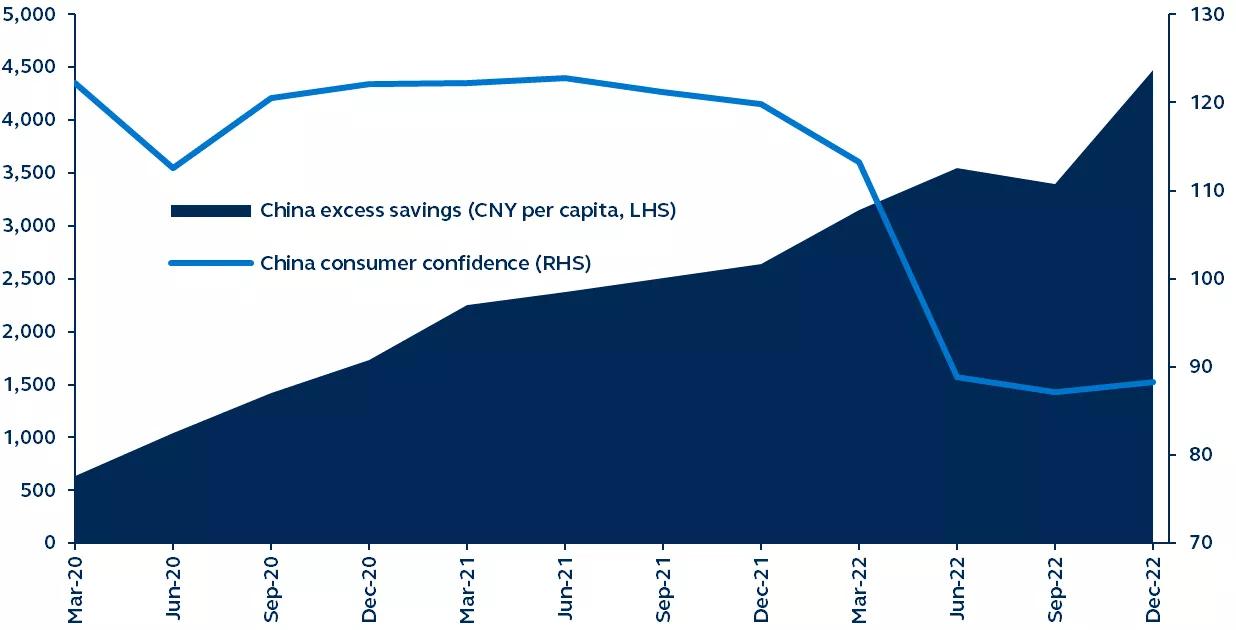

Equities in China have delivered a spectacular rebound since the country’s COVID reopening, with MSCI China up 37% in the four months ending February 2023. From here, the pace of demand recovery in China will be a critical driver for markets— implementing a policy mix which promotes tapping into excess household savings can help restore consumer confidence, and ultimately spur further economic success in China this year.

China excess savings and consumer confidence

2020-2022, quarterly

Source: Bloomberg, Principal Asset Management. Data as of March 3, 2023.

The rapid reopening policy in China allowed consumption and mobility to quickly normalize in the first few weeks of 2023. While the economic impact has been immediate, the potential scale and longevity of this consumer-driven rebound may hinge on how willing households are to draw down their excess savings.

During the three COVID years (2020-2022), an uncertain economic outlook, battered confidence, and rolling lockdowns led Chinese consumers to spend less. Consequently, saving rates were on average 4% higher than they were from 2013-2019 (33% vs. 29%, respectively), accumulating per capita excess savings of roughly RMB 4500—equivalent to 5% of GDP.

Today, with greater certainty around the path for future income, consumers are likely to gradually tap into their excess savings—in turn, improving the corporate earnings outlook. However, fully unleashing pent-up demand may be a slow process considering the following headwinds:

- With the memory of repeated COVID lockdowns still fresh, many consumers may remain cautious.

- China’s aging population suggests rising saving rates could be a secular trend, subduing the likely spending rebound.

- The shape of the housing recovery, a key driver to consumption, is still very uncertain.

In the near term, investors should keep a close eye on additional policies that further the housing recovery and restore consumer confidence—both of which will be key to gauging the potential for an extended rally in Chinese risk assets.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2770507