While the direct market impact of geopolitical conflict is typically short lived, the macro impacts can often linger. The key macro concerns from the developments in Israel lie with the threat of upward pressure on oil prices, and how its corresponding effect on core inflation could potentially prompt central bank action.

Global oil prices

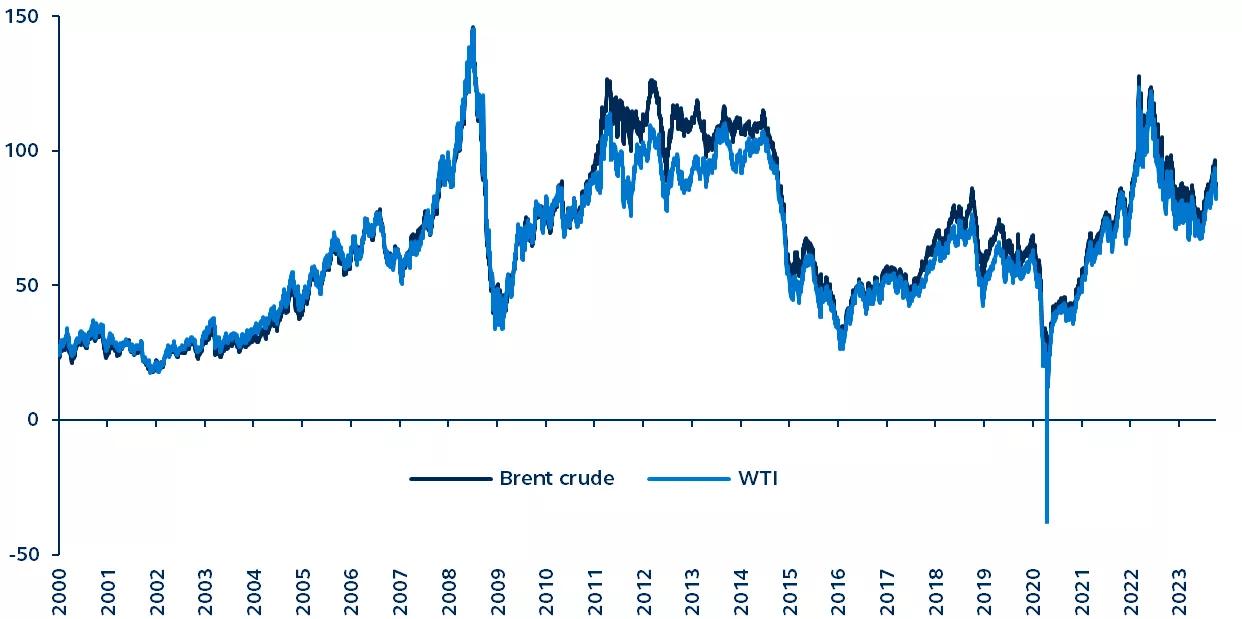

WTI and Brent crude, oil price in USD, January 2000–present

Source: Bloomberg, Principal Asset Management. Data as of October 9, 2023.

Following the horror of the Hamas-led attacks in Israel, global investors are contemplating the potential impact on broad investment markets. While geopolitics typically has a short-lived direct market impact, the indirect impacts via inflation and economic growth can be more persistent.

The critical macro concern lies with the oil market reaction. Brent crude prices have not risen materially, but a significant escalation in tensions would likely apply further upward pressure. Global economic growth is by no means immune, but the fall in global energy intensity in recent decades implies a smaller growth impact than in the 1970s. As a net oil exporter, U.S. economic growth is also less vulnerable.

The inflation risk from spiking oil prices is more pertinent. While policymakers will likely look through these developments in the near term, higher oil prices can work their way into core inflation and inflation expectations if sustained, demanding central bank action.

Safe haven flows have contributed to a sharp fall in bond yields this week. Yet, if oil prices rise further and price pressures do re-emerge, expectations of additional monetary action from policymakers could threaten a renewed bond rout.

In light of the situation in Israel, it is prudent for investors to maintain a diversified portfolio across different asset classes, with a particular emphasis on high quality and defensives.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.® For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3168455