Report details

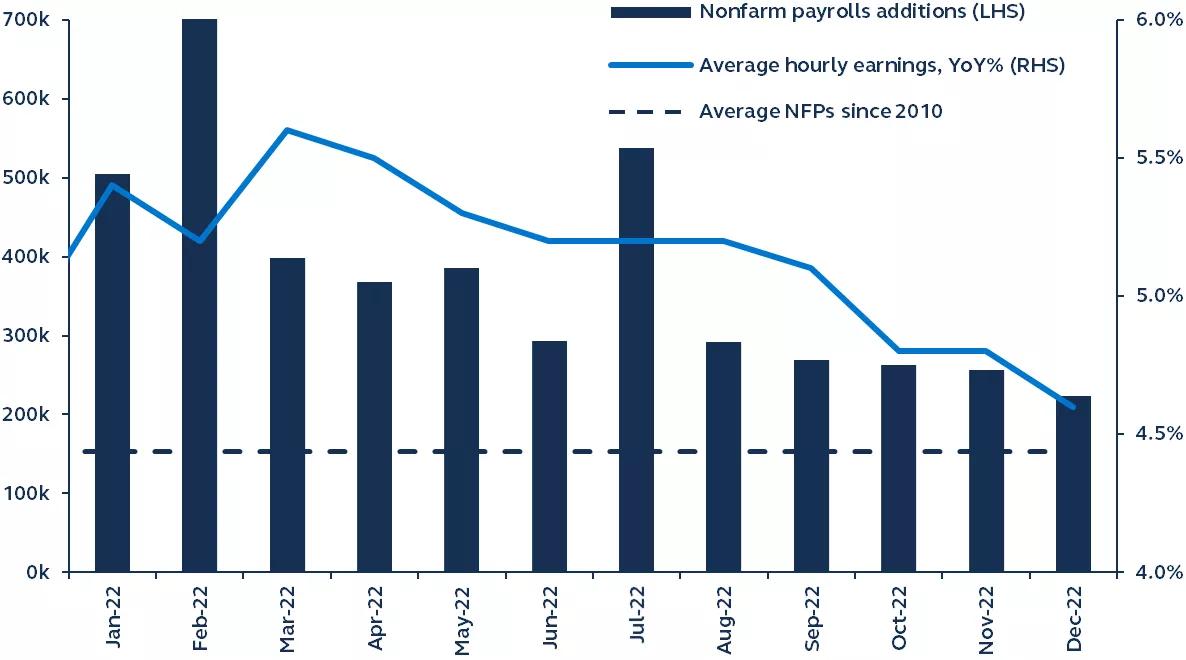

Job gains slowed from 256,000 in November to 223,000 in December. While payroll growth is on a downward trend, the broad picture continues to be one of clear labor market strength. Indeed, the unemployment rate fell from 3.6% in November (revised lower from 3.7%) to 3.5% in December.

The participation rate rose from 62.1% to 62.3% in December—a development that will please the Fed given that it has been hoping for a rise in labor supply. The fact that the unemployment rate dropped even despite the rise in participation emphasizes the continued strength of labor demand.

Following last month’s spike, markets were focused on average hourly earnings growth heading into this month’s report, and softening was delivered. In fact, not only was November’s average hourly earnings growth revised down from 0.6% month-on-month to 0.4%, but growth also softened further to 0.3% in December. Importantly, while wage growth on the goods-producing side of the economy remained strong, wage growth on the services side of the economy—where most of the inflation concerns reside—came in weaker than expected.

From a sector perspective, job gains were broad-based. Leisure and hospitality continued to drive hiring, with 67,000 jobs added, while education and health care services, as well as manufacturing, were particularly strong.

Today’s Goldilocks print of a lower unemployment rate and weaker average hourly earnings growth is certainly going to get equity market bulls’ attention. In fact, expectations for a soft landing in the economy have likely been boosted in light of the December jobs report. Yet, with the unemployment rate back to 3.5%, the main takeaway is still that the labor market supply and demand imbalance is firmly intact—and with such a tight labor market, how realistic is it to expect wage growth to move meaningfully lower? The Fed will likely be skeptical.

Overall, today’s report is undoubtedly positive but shouldn’t move the needle much for the near- term Fed policy rate path. The Fed still needs to raise policy rates further and, in doing so, the risk of recession in 2023 is very elevated.