The substantial excess savings cushion accumulated since 2020 due to generous fiscal assistance during the pandemic is nearly exhausted. As households no longer have a solid financial buffer to support their spending and debt repayment, consumer spending will likely weaken over the coming quarters, toppling the U.S. into a short and shallow recession likely beginning in the second quarter of next year.

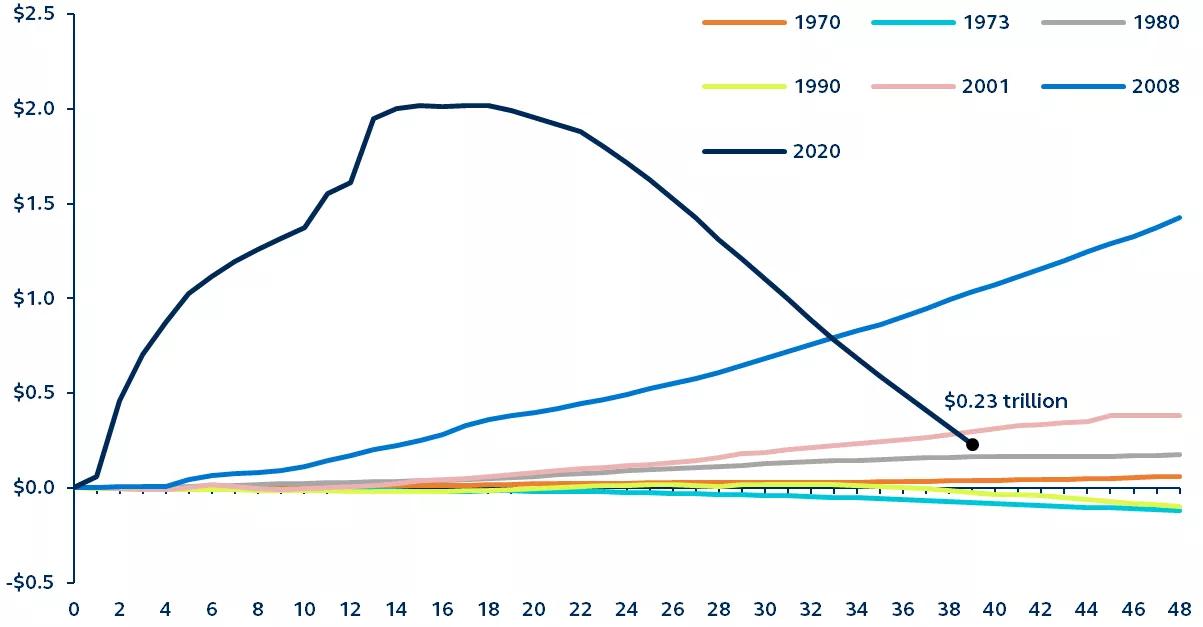

Aggregate excess savings following recession

Trillions, months since start of recession

Source: Bloomberg, Principal Asset Management. Data as of June 30, 2023.

Unlike during the Global Financial Crisis (GFC), today’s household balance sheets are in reasonably good shape. Generous pandemic-related fiscal support injections and reduced spending opportunities during lockdowns contributed to a significant build-up of excess savings to around $2 trillion. As the economy re-opened, households dipped into this war chest of savings to fund their purchases (reducing the need for credit card spending) and to pay down their debts.

The difference between the post-pandemic and post-GFC periods (as well as other recessions) is stark. Post-GFC, households were considerably more cautious with their spending, gradually building up savings as they tried to repair their balance sheets. By contrast, the significant increase in excess savings has fueled consumer spending in the current cycle and helped prevent a surge in household indebtedness.

However, the various support structures for households are now starting to expire. Pandemic-related fiscal support is ending, and with only an estimated $0.23 trillion left, much of the excess savings cushion has now been exhausted. By early 2024, many households will likely be exposed to the full burden of higher interest rates.

Consequently, consumer spending should start to weaken over the coming quarters, tipping the U.S. into recession (albeit shorter in duration, and of shallower magnitude than recent recessionary episodes) likely beginning in 2Q 2024.

Read more about the recession outlook and how to prepare portfolios for this evolving environment in our Midyear perspective 2023: A short and shallow recession.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3104397