The global outlook looks troubled as rising rates, oil prices and the U.S. dollar threaten to exacerbate economic slowdowns. Despite recent economic resiliency, headwinds are building, and investors should be actively positioning their portfolios toward high-quality and defensive assets ahead of the upcoming downturn.

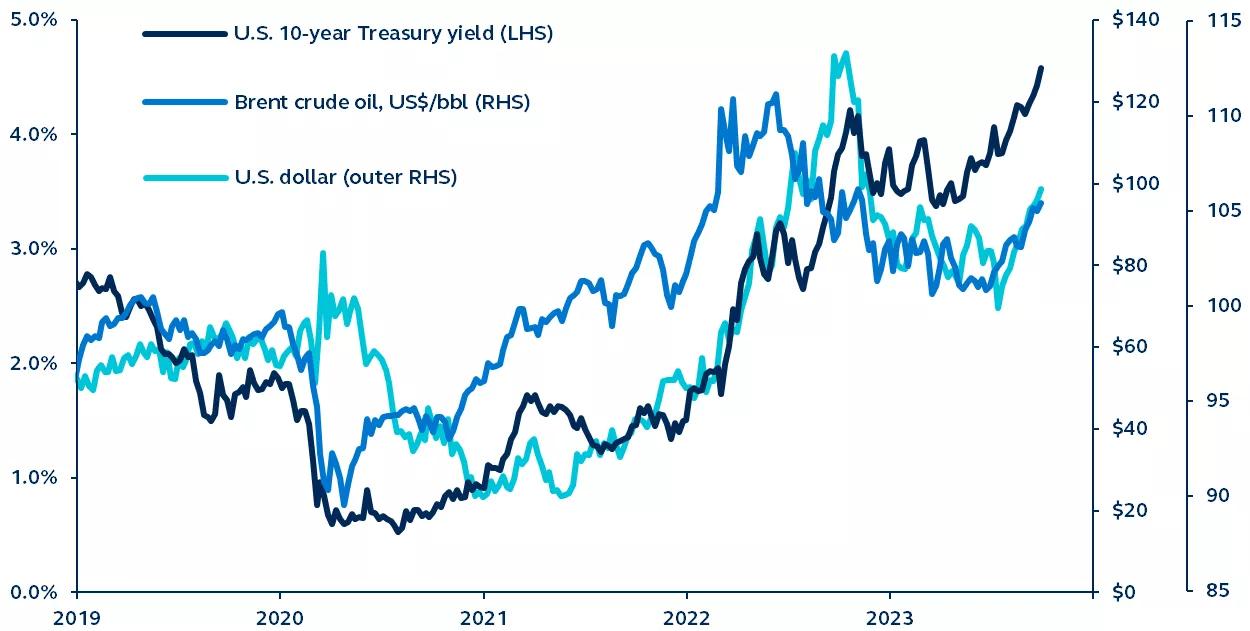

U.S. 10-year Treasury yield, Brent crude oil price and U.S. dollar index

2019–present

Source: Federal Reserve, ICE Futures Europe, CME Group, Bloomberg, Principal Asset Management. Data as of September 30, 2023.

The post-pandemic recovery is being tested by gathering global storm clouds. China’s economic story has disappointed as the property sector weighs heavily on consumption. Proactive and meaningful policy support is required if China’s economy is to hit it’s 5% growth target. Europe is heading for stagnation, weakened by China’s economic struggles and ECB monetary tightening. And while U.S. growth has exceeded expectations, with consumption headwinds building, growth is poised to decelerate.

The convergence of rising interest rates, soaring oil prices, and a strengthening U.S. dollar has created a concerning scenario. Bond vigilantes have reacted to the “higher for longer” narrative and fiscal deficit concerns, while supply cuts and geopolitical tensions in the oil market have put upward pressure on prices. Additionally, the Fed's more hawkish stance compared to other central banks has bolstered the U.S. dollar's value.

Previous bond bear markets have ended in financial turmoil. And when combined with rising oil prices and a strengthening U.S. dollar, there is an elevated risk of casualties across the global financial system. If bond yields continue to rise relentlessly, something will eventually break.

Although there are a few positive aspects in the global economy, such as Japan's recovery from a prolonged period of lackluster growth and India's impressive growth trajectory, the global economic outlook remains weak and vulnerable to a lengthening of the bond yields, oil and U.S. dollar upward moves. Tensions are building, investors should be positioning portfolios for defense.

Read more about the themes impacting markets and portfolios in the period ahead in our 4Q Global Asset Allocation Viewpoints: The last mile.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3182516