative to a basket of foreign currencies.

Market indices have been provided for comparison purposes only. They are unmanaged and do not reflect any fees or expenses. Individuals cannot invest directly in an index.

Risk considerations

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results. Equity investments involve greater risk, including higher volatility, than fixed-income investments. Fixed-income investments are subject to interest rate risk; as interest rates rise their value will decline. International and global investing involves greater risks such as currency fluctuations, political/social instability and differing accounting standards. Small- and mid-cap stocks may have additional risks including greater price volatility. Asset allocation and diversification do not ensure a profit or protect against a loss.

Important information

This material covers general information only and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice. The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, nor an indication that the investment manager or its affiliates has recommended a specific security for any client account. Subject to any contrary provisions of applicable law, the investment manager and its affiliates, and their officers, directors, employees, agents, disclaim any express or implied warranty of reliability or accuracy and any responsibility arising in any way (including by reason of negligence) for errors or omissions in the information or data provided.

This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

This material is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

This document is intended for use in:

- The United States by Principal Global Investors, LLC, which is regulated by the U.S. Securities and Exchange Commission.

- Europe by Principal Global Investors (Ireland) Limited, 70 Sir John Rogerson’s Quay, Dublin 2, D02 R296, Ireland. Principal Global Investors (Ireland) Limited is regulated by the Central Bank of Ireland. Clients that do not directly contract with Principal Global Investors (Europe) Limited (“PGIE”) or Principal Global Investors (Ireland) Limited (“PGII”) will not benefit from the protections offered by the rules and regulations of the Financial Conduct Authority or the Central Bank of Ireland, including those enacted under MiFID II. Further, where clients do contract with PGIE or PGII, PGIE or PGII may delegate management authority to affiliates that are not authorised and regulated within Europe and in any such case, the client may not benefit from all protections offered by the rules and regulations of the Financial Conduct Authority, or the Central Bank of Ireland. In Europe, this document is directed exclusively at Professional Clients and Eligible Counterparties and should not be relied upon by Retail Clients (all as defined by the MiFID).

- United Kingdom by Principal Global Investors (Europe) Limited, Level 1, 1 Wood Street, London, EC2V 7 JB, registered in England, No. 03819986, which is authorized and regulated by the Financial Conduct Authority (“FCA”).

- United Arab Emirates by Principal Investor Management (DIFC) Limited, an entity registered in the Dubai International Financial Centre and authorized by the Dubai Financial Services Authority as an Authorised Firm, in its capacity as distributor / promoter of the products and services of Principal Asset Management. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

- Singapore by Principal Global Investors (Singapore) Limited (ACRA Reg. No. 199603735H), which is regulated by the Monetary Authority of Singapore and is directed exclusively at institutional investors as defined by the Securities and Futures Act 2001. This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

- Australia by Principal Global Investors (Australia) Limited (ABN 45 102 488 068, AFS Licence No. 225385), which is regulated by the Australian Securities and Investments Commission and is only directed at wholesale clients as defined under Corporations Act 2001.

- This document is marketing material and is issued in Switzerland by Principal Global Investors (Switzerland) GmbH.

- Hong Kong SAR (China) by Principal Asset Management Company (Asia) Limited, which is regulated by the Securities and Futures Commission. This document has not been reviewed by the Securities and Futures Commission.

- Other APAC Countries/Jurisdictions, this material is issued for institutional investors only (or professional/sophisticated/qualified investors, as such term may apply in local jurisdictions) and is delivered on an individual basis to the recipient and should not be passed on, used by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation.

- Nothing in this document is, and shall not be considered as, an offer of financial products or services in Brazil. This presentation has been prepared for informational purposes only and is intended only for the designated recipients hereof. Principal Global Investors is not a Brazilian financial institution and is not licensed to and does not operate as a financial institution in Brazil. This document is intended for use in Brazil by Principal Asset Management Ltda., a Brazilian asset manager licensed and authorized to carry out its activities in Brazil according to Declaratory Act n. 9.408/07. This document is delivered on an individual basis to the recipient and should not be passed on or otherwise distributed by the recipient to any other person or organisation.

Insurance products and plan administrative services provided through Principal Life Insurance Co. Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800‐547‐7754, Member SIPC and/or independent broker/dealers. Principal Life, Principal Funds Distributor, Inc., and Principal Securities are members of the Principal Financial Group®, Des Moines, IA 50392.

© 2025, Principal Financial Services, Inc. Principal Asset Management℠ is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

4881123