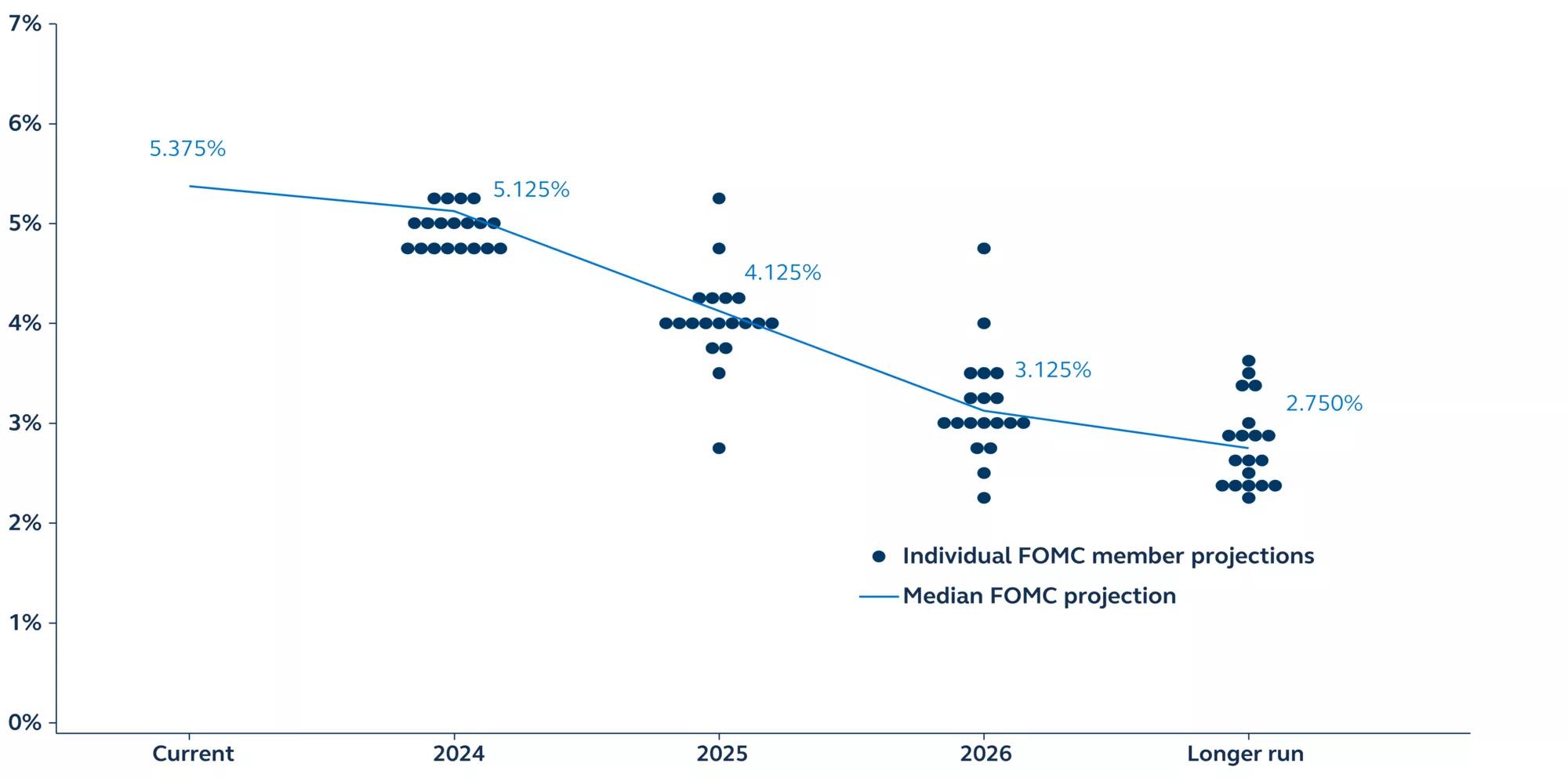

Recent focus has centered on the Federal Open Market Committee’s dot plot, which now suggests just one rate cut in 2024. However, a closer examination reveals the committee is divided, with more participants (8 out of 19) anticipating two rate cuts this year than those expecting only one (7) or none at all (4). A series of subdued inflation reports, along with further signs of a rebalancing labor market, could pave the way for multiple rate cuts this year.

FOMC dot projections

June 2024

Source: Clearnomics, Federal Reserve, Principal Asset Management. Data as of June 12, 2024.

The Federal Open Market Committee’s (FOMC) latest dot plot suggests that policymakers only see room for one policy rate cut this year. Yet, markets remain unconvinced, focusing instead on May’s softer-than-expected inflation data and assigning greater weight to the probability of two 25 basis point cuts in 2024.

After several months of seemingly plateauing inflation progress, the May CPI print delivered a very welcome surprise. Monthly core inflation fell to its slowest pace since October 2022, and core services ex-shelter—the Fed's preferred CPI measure—was negative for the first time since 2021. The market took note that if the next few reports are similarly weak, inflation is likely to undershoot the Fed's latest projections.

It’s also noteworthy that FOMC policymakers are, in fact, very conflicted themselves. Although the median dot signaled just one cut this year, the dot plot’s mode was actually for two cuts—of the 19 participants, four expect no cuts this year, seven expect just one cut, and eight expect two cuts. With the committee so evenly divided, additional soft inflation data could shift policy decisions to a more dovish outcome.

If the deceleration in price pressures continues, and is coupled with evidence of labor market rebalancing, that may be enough to open the door to earlier and multiple cuts this year. Our own forecast, for rate cuts in September and December this year, remains unchanged.

Wall Street Journal Custom Content is a unit of The Wall Street Journal advertising department. The Wall Street Journal news organization was not involved in the creation of this content.

Investing involves risk, including possible loss of Principal. Past Performance does not guarantee future return.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3645910