The new Summary of Economic Projections released today highlighted the Fed’s slightly more optimistic assessment of the economy and its expectation for a cautious easing cycle, with the median projection showing just one 25bp rate cut in 2026, and one in 2027.

- The GDP growth forecast edged up from 1.6% to 1.7% for 2025, from 1.8% to 2.3% for 2026, and from 1.9% to 2.0% for 2027.

- These upward revisions reflect the Fed’s view of solid economic conditions, supported by resilient consumer spending and AI-driven capital investment.

- Importantly, Chair Powell noted that the upgrade to the 2026 growth forecast was at least partially reflective of the government shutdown distortions - (roughly 0.2% shaved from 2025 and added back in 2026 – in other words, without the distortion, the 2025 forecast would have been 1.9% and 2026 would have been 2.1%).

- The unemployment rate forecast remained unchanged at 4.5% for 2025, declining slightly to 4.4% in 2026 and 4.2% in 2027.

- Powell acknowledged that unemployment is not projected to decline significantly despite strong growth forecasts, stating productivity as a likely cause.

- The headline PCE inflation forecast for 2025 was revised down from 3% to 2.9%, for 2026 from 2.6% to 2.4%, while the 2027 and 2028 forecasts remain unchanged at 2.1% and 2.0%, respectively.

- The Fed’s projections reflect the view that tariff-related price increases are expected to have a one-time effect. Once these pass through, inflation should continue easing toward the 2% target.

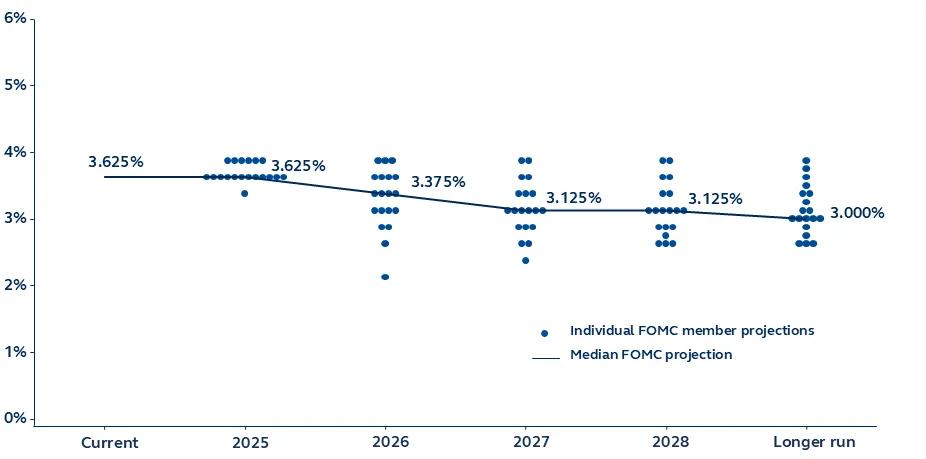

The Fed’s dot plot was largely unchanged from September, with median projections for the Fed funds rate at 3.4% in 2026, and 3.1% in 2027, implying just one 25bps cut in each year. For comparison, the market is currently pricing in two 25bps reductions next year.

The range of estimates has widened, reflecting a wide dispersion in views. Interestingly, several regional Fed presidents (some presumably non-voting members) would have preferred to keep rates unchanged today, suggesting a slightly more hawkish view. Indeed, the number of hawks for 2026 stands at 7 members, nearly 40% of the 19-member committee.