Japanese bond yields and the yen both rallied this week following the Bank of Japan’s (BoJ) surprise decision to widen its yield curve control (YCC) bands. While the BoJ remains committed to bond purchases, markets are interpreting this somewhat hawkish pivot as a potential first step toward rate hikes in 2023. Any reduction in foreign demand for U.S. Treasurys could challenge the U.S. dollar and reestablish the yen as a potentially viable safe-haven in volatile times.

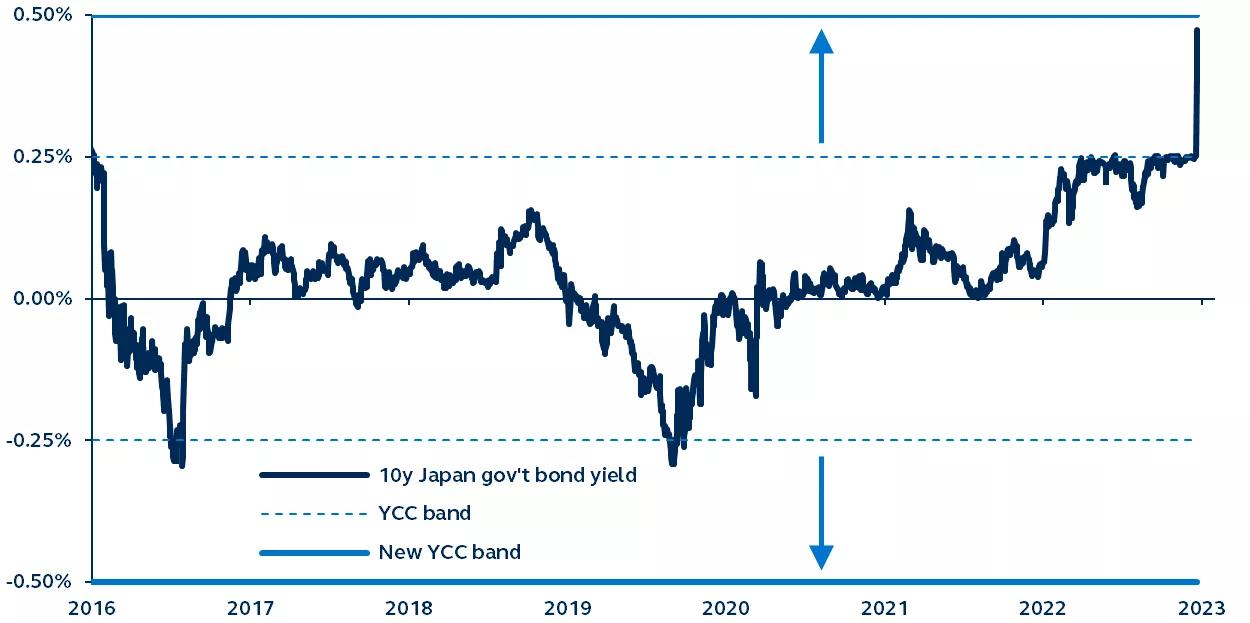

Japan 10-year government bond yield and yield curve control (YCC) bands

2016–present

Bank of Japan, Bloomberg, Principal Asset Management. Data as of December 22, 2022.

The Bank of Japan (BoJ) surprised global markets this week by announcing a doubling of its cap on Japanese government bond (JGB) yields, propelling the yen to its biggest one-day surge since 1998, and pushing JGB yields to their highest levels since 2015.

In a bid to stimulate inflation, the BoJ has capped JGB yields through yield curve control (YCC) since 2016. Although the BoJ attempted to frame their decision as a policy tweak, with Japan’s inflation approaching 4% investors are justifiably considering it as a first step towards rate hikes in 2023.

As one of the last-standing central banks to maintain ultra-easy monetary policy, the BoJ has essentially acted as a global bond anchor. Shifting to a more hawkish stance would pressure global bond yields higher, and, since Japanese investors are the largest foreign holders of U.S. Treasurys and rising JGB yields would likely attract capital back to Japan, demand for U.S. bonds would be significantly reduced. However, any potential selloff would likely be muted, as elevated currency hedging costs have already been weighing on Japanese purchases of U.S. Treasurys, and a likely U.S. recession would put downward pressure on U.S. bond yields.

If nothing else, the BoJ’s actions should serve as a reminder to investors that, even as the global pace of monetary tightening slows, policymakers still can deliver hawkish, disruptive surprises.

Investing involves risk, including possible loss of principal. Past performance is no guarantee of future results and should not be relied upon to make an investment decision. International and global investing involves greater risks such as currency fluctuations, political/social instability and differing accounting standards.

The information presented has been derived from sources believed to be accurate; however, we do not independently verify or guarantee its accuracy or validity. Any reference to a specific investment or security does not constitute a recommendation to buy, sell, or hold such investment or security, and does not take account of any investor’s investment objectives or financial situation and should not be construed as specific investment advice, a recommendation, or be relied on in any way as a guarantee, promise, forecast or prediction of future events regarding an investment or the markets in general. The opinions and predictions expressed are subject to change without prior notice.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Principal Asset Management leads global asset management at Principal.®

For Public Distribution in the U.S. For Institutional, Professional, Qualified and/or Wholesale Investor Use only in other permitted jurisdictions as defined by local laws and regulations.

© 2022, Principal Financial Services, Inc. Principal Asset ManagementSM is a trade name of Principal Global Investors, LLC. Principal®, Principal Financial Group®, Principal Asset Management, and Principal and the logomark design are registered trademarks and service marks of Principal Financial Services, Inc., a Principal Financial Group company, in various countries around the world and may be used only with the permission of Principal Financial Services, Inc.

2652222