Federal Reserve policy rates are set to fall in 2024. However, clear evidence that inflation has been tamed likely needs to emerge before cuts can commence, likely around mid-year. While a smooth landing is still far from certain, rate cuts accompanied by recession avoidance would present a constructive backdrop for risk assets in the year ahead.

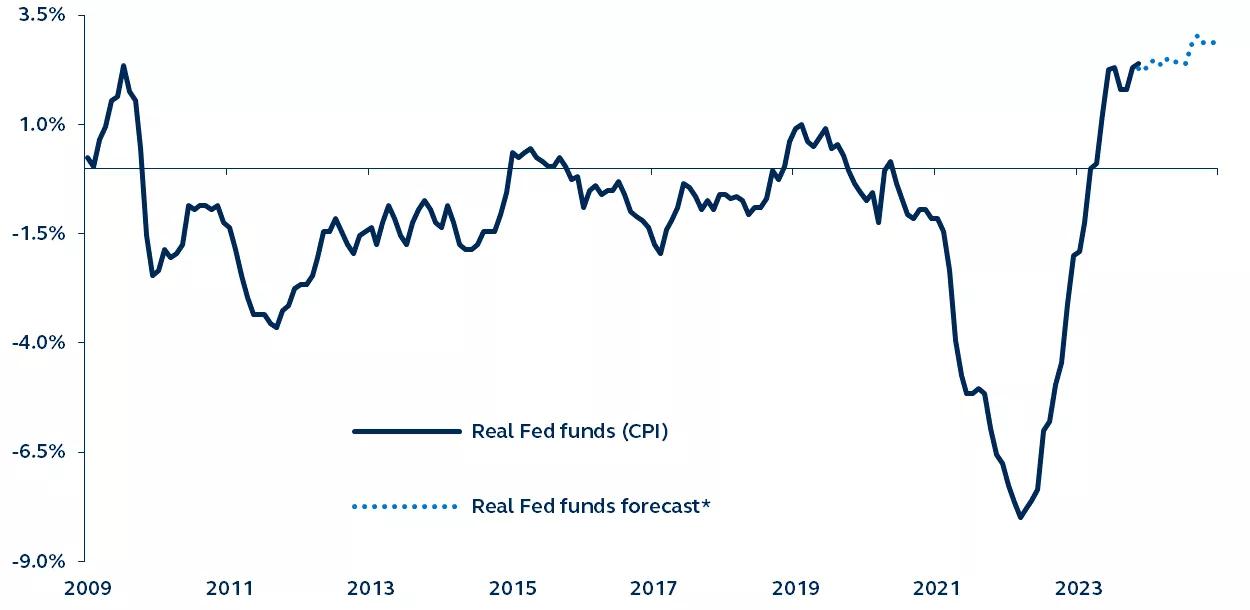

Real Fed funds rate

January 2009–present

Source: Federal Reserve, Bureau of Labor Statistics, Bloomberg, Principal Asset Management. Data as of December 31, 2023.

Core U.S. CPI inflation has fallen below 4%, opening the door to Federal Reserve (Fed) rate cuts this year. Of course, the inflation journey is not yet over, but the Fed has a solid chance of bringing inflation back to target without triggering recession. Make no mistake, it will still be a challenging policy landing. Cutting policy rates too soon risks reigniting inflation. Cutting policy rates too late risks recession.

To stick the landing, the Fed will need several months of data showing inflation is sustainably en-route to the 2% target. Once it has secure evidence, likely to come in 2Q, the Fed will want to act promptly. After all, if the Fed were to keep policy rates on hold at 5.5%, falling inflation would imply a rising real policy rate and, therefore, a tightening monetary stance. Given inflation's current path, the Fed will need to cut policy rates to maintain the same level of monetary restriction in real terms.

Historically, the Federal Reserve has tended only to ease monetary policy once signs of recession emerge. In this unusual economic cycle, still in the pandemic's shadow, rate cuts accompanied by an economic slowdown—not recession—is a high possibility, presenting a constructive backdrop for risk assets. Even so, considering broad equity and credit valuations are stretched, investors must carefully seek opportunities.

Read our latest Global Asset Allocation Viewpoints to discover the opportunities, themes, and investment implications for the quarter ahead.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3324207