The Fed held rates steady at their September meeting, and, as evidenced by the latest dot plot, left the door open for another rate hike this year. However, FOMC member projections are rarely a reliable tracing of the actual Fed policy path, and investors should instead turn their focus to the bigger picture implications of the Fed nearing the end of its year-and-a-half-long tightening cycle.

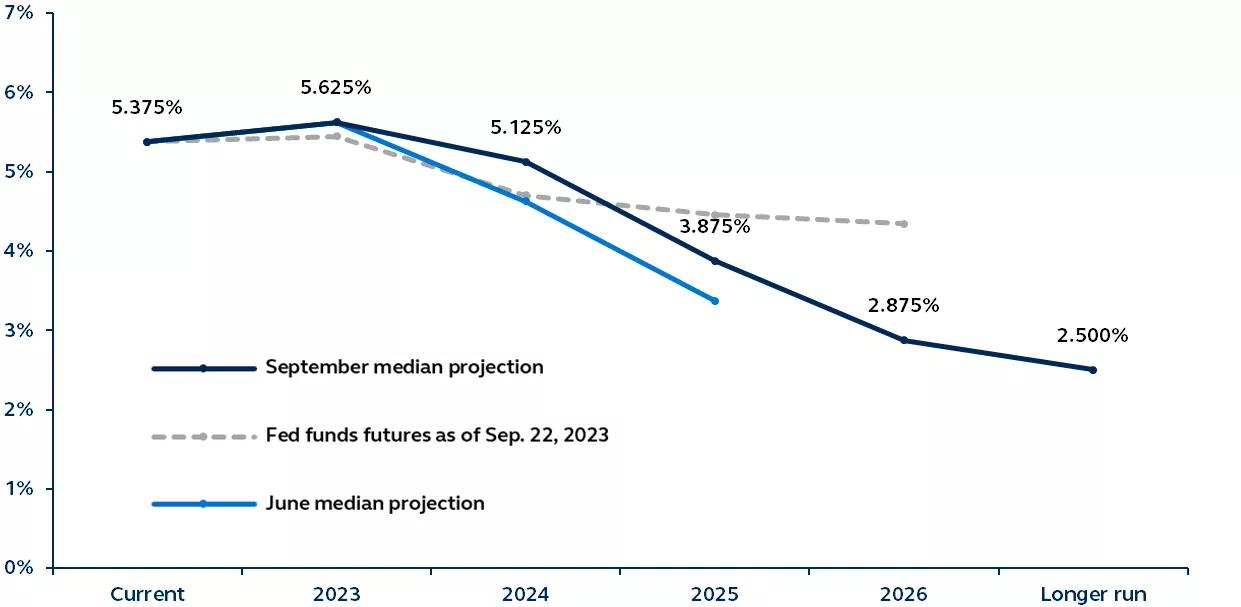

FOMC median Fed funds rate projections versus market expectations

September 2023 versus June 2023 and current Fed funds futures

Source: Federal Reserve, Principal Asset Management. Data as of September 22, 2023.

During their September meeting, the Federal Reserve (Fed) hit the pause button for the second time in this monetary tightening cycle, keeping policy rates at 5.25%-5.50%. The latest Fed dot plot shows that the median policymaker has penciled in another hike this year and only two cuts next year—a more hawkish bias than in their previous dot plot and more hawkish than the market consensus.

How much emphasis should investors put on the Fed dot plot? Experience suggests that some caution is required. Two years ago, in September 2021, the median policymaker believed that policy rates would sit at just 1% by the end of 2023. A year later, in September 2022, that median dot had moved up to 4.6%—a much more accurate projection, but still 75 basis points off target.

Given the uncertainty of the dot plot, investors should avoid reading it as a guide to Fed policy and instead focus on the growth and inflation fundamentals. The long-awaited economic downturn will likely materialize in 2Q 2024, applying further downward pressure on inflation. Not only will this open the door to gradual policy easing, but it will firmly close the chapter on a key element of discomfort that has plagued markets and investors since liftoff in March of last year.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3114573