Economists finally got a forecast correct. After two months of downside surprises, inflation in December was exactly in line with consensus expectations. Annual headline CPI slowed from 7.1% in November to 6.5% in December, its lowest level in more than a year, while core CPI slowed from 6% to 5.7%. Price pressures are clearly on a slowing trend, yet, with inflation still three times higher than the Federal Reserve’s (Fed) target, the pace of disinflation is not yet fast enough to stop the Fed from hiking policy rates further.

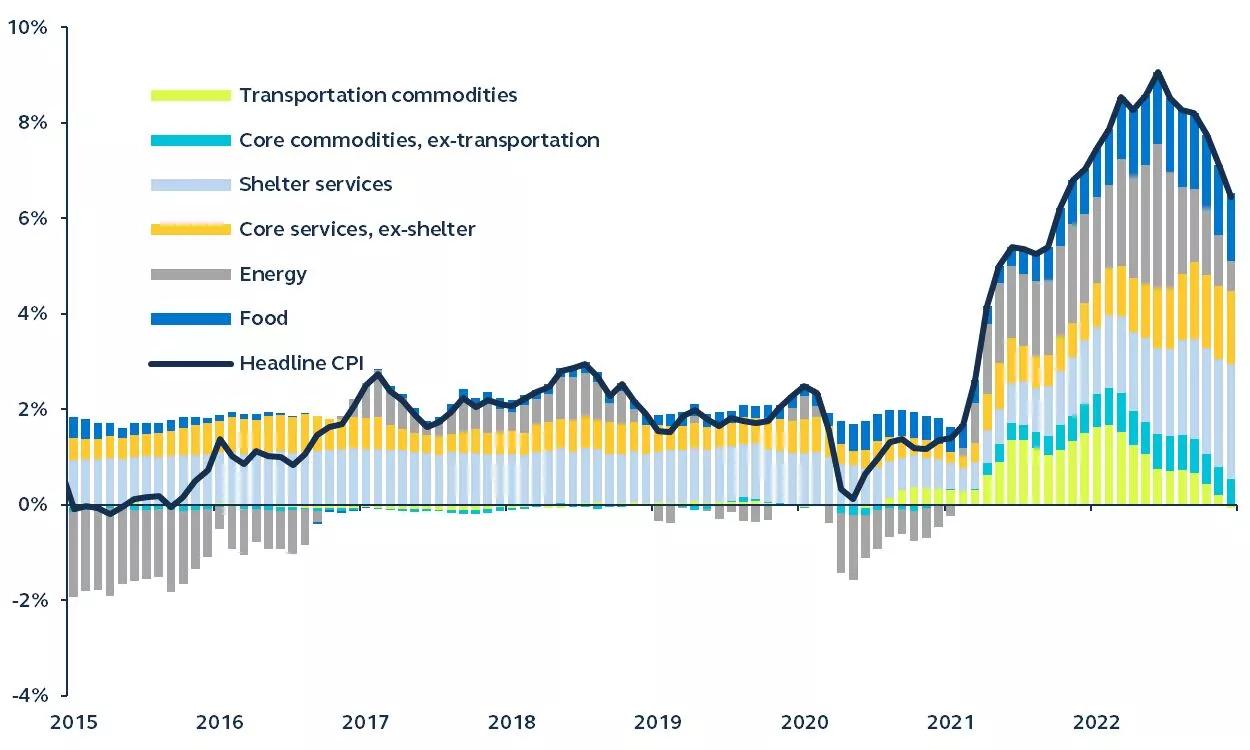

Contribution to headline U.S. inflation

Year-over-year, January 2015–December 2022

Bureau of Labor Statistics, Principal Asset Management. Data as of January 12, 2023.

Response details

- Headline CPI fell 0.1% on the month, the first negative print since May 2020, as energy prices fell sharply. Core CPI (which excludes food and energy prices) rose 0.3% on the month, in line with expectations, but up from 0.2% in December. In fact, the annualized three-month change in core CPI weakened from 6.0% in September to 3.1% in December. This should give the Fed clear confidence that inflation is now on the right path.

- The underlying components of inflation painted a mixed picture. While annual core goods inflation slowed from 3.7% to 2.1% in December, services inflation rose from 6.8% to 7%.

- Core goods prices fell 0.3% month-on-month in December. With the continued easing of supply chain bottlenecks, core goods inflation should continue to decline over coming months.

- Core services inflation increased from 0.4% month-on-month in November to 0.5% in December. Shelter costs, which are the biggest component of core services and account for around one third of the overall CPI basket, were once again the biggest contributor to the monthly core CPI increase. On the face of it, the continued strength of shelter inflation, which includes OER and rental inflation, is concerning. But as private sector data points to a stabilization in rents across the country (and there is typically a lag before those developments feed through to the official shelter inflation data), the Fed will likely look through these numbers.

- Core services ex-housing, a main focus of Chair Powell because it provides a clearer read- through to wage pressures, rose by 0.4% in December—below 2022’s average monthly rate of 0.5%.

- Food inflation decelerated, while energy inflation declined further—two fairly significant pieces of good news to consumers.

This month’s inflation report should give the Fed some confidence that their aggressive rate hiking cycle is starting to pay off. Considering today’s CPI numbers, coupled with last week’s data which showed softening average hourly earnings growth, the Fed may prefer to step down their pace of tightening further to 25 basis points at the February meeting. Yet, with multiple Fed speakers still signalling their preference to take policy rates above 5% (even after the CPI release), the slowdown in that pace of hiking will not necessarily impact the peak rate. Indeed, we continue to expect the Fed to take policy rates to 5.25% over the coming months.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results.

Views and opinions expressed are accurate as of the date of this communication and are subject to change without notice. This material may contain ‘forward-looking’ information that is not purely historical in nature and may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this material is at the sole discretion of the reader.

The information in the article should not be construed as investment advice or a recommendation for the purchase or sale of any security. The general information it contains does not take account of any investor’s investment objectives, particular needs, or financial situation.

2677041