Outlook

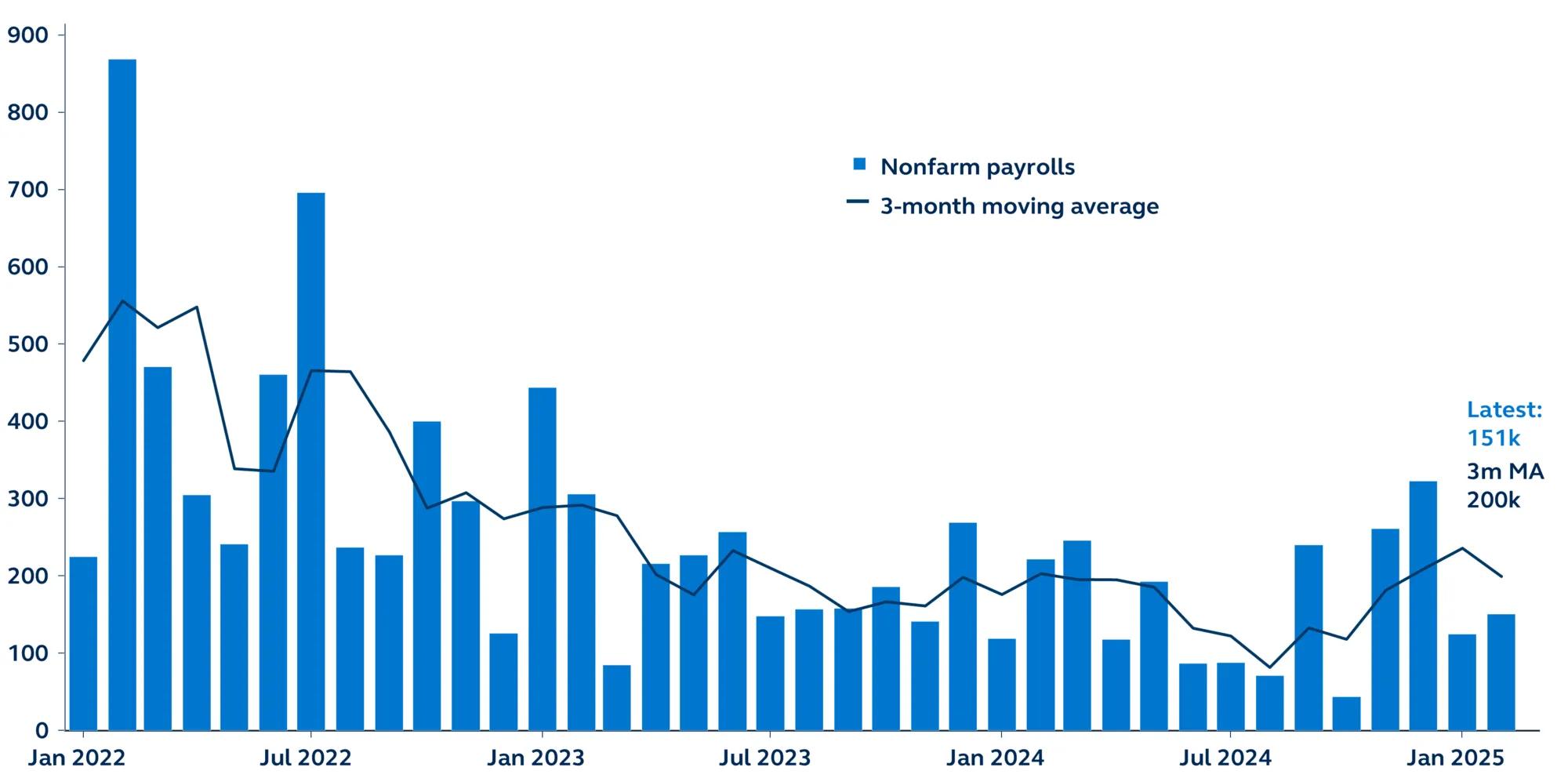

After the headlines of recent days, there were fears that today’s jobs report would reveal some deeply unsettling news about the health of the labor market, so the payrolls number has been met with relief—even as it confirmed a softening trend.

Yet, there are concerns that the labor market is on the verge of a sharp downward shift as government policies take effect and consumers begin to retrench. So, while today’s jobs report is not sufficiently weak to prompt Fed action at its meeting in two weeks, it does raise the prospects of a rate cut in the coming months. The economic backdrop and sentiment have taken a significant hit in the past few weeks. They will undoubtably require some Fed attention, even as inflation pressures potentially start to creep higher once again.