A deal to suspend the U.S. debt limit has finally been agreed, putting an end to a months-long distraction for investors. Now, the U.S. Treasury is scrambling to replenish its cash balance, and market expectations for the rate outlook are seeing significant revisions. With inflation remaining sticky and the labor market proving extremely resilient, a further policy rate hike is likely from here, while a rate cut this year is almost certainly not in the cards.

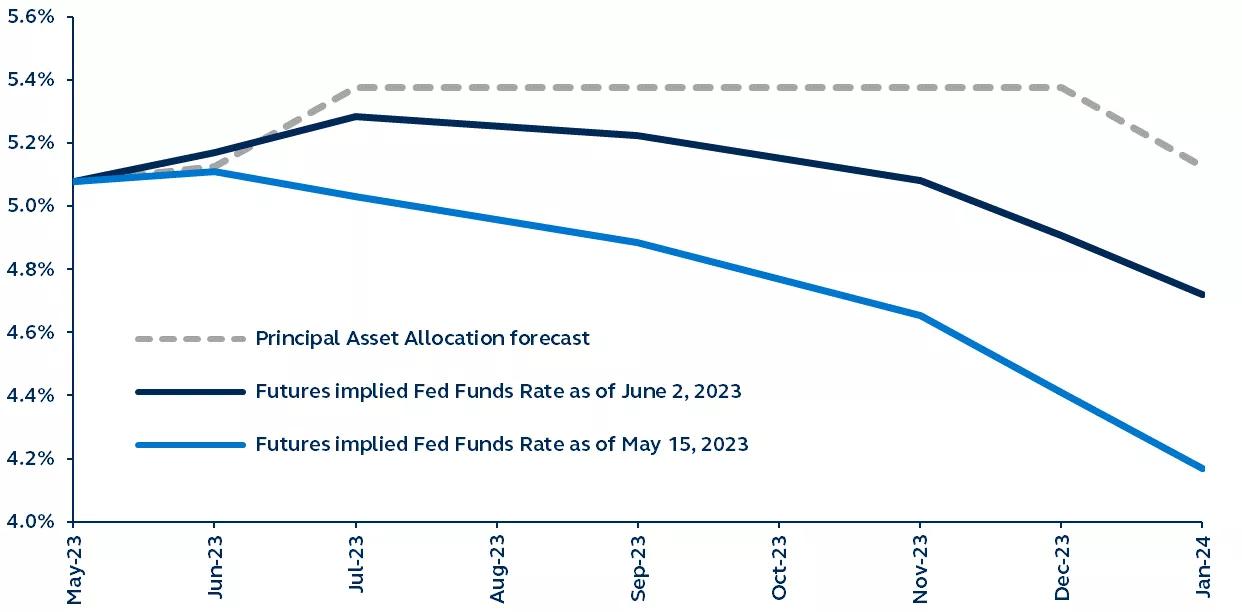

Market expectations for U.S. Fed Funds Rate

Present–January 2024

Source: Bloomberg, Principal Asset Management. Data as of June 2, 2023.

Policymaker agreement to suspend the debt ceiling until January 1, 2025, has brought only a small sigh of market relief, as equity markets had priced in a negligible probability of default. The aftermath, however, leaves a few key factors investors should note while positioning for the period ahead.

- Spending cuts: The fiscal impact of the deal is small and, therefore, inconsequential from an economic standpoint. The bill lowers federal spending over the next fiscal year by 0.25% of GDP. As a comparison, the debt ceiling agreement in 2011 reduced spending by 0.7% of GDP.

- Liquidity drain: Since hitting the debt limit in January, the Treasury has run down its cash balance to keep making payments. Now, it must replenish it. Doing so will involve significant Treasury issuance, effectively draining liquidity from the financial system and raising short-term borrowing costs—potentially further challenging already beleaguered banks.

- Fed policy: Investors are now re-focusing on sticky inflation and the extremely tight labor market, prompting a repricing of the market’s rate outlook. Not only is a further policy rate hike likely, but rate cuts this year are being steadily priced out.

Now that the debt ceiling noise has faded, investors can see that the fundamental picture is unchanged. Quality defensive equities and core fixed income will likely remain attractive during the tight liquidity, high-rate environment ahead.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. Asset allocation and diversification do not ensure a profit or protect against a loss.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2934890