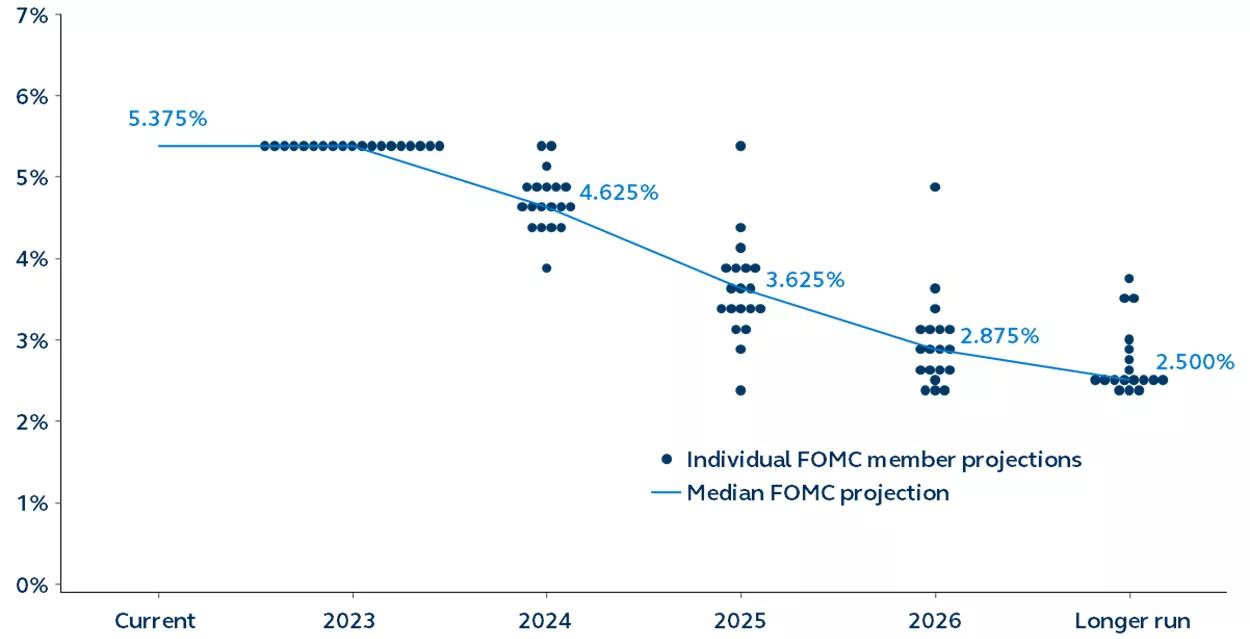

At the December Federal Open Market Committee (FOMC) meeting, the benchmark policy rate remained at 5.25%-5.50% for the third consecutive meeting, which was in line with expectations. More significantly, the latest dot plot revealed the committee expects 75 basis points of cuts next year—essentially endorsing the market’s view that the direction of travel for rates is downwards.

Countdown to rate cuts

In recent weeks, several Fed speakers have suggested a shift to a more dovish stance. As a result, coming into today’s meeting, the market was pricing in 115 basis points of cuts next year, with the first cut expected as soon as March.

There had been a broad expectation that today’s FOMC meeting would see a pushback against such dovish market expectations. Yet, Chair Powell emphasized the significant inflation progress to date, noting that rate cuts were a topic of discussion by the FOMC today, and the latest dot plot revealed a sharper pace of rate cuts than indicated in the September projections. Markets are now pricing in 130 basis points of cuts next year.