China’s economic performance has been extremely disappointing since the lifting of lockdowns late last year, and economic data has repeatedly missed forecasts. The government’s 5% GDP growth target is now being met with skepticism, and fears of a deflation trap have engulfed investor sentiment. At the heart of China’s economic troubles lies the property sector, and until policymakers proactively and sufficiently target rejuvenating it, prospects for China likely remain dim.

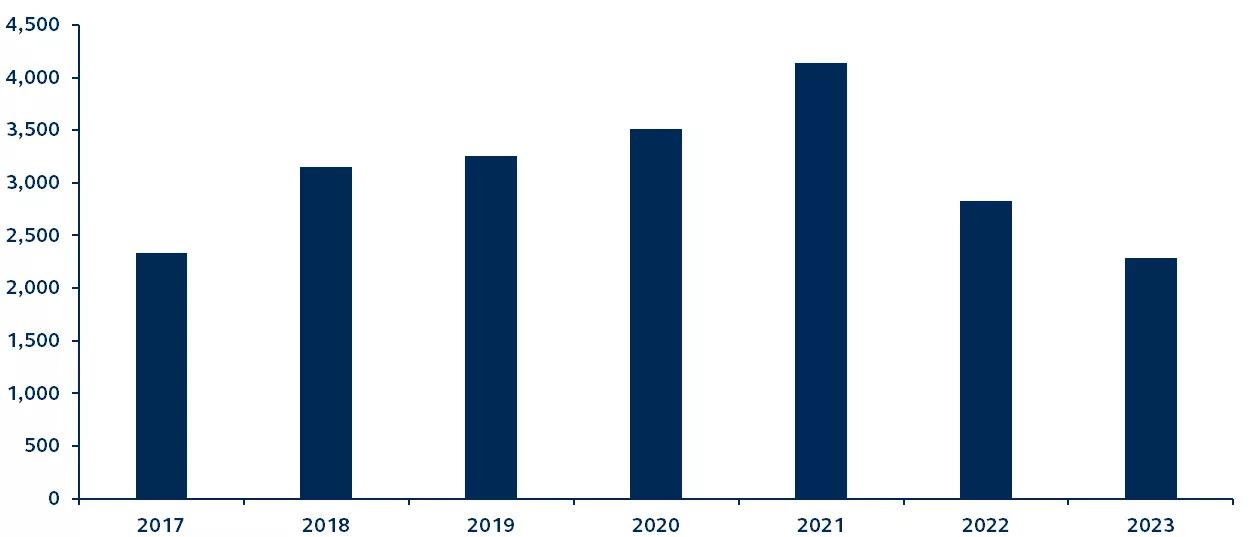

China land sales revenue through July of each year

Cumulative, $billions RMB

Source: Ministry of Finance of the People's Republic of China. Data as of July 31, 2023.

Much of China’s recent financial stress and deepening economic weakness can be traced back to the malfunctioning property sector—a problem that risks dragging the whole economy into a prolonged and damaging downturn. Specifically, there are four channels through which property impacts the overall economic and financial health of China:

GDP growth: The property and construction sector’s sizeable exposure to the overall property market implies that the government’s 5% GDP target will be hard to meet if the property sector doesn’t start to recover.

Households: The property sector has an outsized wealth effect compared to other investments in China. Given the sector’s struggles, shrinking wealth is deterring consumers’ willingness to spend.

Local government: Falling land sales are decimating local government’s budgets, fueling fears about local government funding vehicle (LGFV) debts.

Financial system: Some trust products provide shadow bank financing to developers that help protect them against default risks.1 Further strains to the financial system would certainly serve to dampen market sentiment at a time when investors are already nervous.

The property sector's issues are significantly impacting China's outlook and causing concern for global investors. Without adequate action from policymakers to address market weakness, investor enthusiasm for investment in China will likely be subdued. However, history has taught that China frequently makes policy adjustments during the bleakest times—an environment that can create investment opportunities for active investors.

For a deeper dive into the causes of China’s property sector slump and the investment implications moving forward, read China’s property slump takes center stage.

1Trust products are a wealth management product launched by trust companies which are often linked to shadow banking and attract high net worth investors through high potential returns.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. International investing involves greater risks such as currency fluctuations, political/social instability, and differing accounting standards. Risk is magnified in emerging markets, which may lack established legal, political, business, or social structures to support securities markets.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are offered through Principal Securities, Inc., 800-547-7754, Member SIPC and/or independent broker/dealers.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2023, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

3114573