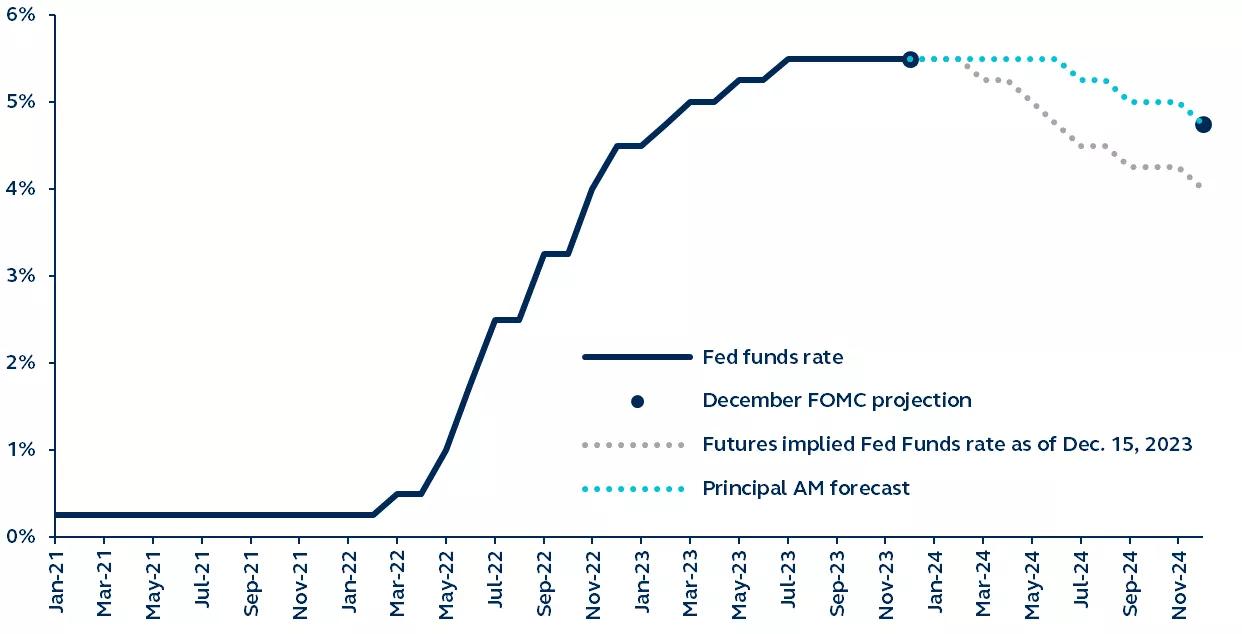

The Fed and markets agree that rate cuts are coming, but less so on exactly when. Rather than being time dependent, the Fed will remain data dependent, likely requiring the U.S. economy to show distinct signs of slowing before they can feel confident inflation is on a sustainable path to target, before turning to rate cuts. Yet, although the market’s current estimate of policy easing beginning in March is likely a little optimistic, the more important message remains clear: a path to rate cuts is emerging.

Federal Reserve policy rates path

Fed funds rate and projections

Source: Federal Reserve, Bloomberg, Principal Asset Management. Data as of December 15, 2023.

The Federal Reserve’s latest dot plot revealed the committee expects 75 basis points of cuts next year, aligning with the market’s view that the direction of travel for rates is downward. However, market pricing continues to be more aggressive than the Fed’s, anticipating double the amount of easing, with the first rate cut coming as early as March.

Looking at the past four hiking cycles, the period between reaching peak Fed funds to lowering rates has ranged from 5 months to 15 months. Rather than being time dependent, the decision to pivot is data dependent. Typically, a weakening labor market, below-trend economic growth, and on-target inflation have served as prerequisites for a rate cut.

Currently, the U.S. economy remains robust. Recent retail sales are suggestive of a resilient consumer, while jobless claims have flattened out. While inflation is trending toward target, if growth remains above trend, price pressures threaten to re-emerge.

As such, while markets are expecting the first rate cut to come as early as March, such expectations may be overly optimistic. It is more likely that clear evidence of an economic slowdown will take longer to emerge, possibly around mid-year. Nonetheless, the message for investors is clear: there is a path to monetary easing in 2024. Uncertainty around the exact timing of cuts will add volatility, but it will not change the trend.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc. Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3286614