China's recent stimulus measures, including monetary easing and a massive fiscal pledge, have sparked a sharp rally in equities, particularly in real estate and consumer staples. While market sentiment has improved, the long-term impact will hinge on the actual scale and execution of fiscal policy. Investors are cautiously optimistic, but much depends on how effectively China targets its property sector and broader economy.

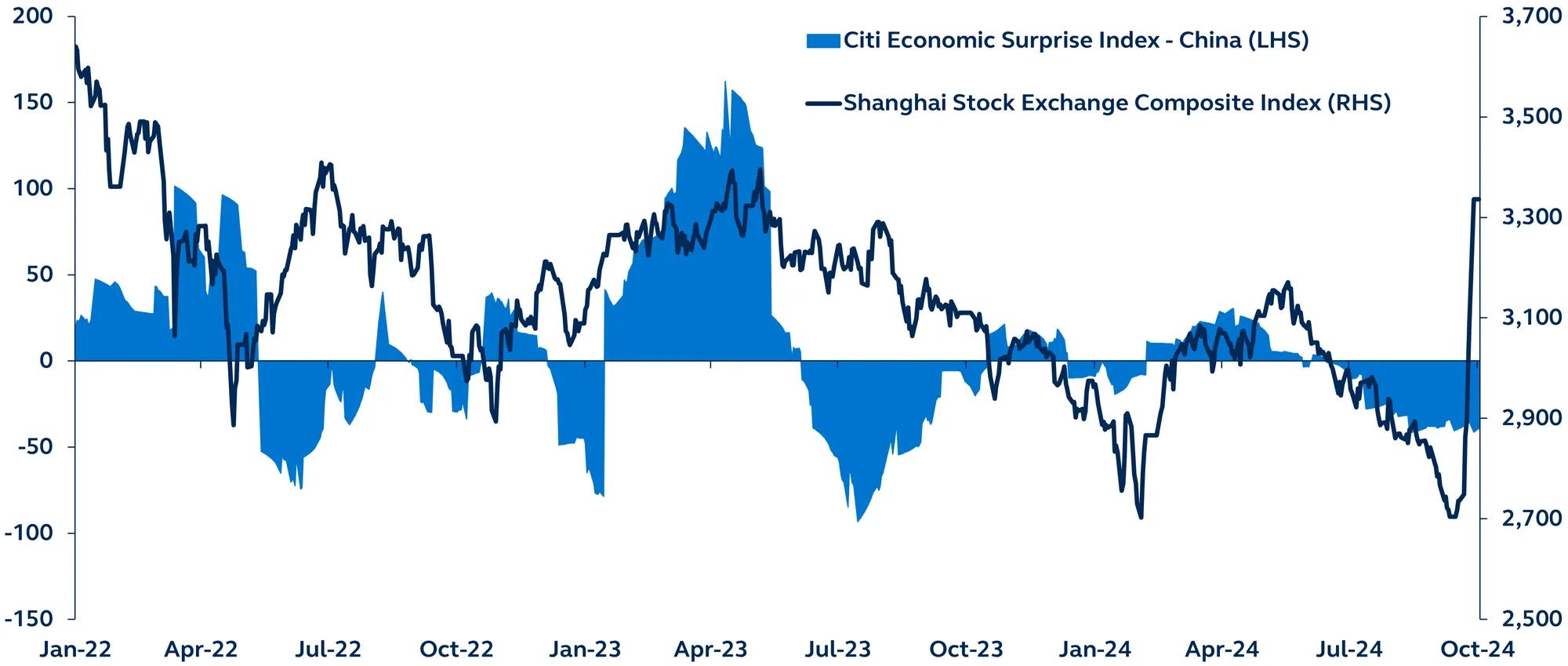

Citi China Economic Surprise Index and the Shanghai Composite Index

Index level, 2022–present

Amid concerns that China may fall short of its 5% GDP growth target this year, policymakers have introduced a significant package of monetary easing measures. These include cuts to mortgage rates, reduced down payment requirements, and the creation of an RMB 800 billion liquidity pool aimed at stabilizing equities, all designed to bolster the real estate sector and financial markets. Alongside these efforts, there is a strong commitment for further fiscal stimulus, with reports indicating 2 trillion yuan earmarked to boost consumption and another 1 trillion yuan to recapitalize banks.

If the reports are correct, the nominal size of the stimulus could be among the largest ever in history. Markets have reacted forcefully — the Shanghai Composite rallied over 23% from its September lows, with consumer staples and real estate stocks among the key beneficiaries. The renminbi also further strengthened against the dollar, with Chinese government bond yields rising on the back of the announcement.

The long-term effectiveness of the announced measures will largely hinge on the specifics of the fiscal policy that is ultimately implemented. A well-targeted fiscal stimulus, aimed at rejuvenating the property sector and reviving animal spirits, could significantly improve China’s economic prospects, potentially generating positive spillovers for the global economy. While investors have reason for cautious optimism, much will depend on the size and implementation of the various measures, details of which are still pending.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2024, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3913421