During earnings downturns, despite the potential for further earnings weakness, markets have historically responded with expanding multiples ahead of an earnings trough. While 2023 presents unique challenges, a resilient economy characterized by easing inflation, reduced supply chain pressures, and proactive cost containment efforts suggest opportunities for potential outperformance exist within companies focused on improved operating efficiency and margin stability.

Stock market and earnings

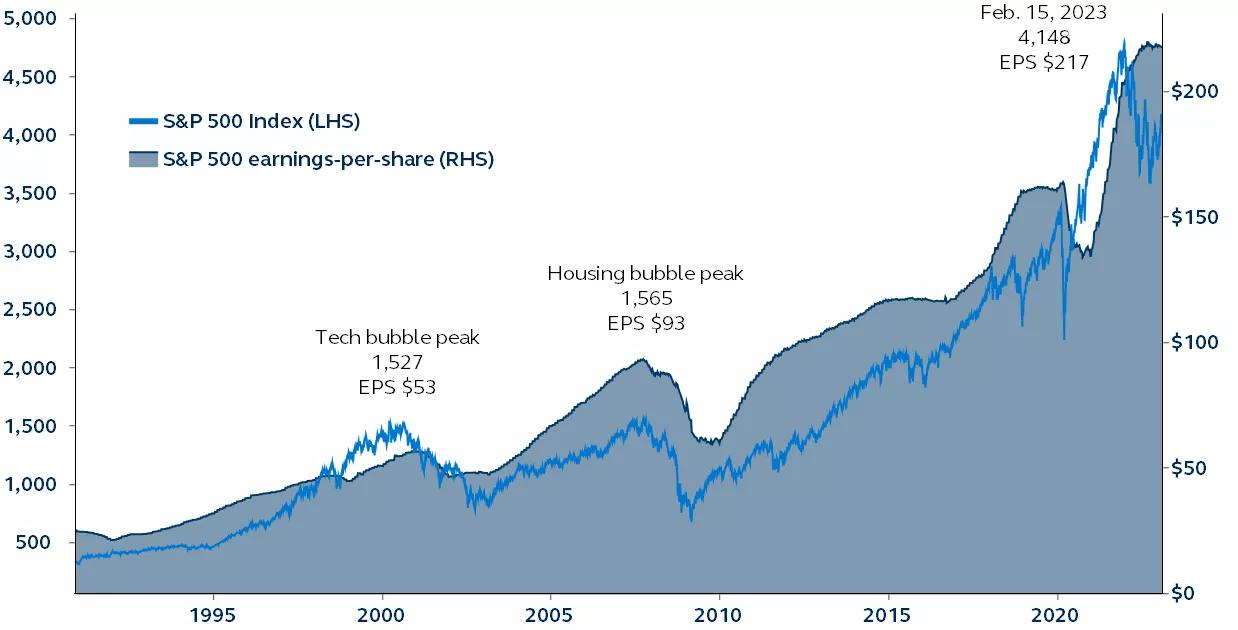

S&P 500 Index price and trailing earnings-per-share since 1990

Clearnomics, Refinitiv, Standard & Poor’s, Principal Asset Management. Data as of February 15, 2023.

As anticipated, year-over-year earnings growth for stocks in the S&P 500 has flatlined and dipped into negative territory based on 4Q 2022 earnings reports.1 Interestingly however, equity returns during this reporting season have been generally vibrant. Even when companies reported less than stellar earnings, they have still been well received if their managements communicated a focus on operational efficiencies and protecting future margins.

During earnings downturns, despite the potential for further earnings weakness, markets have historically responded with expanding multiples ahead of an earnings trough (2009, 2016). The unique risk facing investors in 2023, however, is the possibility of an earnings recession coupled with a Federal Reserve that is fixated on its inflation fight—and not in a position to cut rates in support of both economic and corporate growth, as it had in previous cycles.

Despite the concern, the economy is showing resilience—the labor market is robust, consumers are spending, supply chain pressures have reduced, and companies are implementing proactive cost containment efforts—all of which are bullish for corporate profitability. While this likely impedes the Fed's goals of arresting inflation (and provokes higher rates for longer), the potential for margin preservation supports a more bullish case for investors. Within portfolios, international equities and higher quality small- caps that are anchored by sustainable earnings are poised to benefit and may present an opportunity for potential equity market outperformance.

1 As of February 16, with approximately 70% of companies having reported earnings for 4Q 2022, year-over-year earnings growth is currently estimated at - 3%.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2744267