The strict “COVID zero” policy was among the key factors impeding China’s growth recovery this year. Recently, however, the Chinese government announced its “20 optimizing measures on COVID policy,” fueling a sharp Chinese market rally. While these measures don’t suggest immediate reopening, they may mark the beginning of the end for cumbersome lockdowns.

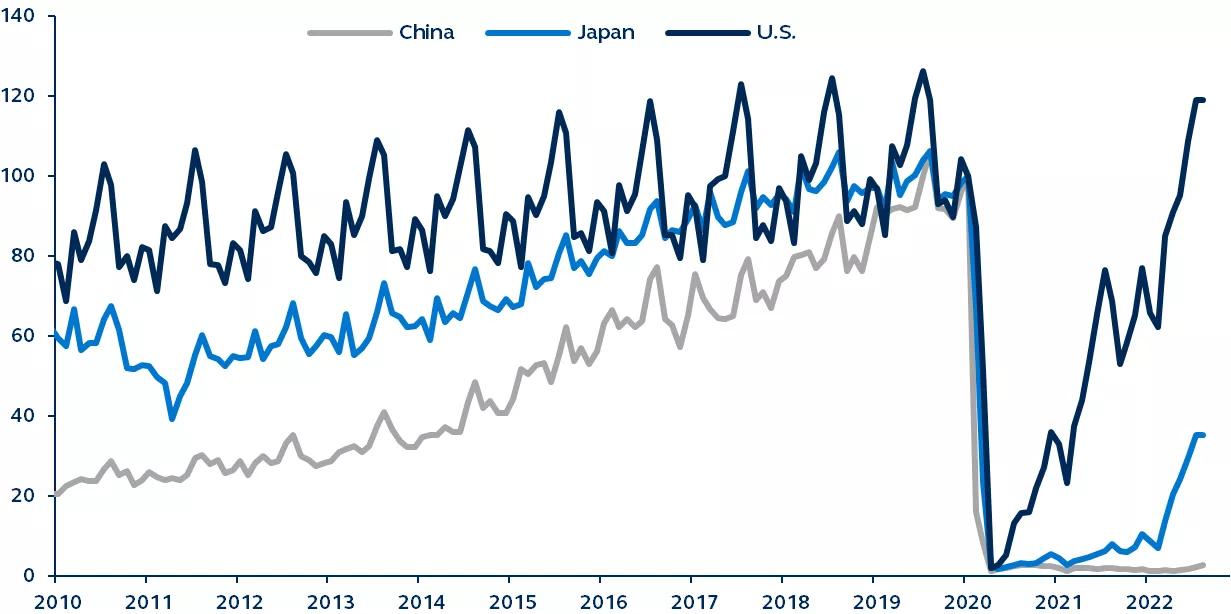

Airline passenger traffic

Normalized to 100 at January 1, 2020, January 2010 - August 2022

Bloomberg, Principal Asset Management. Data as of November 18, 2022.

In the first week of November, speculation that China’s strict COVID policies would be relaxed triggered a spectacular 13% rally in MSCI China. The official announcement of “20 optimizing measures on COVID policy” that followed, which addresses the pain points of China’s COVID policy and promotes moves that will likely lead to full reopening, immediately lifted China equities into bull market territory.

The euphoric market response is unsurprising. Highly infectious new strains have rendered China’s once effective “COVID zero” policy extremely costly to maintain. Frequent lockdowns haven’t just deterred consumption activity (airline passenger traffic, for example, has yet to return), but also restricted the impact of stimulus on infrastructure investments, in turn worsening the property downturn.

The gradual removal of restrictions would open the door for more effective fiscal stimulus, further restoring market confidence. Yet, there are still challenges to overcome:

- New vaccines need to be developed and vaccination rates must increase significantly.

- Case counts are already elevated, and looser COVID restrictions could lead to another surge in infections.

- Implementation risks remain as local governments often enforce stricter restrictions than national guidelines recommend.

China’s latest decision to reconnect with the world is extremely growth positive. As ever though, investors should cautiously monitor developments as faithful execution of the reopening plan will be key to the investment outlook.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. International and global investing involves greater risks such as currency fluctuations, political/social instability and differing accounting standards.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

Principal Asset Management leads global asset management at Principal.®

2601385