Following a sluggish 2022, many investors expected a countercyclical stimulus response this year, the typical approach from China’s policymakers in the past. However, recent policy suggests that a shift is underway—one that emphasizes nimble and long-term focused policymaking and aims to avoid excessive stimulus. The result has been a more stable outlook for China, making the country a bright spot amid significant global uncertainty.

China Credit Impulse Index

Level, 2008-present

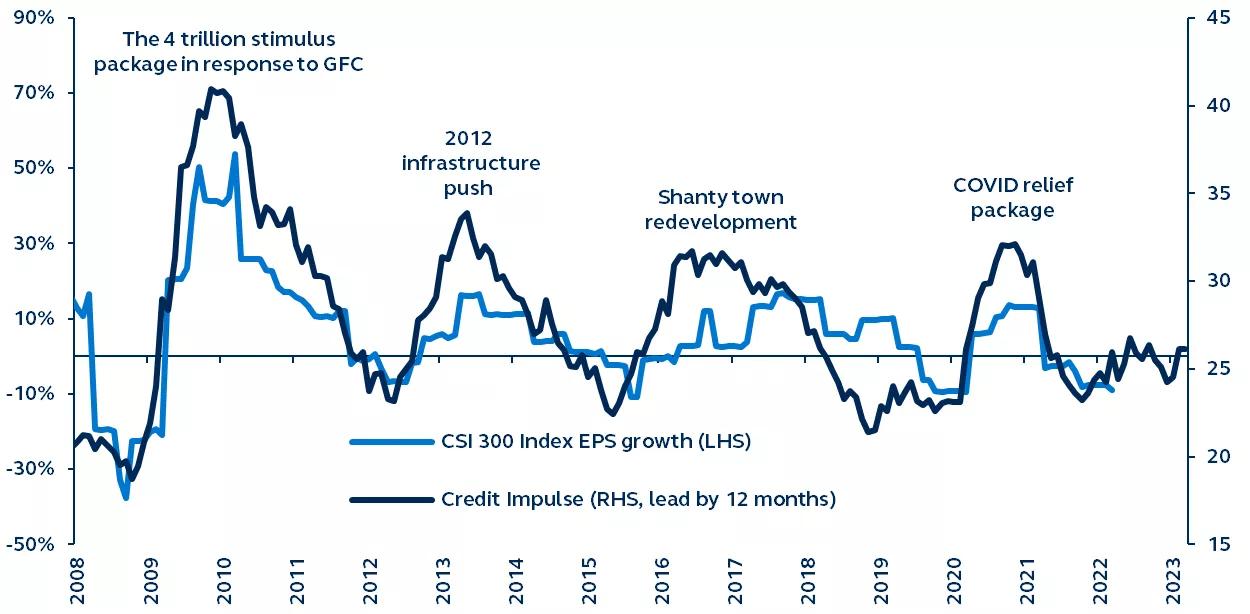

Note: The China Credit Impulse Index measures the credit cycle in a market. A rising level indicates the economy is recovering.

Source: Bloomberg, Principal Global Investors. Data as of March 31, 2023.

China’s credit impulse experienced a much lower peak in 2022 than during prior cycles, reflecting an important policy shift. After adopting countercyclical policies, which involve large fiscal stimulus and credit boosts during economic slowdowns, for over a decade, China’s policymakers have been gradually adjusting their policy approach toward “cross-cyclical adjustment.” This strategy emphasizes preemptive, nimble, targeted, and long-term focused policymaking, and avoids excessive and ineffective stimulus.

Global investors may be disappointed as the policy shift implies China’s economic growth is unlikely to revert to the elevated levels seen in the last decade. However, slower growth is not necessarily a negative development. The previous adoption of “countercyclical policies” often left the Chinese economy veering from sharp upturns to significant slowdowns, rendering it reliant on easy money.

Now, with the adoption of the “cross-cyclical adjustment” framework, investors should expect that China’s credit growth trajectory will be managed such that it doesn’t lead to boom-bust cycles and excessive leverage. The country should emerge with a stronger balance sheet and less financial risks.

The seemingly prudent and positive policy actions have resulted in a stable outlook for China and make the country a bright spot amid significant global economic uncertainty. Investors, treating China as a key diversifier of global portfolios, should return focus to organic economic growth and bottom-up fundamentals, instead of speculating on large policy stimulus.

For a deeper dive into the policy shift and what it means for investors, read China policy: From cyclical to secular.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2867763