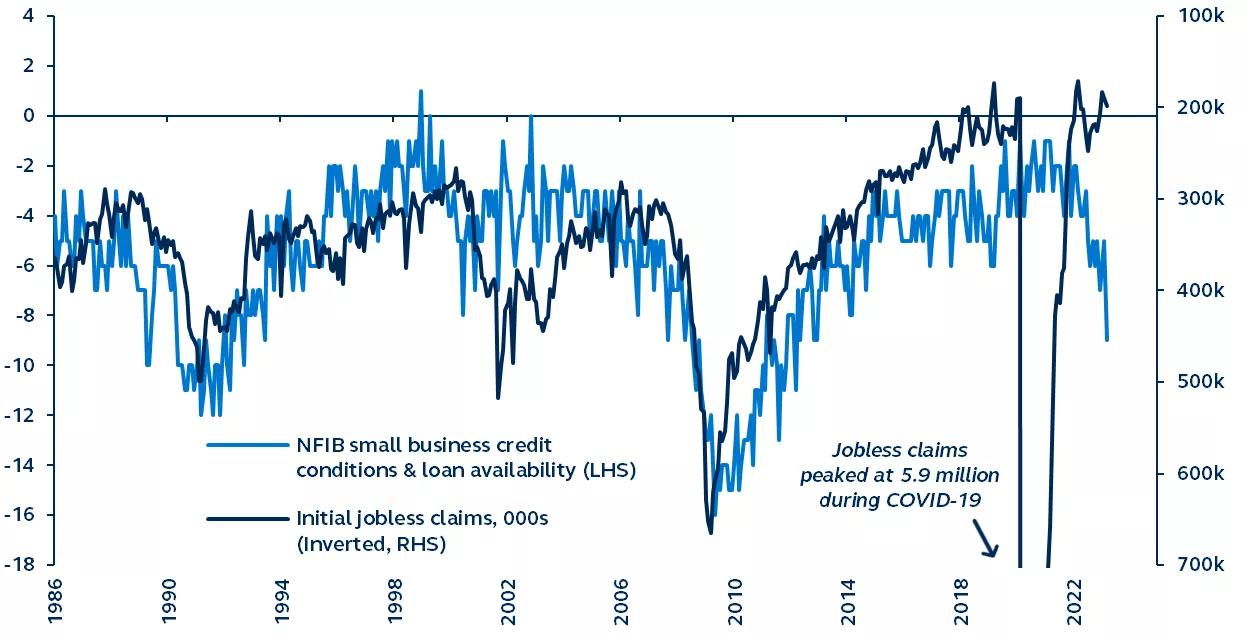

Together with the lagged effects of Fed rate hikes, recent bank failures are likely to adversely affect credit conditions. The impact on small businesses, which employ the largest share of workers in the U.S. economy and are already starved of credit, will be consequential. As job losses likely accelerate heading into the second half of 2023, this credit crunch could become the vicious spiral that eventually precipitates recession.

Small business credit conditions and initial jobless claims

1986–present

Source: NFIB, Bureau of Labor Statistics, Bloomberg, Principal Asset Management. Data as of April 11, 2023.

Economic growth surprised to the upside during the first quarter of 2023, as softness in economic data in late-2022 proved to be just seasonal noise. In fact, since the start of the year, most activity data has emphasized the U.S. economy’s continued resilience. However, the lagged effects of the Federal Reserve’s hiking cycle are beginning to confront the underlying economy.

In particular, credit availability is increasingly dissipating. On the back of the Fed’s rapid tightening cycle, loan officers have raised credit standards and are issuing loans only to the worthiest of borrowers. Such tightening in credit conditions will be further exacerbated by recent bank failures and will likely force small/regional banks to prioritize repairing their balance sheets over lending.

Typically, as credit conditions and loan availability fall, jobless claims follow, suggesting that initial jobless claims nearly double those of the last 15 months would be reasonable in this environment. And for small businesses, which account for the majority of U.S. employment and already feel that credit conditions are the most constricted since 2012, this credit crunch will be particularly consequential.

In contrast to current buoyancy, the U.S. economic outlook is far from rosy. A proliferating small business credit crunch is unfolding and is likely to adversely impact employment levels. This could become the vicious spiral that eventually precipitates recession in the second half of 2023.

Read our 2Q 2023 Global Asset Allocation Viewpoints for more themes, opportunities, and investment implications across markets and portfolios.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal®.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2846927