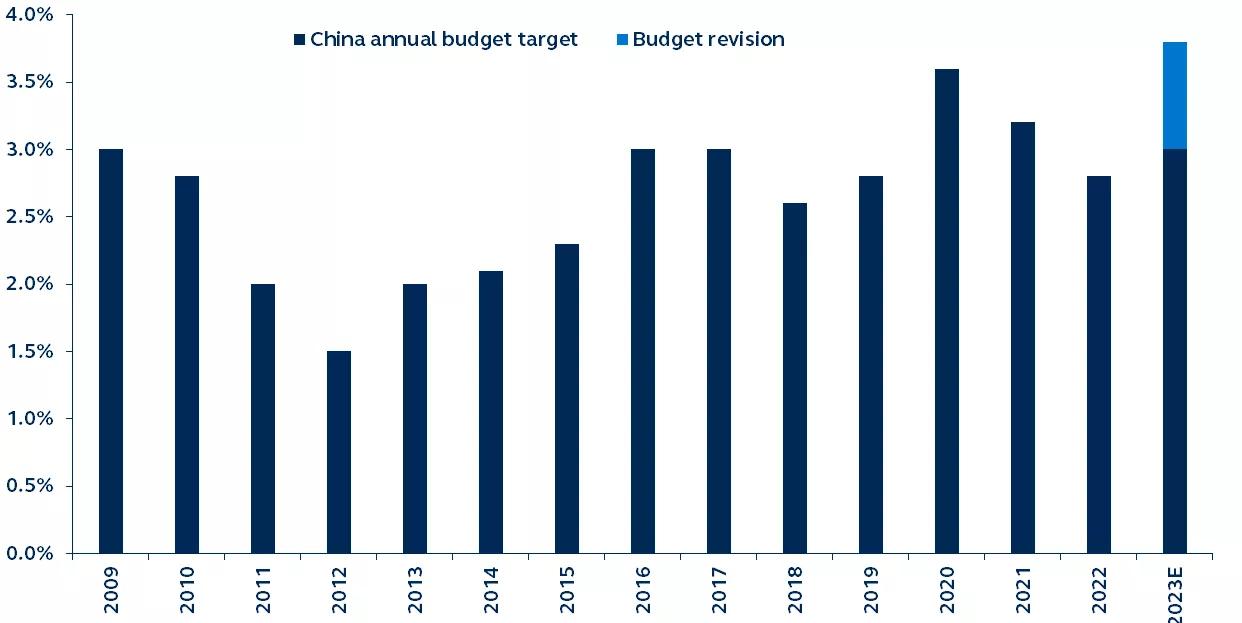

A surprising mid-year budget revision from policymakers in China was recently approved, widening the budget deficit from 3.0% to 3.8%. This occurrence is unusual, as previous revisions mostly resulted from major economic events like earthquakes and financial crises. The fact that this change is happening during amid a stabilizing economic backdrop indicates a strong commitment from policymakers to boost growth, and likely improves sentiment for the region.

China annual budget target

% of GDP, 2009–present

Source: Bloomberg, Principal Asset Management. Data as of November 3, 2023.

Recently, China’s legislative body surprised markets with a mid-year budget revision which could widen the budget deficit from 3.0% to 3.8%, surpassing the critical 3.0% threshold that’s only recently been exceeded during the COVID years.

Intra-year budget revisions are historically rare. Similar revisions were announced following both the 1998 Asian Financial Crisis and the 2008 Sichuan earthquake, instances when significant outside forces had impacted China’s economy. The absence of a catastrophic event this time, and in fact, that China is experiencing a period of economic stability indicates a strong commitment from policymakers to boost growth.

3Q GDP grew 4.9% year-on-year, beating consensus significantly and making China’s 5% growth target likely achievable. Investors had worried that the better-than-expected economic data would trigger an early policy exit, leading to a “good news is bad news” market reaction. While the fear was justified, considering stimulative policies have previously fallen short of expectations in recent years, the surprise budget revision suggests this time could be different.

Policymakers appear to have recognized that the lingering property rout and indebted local government require meaningful fiscal expansion. While a bazooka type of stimulus reminiscent of previous cycles is still not the base case, coordinated fiscal and monetary moves will likely continue until the economy is out of the woods—perhaps giving reason for investors to revisit their subdued enthusiasm for the region.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3211265